Pep Boys 2005 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

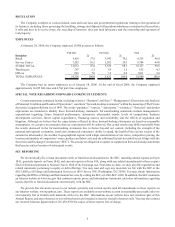

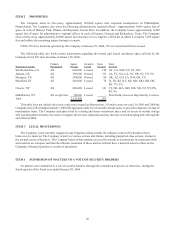

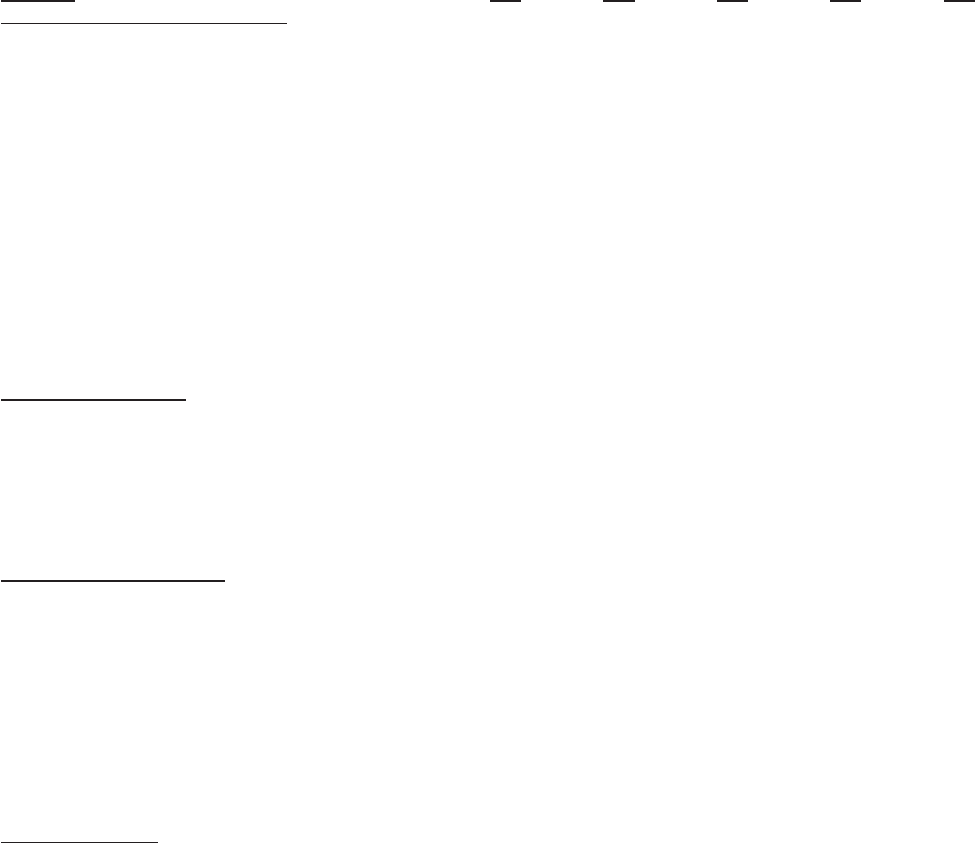

ITEM 6 SELECTED FINANCIAL DATA

The following tables set forth the selected financial data for the Company and should be read in conjunction with the

Consolidated Financial Statements and Notes thereto included elsewhere herein.

(dollar amounts are in thousands, except share data)

Year ended

Jan. 28,

2006

Jan. 29,

2005

Jan. 31,

2004

Feb. 1,

2003

Feb. 2,

2002

STATEMENT OF OPERATIONS DATA

Merchandise sales $ 1,852,067 $ 1,860,628 $ 1,726,010 $ 1,695,275 $ 1,704,841

Service revenue 383,159 409,346 405,309 399,553 402,928

Total revenues 2,235,226 2,269,974 2,131,319 2,094,828 2,107,769

Gross profit from merchandise sales 480,872 528,900(2) 485,207(3) 508,871(4) 493,459(5)

Gross profit from service revenue 30,446 92,694 94,659(3) 100,182(4) 99,232(5)

Total gross profit 511,318 621,594(2) 579,866(3) 609,053(4) 592,691(5)

