Pep Boys 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

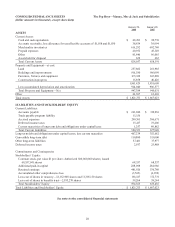

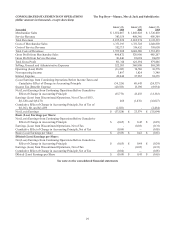

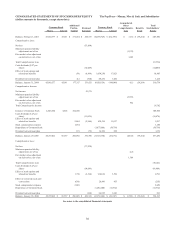

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

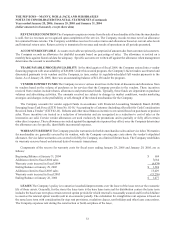

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments - an amendment

of FASB Statements No. 133 and 140” (SFAS 155). SFAS 155 simplifies accounting for certain hybrid instruments currently

governed by SFAS No. 133 , “Accounting for Derivative Instruments and Hedging Activities” (SFAS 133), by allowing fair

value remeasurement of hybrid instruments that contain an embedded derivative that otherwise would require bifurcation.

SFAS 155 also eliminates the guidance in SFAS 133 Implementation Issue No. D1, “Application of Statement 133 to Beneficial

Interests in Securitized Financial Assets,” which provides such beneficial interests are not subject to SFAS 133. SFAS 155

amends SFAS No. 140, “ Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities - a

Replacement of FASB Statement No. 125,” by eliminating the restriction on passive derivative instruments that a qualifying

special-purpose entity may hold. This statement is effective for financial instruments acquired or issued after the beginning

of our fiscal year 2007. We do not expect the adoption of this statement to have a material impact on our financial condition,

results of operations or cash flows.

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections- a replacement of APB

Opinion No. 20 and FASB Statement No. 3” (SFAS 154). SFAS 154 requires retrospective application to prior periods’

financial statements of changes in accounting principle, unless it is impracticable to determine either the period-specific

effects or the cumulative effect of the change. SFAS 154 also requires that retrospective application of a change in accounting

principle be limited to the direct effects of the change. Indirect effects of a change in accounting principle, such as a change

in nondiscretionary profit-sharing payments resulting from an accounting change, should be recognized in the period of the

accounting change. SFAS 154 also requires that a change in depreciation, amortization, or depletion method for long-lived,

nonfinancial assets be accounted for as a change in accounting estimate effected by a change in accounting principle. SFAS

154 is effective for accounting changes and corrections of errors made in fiscal years beginning after December 15, 2005.

Early adoption is permitted for accounting changes and corrections of errors made in fiscal years beginning after the date this

Statement is issued. The Company will adopt the provisions of SFAS 154 as applicable beginning in fiscal 2006.

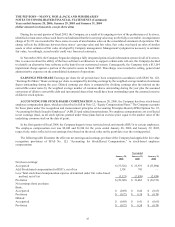

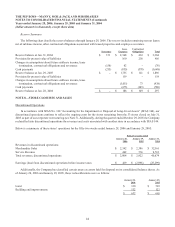

In March 2005, the FASB issued FIN 47, “Accounting for Conditional Asset Retirement Obligations”, an interpretation of

SFAS 143, “Asset Retirement Obligations”. FIN 47 addresses diverse accounting practices that have developed with regard to

the timing of liability recognition for legal obligations associated with the retirement of a tangible long-lived asset in which

the timing and/or method of settlement are conditional on a future event that may or may not be within the control of the entity.

FIN 47 also clarifies when an entity should have sufficient information to reasonably estimate the fair value of an asset

retirement obligation. The provision is effective for fiscal years ending after December 15, 2005. The Company adopted FIN

47 on January 28, 2006. For the Company, this interpretation only applied to legal obligations associated with surrendering

its leased properties. These obligations were previously omitted from the Company’s SFAS 143 analysis due to their uncertain

timing. The impact of adopting FIN 47 was the recognition of net additional leasehold improvement assets amounting to

$470,000, an asset retirement obligation of $3,652,000 and a charge of $3,182,000 ($2,021,000, net of tax), which was included

in Cumulative Effect of Change in Accounting Principle in the accompanying consolidated statement of operations.

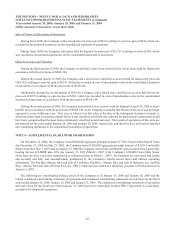

In December 2004, the FASB issued SFAS No. 123 (revised 2004) “Share-Based Payment” SFAS No. 123(R), which

replaces SFAS No. 123, “Accounting for Stock-Based Compensation,” and supercedes Accounting Principles Board (APB)

Opinion No. 25, “Accounting for Stock Issued to Employees,” and subsequently issued stock option related guidance. This

statement (SFAS 123(R))establishes standards for the accounting of transactions in which an entity exchanges its equity

instruments for goods and services, primarily on accounting for transactions in which an entity obtains employee services in

share-based payment transactions. It also addresses transactions in which an entity incurs liabilities in exchange for goods

and services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those

equity instruments. Entities will be required to measure the cost of employee services received in exchange for an award of

equity instruments based on the grant-date fair value of the award. That cost will be recognized over the period during which

an employee is required to provide service in exchange for the award (usually the vesting period). The grant-date fair value

of employee share options and similar instruments will be estimated using option-pricing models. If an equity award is

modified after the grant date, incremental compensation cost will be recognized in an amount equal to the excess of the fair

value of the modified award over the fair value of the original award immediately before the modification. SFAS 123(R) also

amended FAS No. 95, “Statement of Cash Flows” to require the benefits of tax deductions in excess of recognized compensation

cost be reported as financing cash inflows rather than as a reduction in income taxes paid, which is included within operating

cash flows.