Pep Boys 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

EMPLOYMENT AGREEMENTS WITH THE NAMED EXECUTIVE OFFICERS

Change in Control Agreements. We have agreements with Messrs. Smith, Bacon and Page that become effective upon

a change in control of Pep Boys. On February 9, 2006 we entered into such an agreement with Mr. Stevenson which replaced

his employment agreement that was scheduled to expire on April 28, 2006. Following a change in control, these employment

agreements become effective for two years and provide these executives with positions and responsibilities, base and incentive

compensation and benefits equal or greater to those provided immediately prior to the change in control. In addition, we are

obligated to pay any excise tax imposed by Section 4999 of the Internal Revenue Code (a parachute payment excise tax) on a

change in control payment made to a named executive officer. A trust agreement has been established to better assure the

named executive officers of the satisfaction of Pep Boys’ obligations under their employment agreements following a change

in control.

We also have a Change of Control Agreement with Mr. Yanowitz that is substantially similar to those entered into by the

Company’s other executive officers, except that (i) it provides for a payment equal to two years’ salary, bonus and benefits, if

Mr. Yanowitz provides three-months of transition services following a change of control, and (ii) the definition of change of

control thereunder has been expanded to include a sale, discontinuance or closure of a material portion of the Company’s

assets and those business combination transactions where the Company’s shareholders own less than 75% of the equity of the

resulting entity. The Company has also agreed to pay Mr. Yanowitz a one-time cash bonus of $340,000 upon the earlier of

September 1, 2006 or the consummation of a strategic transaction.

Non-Competition Agreements. In exchange for a severance payment equal to one year’s base salary upon the termination

of their employment without cause, each of Messrs. Stevenson, Bacon and Yanowitz has agreed to customary covenants

against competition during their employment and for one year thereafter. In exchange for a severance payment equal to one

and one-half years’ base salary upon the termination of his employment without cause or his resignation effective February 3,

2007, Mr. Page has agreed to customary covenants against competition during his employment and for eighteen months

thereafter. In exchange for a severance payment equal to two years’ base salary and the accelerated vesting of all then

outstanding Company equity upon the termination of his employment without cause, Mr. Smith has agreed to customary

covenants against competition during his employment and for two years thereafter.

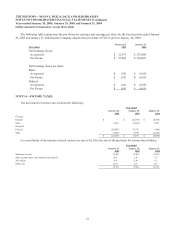

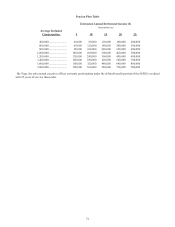

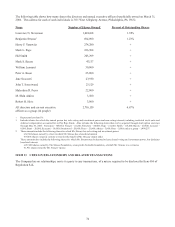

STOCK OPTION GRANTS IN LAST FISCAL YEAR

The following table shows information about stock options granted to the named executive officers during fiscal 2005.

Individual Grants

Number of

Securities

Underlying

Options

% of Total

Options

Granted to

Employees in

Fiscal Year

Exercise or

Base Price Expiration

Potential Realized Value

at Assumed Annual Rates

of Stock Price Appreciation

for Option Term

Name Granted (#)(a) (%)(b) ($/Share) Date 5% ($) 10% ($)

Lawrence N. Stevenson 130,000 45.0 17.54 02/25/12 928,270 2,163,265

Hal Smith 20,000 6.9 17.54 02/25/12 142,811 332,810

Mark S. Bacon 50,000 17.3 17.84 02/28/12 363,134 846,256

Mark L. Page 2,500 0.9 17.54 02/25/12 17,851 41,601

Harry F. Yanowitz 10,000 3.5 17.54 02/25/12 71,405 166,405

(a) The stock options were granted at a price equal to the fair market value on the date of grant with 20% exercisable

immediately and an additional 20% exercisable on each of the next four anniversaries of the grant date.

(b) In fiscal 2005, options to purchase 288,675 shares of Pep Boys Stock were granted to 34 employees.