Pep Boys 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

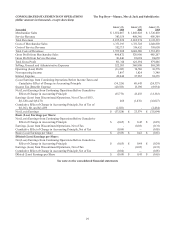

Fiscal 2004 vs. Fiscal 2003

Total revenues for fiscal 2004 increased 6.5%. This increase was due primarily to an increase in comparable store

revenues of 6.6%. Comparable store service revenue increased 1.1% while comparable store merchandise sales increased

7.9%. All stores that are included in the comparable store sales base as of the end of the period are included in the Company’s

comparable store data calculations. Upon reaching its 13th month of operation, a store is added to our comparable store sales

base. Stores are removed from the comparable store sales base upon their relocation or closure. Once a relocated store reaches

its 13th month of operation at its new location, it is added back into our comparable store sales base. Square footage increases

are infrequent and immaterial and, accordingly, are not considered in our calculations of comparable store data.

Gross profit from merchandise sales increased, as a percentage of merchandise sales, to 28.4% in fiscal 2004 from 28.1%

in fiscal 2003. This was a 9.0% or $43,693,000 increase from the prior year. This increase, as a percentage of merchandise

sales, was due to the recognition of a $12,695,000 gain on the disposal of one of the Company’s distribution centers and a

decrease in store occupancy costs, offset in part, by decreased merchandise margins. The decrease in store occupancy costs,

as a percentage of merchandise sales, was due to the impact of a charge made in 2003 for an asset impairment of $1,371,000

coupled with lower rent, as a percentage of merchandise sales. The decrease in merchandise margins was due primarily to

promotional pricing in fiscal 2004 as compared to fiscal 2003 which was negatively impacted by an inventory write down of

$24,580,000 made in the second quarter as a result of the restructuring.

Gross profit from service revenue decreased, as a percentage of service revenue, to 22.6% in fiscal 2004 from 23.4% in

fiscal 2003. This was a 2.1% or $1,965,000 decrease from the prior year. This decrease, as a percentage of service revenue,

was due primarily to increases in service employee benefits. The increase in employee benefits was due primarily to increased

workers' compensation costs.

Selling, general and administrative expenses decreased, as a percentage of total revenues, to 24.1% in fiscal 2004 from

26.7% in fiscal 2003. This was a $22,480,000 or 3.9% decrease over the prior year. This decrease, as a percentage of total

revenues, was due primarily to a decrease in general office costs and employee benefits offset, in part, by an increase in net

media expense. The decrease in general office costs was due to incremental savings from our 2003 restructuring actions of

approximately $4,000,000, the impact in fiscal 2003 of increased legal costs of $24,600,000 related to the action entitled

“Dubrow et al vs. The Pep Boys-Manny, Moe and Jack” and $5,613,000 for costs associated with the corporate restructuring.

The decrease in employee benefits is due to savings in fiscal 2004 from our fiscal 2003 restructuring actions, along with the

impact of a charge made in 2003 for the settlement of a retirement plan obligation. The increase in net media expense, as a

percentage of total revenues, was due primarily to an increase in media expenditures resulting from a more aggressive circular

advertising program in fiscal 2004.

Interest expense decreased 6.0% or $2,290,000 due primarily to lower debt levels.

Loss from discontinued operations decreased from a loss of $16,027,000, net of tax, in fiscal 2003 to a loss of $1,876,000,

net of tax, in fiscal 2004 due to the fact that the charges associated with the corporate restructuring occurred primarily in

fiscal 2003.

Net earnings increased, as a percentage of total revenues, due primarily to an increase in gross profit from merchandise

sales as a percentage of merchandise sales, a decrease in selling, general and administrative expenses and a decrease in

interest expense as a percentage of total revenues coupled with a decrease in the loss from discontinued operations and the

impact of a net charge for the cumulative effect of a change in accounting principle for the adoption of SFAS No. 143,

"Accounting for Asset Retirement Obligations" recorded in fiscal 2003.