Pep Boys 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

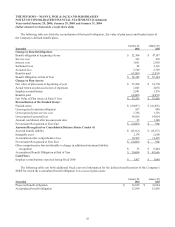

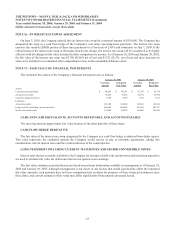

NOTE 10—BENEFIT PLANS

DEFINED BENEFIT PLANS

The Company has a defined benefit pension plan covering substantially all of its full-time employees hired on or before

February 1, 1992. Normal retirement age is 65. Pension benefits are based on salary and years of service. The Company’s

policy is to fund amounts as are necessary on an actuarial basis to provide assets sufficient to meet the benefits to be paid to

plan members in accordance with the requirements of ERISA.

The actuarial computations are made using the “projected unit credit method.” Variances between actual experience and

assumptions for costs and returns on assets are amortized over the remaining service lives of employees under the plan.

As of December 31, 1996, the Company froze the accrued benefits under the plan and active participants became fully

vested. The plan’s trustee will continue to maintain and invest plan assets and will administer benefit payments.

The Company also has a Supplemental Executive Retirement Plan (SERP). This unfunded plan has a defined benefit component

that provides key employees designated by the Board of Directors with retirement and death benefits. Retirement benefits are

based on salary and bonuses; death benefits are based on salary. Benefits paid to a participant under the defined pension plan

are deducted from the benefits otherwise payable under the defined benefit portion of the SERP.

On January 31, 2004, the Company amended and restated its SERP. This amendment converted the defined benefit plan

to a defined contribution plan for certain unvested participants and all future participants, and resulted in an expense under

SFAS No. 88, “Employers’ Accounting for Settlements and Curtailments of Defined Benefit Pension Plans and for Termination

Benefits” (SFAS 88), of approximately $2,191. All vested participants under the defined benefits portion will continue to

accrue benefits according to the previous defined benefit formula.

In fiscal 2004, the Company settled several obligations related to the benefits under the defined benefit SERP. These

obligations totaled $2,065. These obligations resulted in an expense under SFAS 88 of approximately $774 in fiscal 2004.

In fiscal 2003, the Company settled an obligation of $12,620 related to the defined benefits SERP obligation for the

former Chairman and CEO. That obligation resulted in an expense under SFAS 88 of approximately $5,231.

The Company uses a December 31 measurement date for determining benefit obligations and the fair value of plan assets

of its plans.

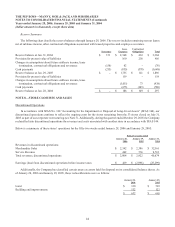

Pension expense includes the following:

Year ended

Jan. 28,

2006

Jan. 29,

2005

Jan. 31,

2004

Service cost $ 363 $ 438 $ 611

Interest cost 3,011 2,903 3,056

Expected return on plan assets (2,339) (2,299) (2,064)

Amortization of transitional obligation 163 163 274

Amortization of prior service cost 360 364 615

Recognized actuarial loss 2,205 1,733 1,723

Net periodic benefit cost 3,763 3,302 4,215

FAS 88 curtailment charge — — 2,191

FAS 88 settlement charge 568 774 5,231

FAS 88 special termination benefits — — 300

Total Pension Expense $ 4,331 $ 4,076 $ 11,937