Pep Boys 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

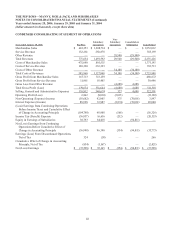

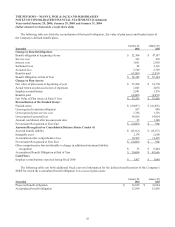

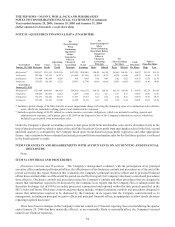

The following table sets forth the reconciliation of the benefit obligation, fair value of plan assets and funded status of

the Company’s defined benefit plans:

Year ended

January 28,

2006

January 29,

2005

Change in Benefit Obligation:

Benefit obligation at beginning of year $ 52,384 $ 47,197

Service cost 363 438

Interest cost 3,011 2,903

Settlement loss 82 2,316

Actuarial loss 2,749 2,383

Benefits paid (4,240) (2,853)

Benefit Obligation at End of Year $ 54,349 $ 52,384

Change in Plan Assets:

Fair value of plan assets at beginning of year $ 35,508 $ 34,730

Actual return on plan assets (net of expenses) 1,043 2,055

Employer contributions 2,981 1,576

Benefits paid (4,240) (2,853)

Fair Value of Plan Assets at End of Year $ 35,292 $ 35,508

Reconciliation of the Funded Status:

Funded status $ (19,057) $ (16,876)

Unrecognized transition obligation 817 980

Unrecognized prior service cost 1,358 1,718

Unrecognized actuarial loss 14,828 14,024

Amount contributed after measurement date 25 1,140

Net Amount Recognized at Year-End $ (2,029) $ 986

Amounts Recognized on Consolidated Balance Sheets Consist of:

Accrued benefit liability $ (15,112) $ (13,137)

Intangible asset 2,174 2,698

Accumulated other comprehensive loss 10,909 11,425

Net Amount Recognized at Year End $ (2,029) $ 986

Other comprehensive loss attributable to change in additional minimum liability

recognition $ 35 $ 9,204

Accumulated Benefit Obligation at End of Year $ 50,404 $ 48,646

Cash Flows

Employer contributions expected during fiscal 2006 $ 1,417 $ 1,090

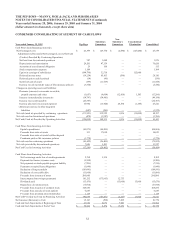

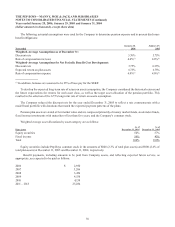

The following table sets forth additional fiscal year-end information for the defined benefit portion of the Company’s

SERP for which the accumulated benefit obligation is in excess of plan assets:

Year ended

January 28,

2006

January 29,

2005

Projected benefit obligation $ 16,859 $ 16,624

Accumulated benefit obligation 12,914 12,885