Pep Boys 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

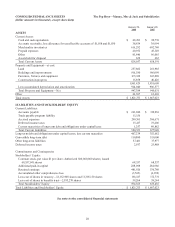

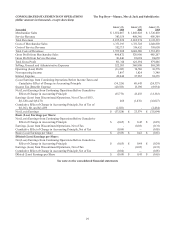

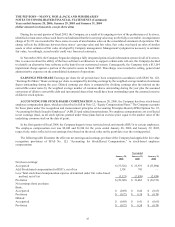

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’EQUITY The Pep Boys—Manny, Moe & Jack and Subsidiaries

(dollar amounts in thousands, except share data)

Common Stock

Shares Amount

Additional

Paid-in-

Capital

Retained

Earnings

Treasury Stock

Shares Amount

Accumulated

Other

Comprehensive

Loss

Benefits

Trust

Total

Stockholders’

Equity

Balance, February 1, 2003 63,910,577 $ 63,911 $ 177,244 $ 586,735 (10,070,729) $ (162,595) $ (151) $ (59,264) $ 605,880

Comprehensive Loss:

Net loss (33,894)

Minimum pension liability

adjustment, net of tax (1,253)

Fair market value adjustment

on derivatives, net of tax 1,389

Total Comprehensive Loss (33,758)

Cash dividends ($.27 per

share) (14,089) (14,089)

Effect of stock options and

related tax benefits (39) (6,499) 1,054,250 17,021 10,483

Dividend reinvestment plan 112 (320) 88,320 1,426 1,218

Balance, January 31, 2004 63,910,577 63,911 177,317 531,933 (8,928,159) (144,148) (15) (59,264) 569,734

Comprehensive Income:

Net income 23,579

Minimum pension liability

adjustment, net of tax (5,799)

Fair market value adjustment

on derivatives, net of tax 962

Total Comprehensive Income 18,742

Issuance of Common Stock 4,646,464 4,646 104,208 108,854

Cash dividends ($.27 per

share) (15,676) (15,676)

Effect of stock options and

related tax benefits 2,064 (2,984) 638,210 10,137 9,217

Stock compensation expense 1,184 1,184

Repurchase of Common Stock (3,077,000) (39,718) (39,718)

Dividend reinvestment plan 193 (72) 61,819 998 1,119

Balance, January 29, 2005 68,557,041 68,557 284,966 536,780 (11,305,130) (172,731) (4,852) (59,264) 653,456

Comprehensive Loss:

Net loss (37,528)

Minimum pension liability

adjustment, net of tax (22)

Fair market value adjustment

on derivatives, net of tax 1,309

Total Comprehensive Loss (36,241)

Cash dividends ($.27 per

share) (14,686) (14,686)

Effect of stock options and

related tax benefits 1,719 (2,520) 338,856 5,592 4,791

Effect of restricted stock unit

conversions (636) 28,981 433 (203)

Stock compensation expense 2,049 2,049

Repurchase of Common Stock (1,282,600) (15,562) (15,562)

Dividend reinvestment plan (120) 66,925 1,081 961

Balance, January 28, 2006 68,557,041 $ 68,557 $ 288,098 $ 481,926 (12,152,968) $ (181,187) $ (3,565) $ (59,264) $ 594,565

See notes to the consolidated financial statements