Pep Boys 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

In the third quarter of fiscal 2004, the Company announced a share repurchase program for up to $100,000,000 of the

Company’s shares. The Company repurchased approximately 1,283,000 shares during fiscal 2005 for approximately

$15,562,000. The repurchase program was extended through September 8, 2006. As of January 28, 2006, the Company had

repurchased a total of 4,359,600 shares at an average cost of $12.68 per share ($55,280,000).

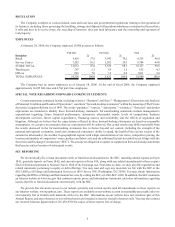

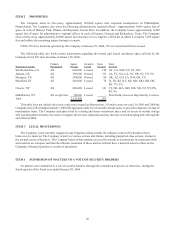

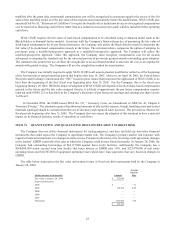

Contractual Obligations

The following chart represents the Company’s total contractual obligations and commercial commitments as of January 28,

2006:

(dollar amounts in thousands)

Obligation Total

Due in less

than 1 year

Due in

1–3 years

Due in

3–5 years

Due after

5 years

Long-term debt (1) $ 586,667$ 2,548$ 123,256$ 260,685$ 200,178

Operating leases 503,016 61,930 116,949 87,294 236,843

Expected scheduled interest payments on all long –

term debt 227,202 31,794 90,248 75,160 30,000

Capital leases 829 209 466 154 —

Total cash obligations $ 1,317,714$ 96,481$ 330,919$ 423,293$ 467,021

(1) Long-term debt includes current maturities. Due in 3-5 years total includes $200,000,000 Senior Secured Term loan due

January 21, 2011. Such maturity accelerates to March 1, 2007 if the Company’s $119,000,000 Convertible Senior Notes

have not been converted, repurchased or refinanced prior to March 1, 2007. At January 28, 2006, the Company has both

the ability and intent to retire the $119,000,000 Convertible Senior Notes prior to March 1, 2007.

The table excludes our pension obligation. We made voluntary contributions of $1,867,000, $1,819,000, and $14,043,000

to our pension plans in fiscal 2005, 2004, and 2003, respectively. Future plan contributions are dependent upon actual plan

asset returns and interest rates. We expect contributions to approximate $1,417,000 in fiscal 2006. See Note 10 of Notes to

Consolidated Financial Statements in “Item 8 Financial Statements and Supplementary Data” for further discussion of our

pension plans.

(dollar amounts in thousands)

Commercial Commitments Total

Due in less

than 1 year

Due in

1–3 years

Due in

3–5 years

Due after

5 years

Import letters of credit $ 1,015$ 1,015$ —$ —$ —

Standby letters of credit 41,218 18,483 22,735 — —

Surety bonds 13,021 12,743 128 150 —

Total commercial commitments $ 55,254 $ 32,241 $ 22,863 $ 150 $ —

Long-term Debt

On January 27, 2006 the Company entered into a $200,000,000 Senior Secured Term Loan facility due January 27, 2011

(March 1, 2007 if the Company’s 4.25% Convertible Senior Notes have not been converted, repurchased or refinanced prior

to March 1, 2007- the Company anticipates refinancing the 4.25% Convertible Senior Notes prior to March 1, 2007). This

facility is secured by the real property and improvements associated with 154 of the Company’s stores. Interest at the rate of

LIBOR plus 3.0% on this facility is payable starting in February 2006. Proceeds from this facility were used to satisfy and

discharge the Company’s outstanding $43,000,000 6.88% Medium Term Notes due March 6, 2006 and $100,000,000 6.92%

Term Enhanced Remarketable Securities (TERMS) due July 7, 2016 and to reduce borrowings under the Company’s line of

credit by approximately $39,000,000.

In the second quarter of fiscal 2005, the Company reclassified $100,000,000 aggregate principal amount of the TERMS

to current liabilities on the consolidated balance sheet. The TERMS were retired on January 27, 2006 with cash from the

Company’s $200,000,000 Senior Secured Term Loan facility. In retiring the TERMS, the Company was obligated to purchase

a call option, which, if exercised, would have allowed the securities to be remarketed through a maturity date of July 7, 2016.

The $8,100,000 redemption price of the call option was based upon the then present value of the remaining payments on the

TERMS through July 17, 2016, at 5.45%, discounted at the 10 year Treasury rate. Additionally, the Company prepaid

$1,296,000 in interest through the original maturity date of July 17, 2006.