Selling, general and administrative expenses 522,501(1) 546,808(2) 569,288(3) 503,645(4) 497,284(5)

Operating (loss) profit (11,183)(1) 74,786(2) 10,578(3) 105,407(4) 95,407(5)

Non-operating income 3,897 1,824 3,340 3,097 4,623

Interest expense 49,040 35,965 38,255 47,237 53,709

(Loss) earnings from continuing operations before income taxes

and cumulative effect of change in accounting principle (56,326)(1) 40,645(2) (24,337)(3) 61,267(4) 46,321(5)

Net (loss) earnings from continuing operations before cumulative

effect of change in accounting principle (35,773)(1) 25,455(2) (15,383)(3) 38,393(4) 29,765(5)

Discontinued operations, net of tax 266 (1,876) (16,027) 1,075 602

Cumulative effect of change in accounting principle, net of tax (2,021) — (2,484) — —

Net (loss) earnings (37,528)(1) 23,579(2) (33,894)(3) 39,468(4) 30,367(5)

BALANCE SHEET DATA

Working capital $ 247,526$ 180,651$ 76,227$ 130,680$ 115,201

Current ratio 1.43 to 1 1.27 to 1 1.10 to 1 1.24 to 1 1.21 to 1

Merchandise inventories $ 616,292$ 602,760$ 553,562$ 488,882$ 519,473

Property and equipment-net 947,389 945,031 923,209 974,673 1,008,697

Total assets 1,821,753 1,867,023 1,778,046 1,741,650 1,755,990

Long-term debt (includes all convertible debt) 586,239 471,682 408,016 525,577 544,418

Total stockholders’ equity 594,565 653,456 569,734 605,880 578,010

DATA PER COMMON SHARE

Basic (loss) earnings from continuing operations before cumulative

effect of change in accounting principle $ (0.65)(1) $ 0.45(2) $ (0.29)(3) $ 0.75(4) $ 0.58(5)

Basic (loss) earnings (0.69)(1) 0.42(2) (0.65)(3) 0.77(4) 0.59(5)

Diluted (loss) earnings from continuing operations before

cumulative effect of change in accounting principle (0.65)(1) 0.44(2) (0.29)(3) 0.72(4) 0.57(5)

Diluted net (loss) earnings (0.69)(1) 0.41(2) (0.65)(3) 0.74(4) 0.58(5)

Cash dividends declared 0.27 0.27 0.27 0.27 0.27

Stockholders’ equity 10.97 11.87 10.79 11.73 11.24

Common share price range:

High 18.80 29.37 23.99 19.38 18.48

Low 11.75 11.83 6.00 8.75 4.40

OTHER STATISTICS

Return on average stockholders’ equity (6.0)% 3.9% (5.8)% 6.7% 5.3%

Common shares issued and outstanding 54,208,803 55,056,641 52,787,148 51,644,578 51,430,861

Capital expenditures $ 92,083 $ 103,766 $ 43,262 $ 43,911 $ 25,375

Number of retail outlets 593 595 595 629 628

Number of service bays 6,162 6,181 6,181 6,527 6,507

(1) Includes a pretax charge of $4,200 related to an asset impairment charge reflecting the remaining value of a commercial sales software

asset, which was included in selling, general and administrative expenses.

(2) Includes a pretax charge of $6,911 related to certain executive severance obligations, which was included in selling, general and

administrative expenses, and a pretax gain of $12,695 on the disposal of one of the Company’s distribution centers, which was

included in gross profit from merchandise sales.

(3) Includes pretax charges of $88,980 related to corporate restructuring and other one-time events of which $29,308 reduced gross profit

from merchandise sales, $3,278 reduced gross profit from service revenue and $56,394 was included in selling, general and

administrative expenses.

(4) Includes pretax charges of $2,529 related to the Profit Enhancement Plan of which $2,014 reduced the gross profit from merchandise

sales, $491 reduced gross profit from service revenue and $24 was included in selling, general and administrative expenses.

(5) Includes pretax charges of $5,197 related to the Profit Enhancement Plan of which $4,169 reduced the gross profit from merchandise

sales, $813 reduced gross profit from service revenue and $215 was included in selling, general and administrative expenses.