Pep Boys 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

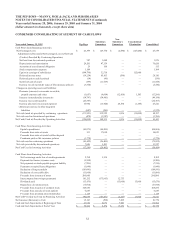

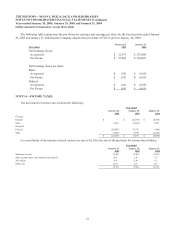

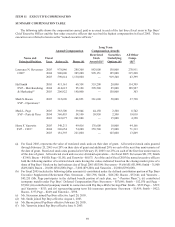

Items that gave rise to significant portions of the deferred tax accounts are as follows:

January 28,

2006

January 29,

2005

Deferred tax assets:

Employee compensation $ 6,693 $ 5,915

Store closing reserves 1,087 995

Legal 500 704

Benefit Accruals 538 —

Net operating loss carryforwards 27,640 8,260

Tax credit carryforwards 12,775 9,089

Accrued leases 13,522 13,067

Other 3,049 2,484

Gross deferred tax assets 65,804 40,514

Valuation allowance (3,545) (1,558)

$ 62,259 $ 38,956

Deferred tax liabilities:

Depreciation $ 55,222 $ 57,677

Inventories 17,655 17,802

Real estate tax 2,405 2,434

Insurance 3,180 3,840

Benefit accruals —1,189

Interest rate swap 2,151 1,388

$ 80,613 $ 84,330

Net deferred tax liability $ 18,354 $ 45,374

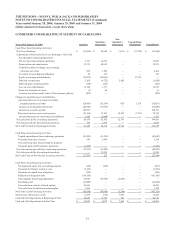

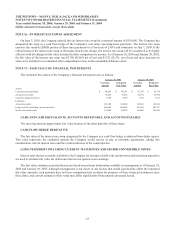

As of January 28, 2006 and January 29, 2005, the company had available tax net operating losses that can be carried forward to future years. The $113,741

net operating loss carryforward in 2006 consists of $73,069 of federal losses and $40,672 of state losses. The federal net operating loss begins to expire in

2023 while the state net operating losses will expire in various years beginning in 2008.

The tax credit carryforward in 2006 consists of $4,412 of Alternative Minimum Tax credits, $2,612 of work opportunity credits, $ 5,506 of state tax credits

and $246 of Charitable Contribution carryforward.

The tax credit carryforward in 2005 consists of $4,400 of Alternative Minimum Tax credits, $1,700 of work opportunity credits, and $2,989 of state tax

credits.

Due to the uncertainty of the Company’s ability to realize certain state tax attributes, valuation allowances of $3,545 and $1,558 were recorded at January

28, 2006 and January 29, 2005, respectively.

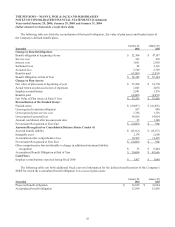

NOTE 15—CONTINGENCIES

The Company is not currently engaged in any litigation arising outside the ordinary course of its business that it believes

to be material. The Company is party to various actions and claims, including purported class actions, arising in the normal

course of business. The Company believes that amounts accrued for awards or assessments in connection with such matters

are adequate and that the ultimate resolution of these matters will not have a material adverse effect on the Company’s

financial position or results of operations.