Pep Boys 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

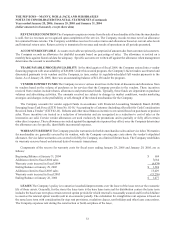

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BUSINESS The Pep Boys-Manny, Moe & Jack and subsidiaries (the “Company”) is engaged principally in the retail sale

of automotive parts and accessories, automotive maintenance and service and the installation of parts through a chain of

stores. The Company currently operates stores in 36 states and Puerto Rico.

FISCAL YEAR END The Company’s fiscal year ends on the Saturday nearest to January 31. Fiscal years 2005, 2004,

and 2003 were comprised of 52 weeks.

PRINCIPLES OF CONSOLIDATION The consolidated financial statements include the accounts of the Company and

its subsidiaries. All significant intercompany balances and transactions have been eliminated.

USE OF ESTIMATES The preparation of the Company’s consolidated financial statements in conformity with

accounting principles generally accepted in the United States of America necessarily requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at

the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting

period. Actual results could differ from those estimates.

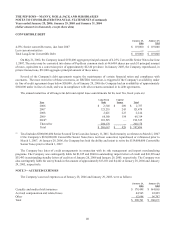

MERCHANDISE INVENTORIES Merchandise inventories are valued at the lower of cost or market. Cost is determined

by using the last-in, first-out (LIFO) method. An actual valuation of inventory under the LIFO method can be made only at

the end of each fiscal year based on inventory and costs at that time. Accordingly, interim LIFO calculations must be based

on management’s estimates of expected fiscal year-end inventory levels and costs. If the first-in, first-out (FIFO) method of

costing inventory had been used by the Company, inventory would have been $615,698 and $588,301 as of January 28, 2006

and January 29, 2005, respectively.

The Company also establishes reserves for potentially excess and obsolete inventories based on current inventory levels,

the historical analysis of product sales and current market conditions. The nature of the Company’s inventory is such that the

risk of obsolescence is minimal and excess inventory has historically been returned to the Company’s vendors for credit. The

Company provides reserves when less than full credit is expected from a vendor or when market is lower than recorded costs.

The reserves are revised on a quarterly basis against historical data for adequacy. The Company’s reserves against inventory

for these matters were $12,822 and $12,676 at January 28, 2006 and January 29, 2005, respectively.

CASH AND CASH EQUIVALENTS Cash equivalents include all short-term, highly liquid investments with a maturity

of three months or less when purchased. All credit and debit card transactions that process in less than seven days are also

classified as cash and cash equivalents.

PROPERTY AND EQUIPMENT Property and equipment are recorded at cost. Depreciation and amortization are

computed using the straight-line method over the following estimated useful lives: building and improvements, 5 to 40 years,

and furniture, fixtures and equipment, 3 to 10 years. Maintenance and repairs are charged to expense as incurred. Upon

retirement or sale, the cost and accumulated depreciation are eliminated and the gain or loss, if any, is included in the

determination of net income. The Company reviews long-lived assets for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be fully recoverable.

SOFTWARE CAPITALIZATION The Company, in accordance with AICPA Statement of Position 98-1, “Accounting

for the Costs of Computer Software Developed or Obtained for Internal Use”, capitalizes certain direct development costs

associated with internal-use software, including external direct costs of material and services, and payroll costs for employees

devoting time to the software projects. These costs are amortized over a period not to exceed five years beginning when the

asset is substantially ready for use. Costs incurred during the preliminary project stage, as well as maintenance and training

costs, are expensed as incurred.

CAPITALIZED INTEREST Interest on borrowed funds is capitalized in connection with the construction of certain

long-term assets. Capitalized interest was immaterial in fiscal years 2005, 2004 and 2003.