Pep Boys 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

Effects of Inflation

The Company uses the LIFO method of inventory valuation. Thus, the cost of merchandise sold approximates current

cost. Although the Company cannot accurately determine the precise effect of inflation on its operations, it does not believe

inflation has had a material effect on revenues or results of operations during all fiscal years presented.

Industry Comparison

We operate in the U.S. automotive aftermarket, which has two general competitive arenas: the Do-It-For-Me (“DIFM”)

(service labor, installed merchandise and tires) market and the Do-It-Yourself (“DIY”) (retail merchandise) market. Generally,

the specialized automotive retailers focus on either the “DIY” or “DIFM” areas of the business. We believe that operation in

both the “DIY” and “DIFM” areas of the business positively differentiates us from most of our competitors. Although we

manage our store performance at a store level in aggregation, we believe that the following presentation shows an accurate

comparison against competitors within the two sales arenas. We compete in the “DIY” area of the business through our retail

sales floor and commercial sales business (Retail Sales). Our Service Center business (labor and installed merchandise and

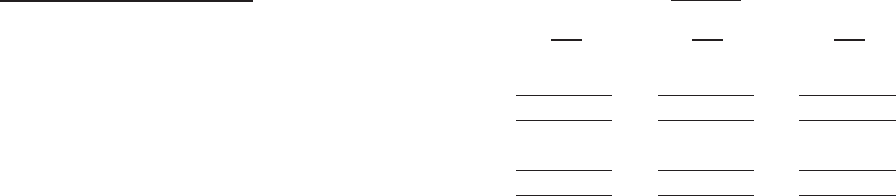

tires) competes in the “DIFM” area of the industry. The following table presents the revenues and gross profit for each area of

the business.

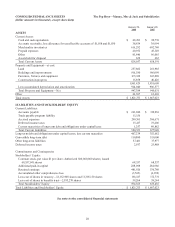

(dollar amounts in thousands) Yearended

January 28,

2006

January 29,

2005

January 31,

2004

Retail Sales (1) $ 1,354,910 $ 1,351,018 $ 1,194,019

Service Center Revenue (2) 880,316 918,956 937,300

Total Revenues $ 2,235,226 $ 2,269,974 $ 2,131,319

Gross Profit from Retail Sales (3) $ 344,893 $ 370,687 $ 308,616

Gross Profit from Service Center Revenue (3) 166,425 250,907 271,250

Total Gross Profit $ 511,318 $ 621,594 $ 579,866

(1) Excludes revenues from installed products.

(2) Includes revenues from installed products.

(3) Gross Profit from Retail Sales includes the cost of products sold, buying, warehousing and store occupancy costs.

Gross Profit from Service Center Revenue includes the cost of installed products sold, buying, warehousing, service

center payroll and related employee benefits and service center occupancy costs. Occupancy costs include utilities,

rents, real estate and property taxes, repairs and maintenance and depreciation and amortization expenses.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Management’s Discussion and Analysis of Financial Condition and Results of Operations discusses the Company’s

consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in

the United States of America. The preparation of these financial statements requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at

the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting

period. On an on-going basis, management evaluates its estimates and judgments, including those related to customer

incentives, product returns and warranty obligations, bad debts, inventories, income taxes, financing operations, restructuring

costs, retirement benefits, risk participation agreements and contingencies and litigation. Management bases its estimates and

judgments on historical experience and on various other factors that are believed to be reasonable under the circumstances,

the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily

apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

The Company believes that the following represent its more critical estimates and assumptions used in the preparation of

the consolidated financial statements, although not inclusive:

• The Company evaluates whether inventory is stated at the lower of cost or market based on historical experience with

the carrying value and life of inventory. The assumptions used in this evaluation are based on current market conditions and

the Company believes inventory is stated at the lower of cost or market in the consolidated financial statements. In addition,