Pep Boys 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

recognized an asset of $2,844, accumulated depreciation of $2,247 and a liability of $4,540 on its consolidated balance

sheet.

In the fourth quarter of fiscal 2005, the Company reviewed and revised its estimated settlement costs. The Company

reversed $1,945 of the liability as the original estimates of the contamination occurrence rate and the cost to remediate such

contaminations proved to be higher than actual experience is yielding.

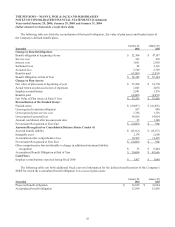

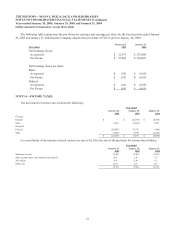

At January 28, 2006, the Company has a liability pertaining to the asset retirement obligation in accrued expenses on its

consolidated balance sheet. The following is a reconciliation of the beginning balance and ending carrying amounts of the

Company’s asset retirement obligation under SFAS 143 from January 31, 2004 through January 28, 2006:

Asset retirement obligation, January 31, 2004 $ 4,901

Asset retirement obligation incurred during the period 142

Asset retirement obligation settled during the period (121)

Accretion expense 135

Asset retirement obligation, January 29, 2005 $ 5,057

Asset retirement obligation incurred during the period 43

Asset retirement obligation settled during the period (141)

Accretion expense 109

Reduction in asset retirement liability (1,945)

Asset retirement obligation, January 28, 2006 $ 3,123

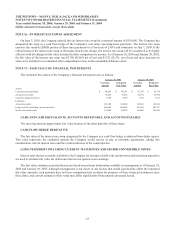

In March 2005, the FASB issued FIN 47, “Accounting for Conditional Asset Retirement Obligations”, an interpretation

of SFAS 143, “Asset Retirement Obligations”. FIN 47 addresses diverse accounting practices that have developed with regard

to the timing of liability recognition for legal obligations associated with the retirement of a tangible long-lived asset in which

the timing and/or method of settlement are conditional on a future event that may or may not be within the control of the entity.

FIN 47 also clarifies when an entity should have sufficient information to reasonably estimate the fair value of an asset

retirement obligation. The provision is effective for fiscal years ending after December 15, 2005.

The Company adopted FIN 47 on January 28, 2006. This interpretation impacted the Company in recognition of legal

obligations associated with surrendering its leased properties. These obligations were previously omitted from the Company’s

SFAS 143 analysis due to their uncertain timing. The impact of adopting FIN 47 was the recognition of net additional leasehold

improvement assets amounting to $470, an asset retirement obligation of $3,652 and a charge of $3,182 ($2,021, net of tax),

which was included in Cumulative Effect of Change in Accounting Principle in the accompanying consolidated statement of

operations.

Had the Company adopted the provisions of FIN 47 prior to January 28, 2006, the amount of the asset retirement

obligations on a pro forma basis would have been $3,441 and $3,230 as of January 29, 2005 and January 31, 2004,

respectively.