Pep Boys 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

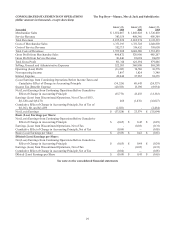

Fiscal 2005 vs. Fiscal 2004

Total revenues for fiscal 2005 decreased 1.5%. This decrease was due primarily to a decrease in comparable store revenues

of 1.3%. Comparable store service revenue decreased 6.1% while comparable store merchandise sales decreased 0.2%. All

stores that are included in the comparable store sales base as of the end of the period are included in the Company’s comparable

store data calculations. Upon reaching its 13th month of operation, a store is added to our comparable store sales base. Stores

are removed from the comparable store sales base upon their relocation or closure. Once a relocated store reaches its 13th

month of operation at its new location, it is added back into our comparable store sales base. Square footage increases are

infrequent and immaterial and, accordingly, are not considered in our calculations of comparable store data.

Gross profit from merchandise sales decreased, as a percentage of merchandise sales, to 26.0% in fiscal 2005 from 28.4%

in fiscal 2004. This was a 9.1% or $48,028,000 decrease from the prior year. This decrease, as a percentage of merchandise

sales, was due to increases in warehousing costs and occupancy costs, and decreases in merchandise margins. The increase

in warehousing costs was mainly due to the recognition of a $12,695,000 gain on disposal of a distribution center in 2004, plus

increases in rent expense and rental equipment for the new warehouse in San Bernardino, CA. The increase in store occupancy

costs was due to increased lease expense associated with the new point-of sale system and building and equipment maintenance

expenses related to the store refurbishment program, offset, in part, by gains on disposal from the sale of two stores. The

decrease in merchandise margin resulted from higher tire costs, a less favorable product mix consisting of more sales from

lower margin products and higher freight costs.

Gross profit from service revenue decreased, as a percentage of service revenue, to 7.9% in fiscal 2005 from 22.6% in

fiscal 2004. This was a 67.2% or $62,248,000 decrease from the prior year. This decrease, as a percentage of service revenue,

was due to decreased service revenue against fixed occupancy costs, in addition to increased payroll and benefits. The

decrease in service revenue resulted primarily from decreased customer traffic and reduced tire sales, which results in fewer

tire-related services and a negative impact on the overall service results. The increase in payroll and benefits was primarily

due to a restructuring of field operations into separate retail and service teams on January 30, 2005. In connection with this

restructuring, certain retail personnel, who were previously utilized in merchandising roles supporting the service business,

were reassigned to purely service-related responsibilities. The labor and benefit costs related to these associates, approximately

$21,132,000, which were previously recognized in selling, general and administrative expenses, are now recognized in costs

of service revenue.

Selling, general and administrative expenses decreased, as a percentage of total revenues, to 23.4% in fiscal 2005 from

24.1% in fiscal 2004. This was a $24,307,000 or 4.4% decrease from the prior year. This decrease, as a percentage of total

revenues, was due primarily to decreases in store expenses, general office costs and employee benefits, offset, in part, by an

increase in net media expense. The decrease in store expenses was primarily caused by a decrease of approximately $21,132,000

in payroll and related benefit costs (see above explanation of field operations restructuring), offset by increased hiring

expenses, and travel expense associated with the store refurbishment program. The decrease in administrative expenses was

primarily due to the recognition of $6,911,000 of executive severance in 2004, offset by a $4,200,000 asset impairment charge

reflecting the remaining value of a commercial sales software asset in 2005, higher travel costs, auditing and tax services and

meeting costs. The increase in net media expense was due primarily to incremental circular advertising and sales promotion

expenses of approximately $11,000,000 related to the grand reopenings.

Interest expense increased 36.4% or $13,075,000 due primarily to $9,738,000 in interest and fees associated with the early

satisfaction and discharge of the Company’s $43,000,000 6.88% Medium Term Notes ($342,000 of interest through original

maturity) and the $100,000,000 6.92% TERMS ($1,296,000 of interest through original maturity, and $8,100,000 to purchase

an associated call option).

Earnings from discontinued operations increased from a loss of $1,876,000, net of tax, in fiscal 2004 to earnings of

$266,000, net of tax, in fiscal 2005 due primarily to changes in assumptions for sublet income and expenses related to closed

stores.

Net earnings decreased, as a percentage of total revenues, due primarily to a decrease in total gross profit, an increase in

interest expense and the impact of a net charge for the cumulative effect of a change in accounting principle for the adoption

of FIN 47, "Accounting for Conditional Asset Retirement Obligations" recorded in fiscal 2005, offset by decreases in income

tax expense and loss from discontinued operations.