Pep Boys 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

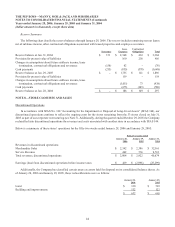

NOTE 4—OTHER CURRENT ASSETS

The Company’s other current assets as of January 28, 2006 and January 29, 2005, were as follows:

January 28,

2006

January 29,

2005

Reinsurance premiums receivable $ 82,629 $ 80,397

Income taxes receivable 2,694 15,404

Other 123 264

Total $ 85,446 $ 96,065

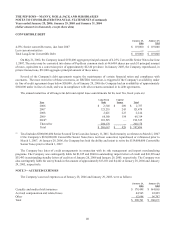

NOTE 5—LEASE AND OTHER COMMITMENTS

On October 18, 2004, the Company entered into a Master Lease agreement providing for the lease of up to $35,000 of new

point-of-sale hardware for the Company’s stores at an interest rate of LIBOR plus 2.25%. This Master Lease is reflected in the

Company’s consolidated financial statements as an operating lease. The Company has evaluated this transaction in accordance

with the guidance of FIN 46R and has determined that it is not required to consolidate the leasing entity. The Company has

an outstanding balance of approximately $20,507 on this operating lease facility as of January 28, 2006. The lease includes a

residual value guarantee with a maximum value of approximately $172. The Company expects the fair market value of the

leased equipment to substantially reduce or eliminate the Company’s payment under the residual guarantee at the end of the

lease term.

In accordance with FIN 45, the Company has recorded a liability for the fair value of the guarantee related to this

operating lease. As of January 28, 2006 and January 29, 2005, the current value of this liability was $105 and $90, respectively,

which is recorded in other long-term liabilities on the consolidated balance sheets.

On August 1, 2003, the Company refinanced $132,000 in operating leases. These leases, which expire on August 1, 2008,

have lease payments with an effective rate of LIBOR plus 2.06%. The Company has evaluated this transaction in accordance

with the original guidance of FIN 46 and has determined that it is not required to consolidate the leasing entity. As of January

28, 2006 there was an outstanding balance of $123,970 under the leases. The leases include a residual value guarantee with a

maximum value of approximately $105,000. The Company expects the fair market value of the leased real estate to substantially

reduce or eliminate the Company’s payment under the residual guarantee at the end of the lease term.

In accordance with FIN 45, the Company has recorded a liability for the fair value of the guarantee related to this

operating lease. As of January 28, 2006 and January 29, 2005, the current value of this liability was $2,493 and $3,491,

respectively, which is recorded in other long-term liabilities on the consolidated balance sheets.

The Company leases certain property and equipment under operating leases and capital leases, which contain renewal

and escalation clauses, step rent provisions, capital improvements funding and other lease concessions. These provisions are

considered in the Company’s calculation of the Company’s minimum lease payments, which are recognized as expense on a

straight-line basis over the applicable lease term. In accordance with SFAS No. 13, as amended by SFAS No. 29, any lease

payments that are based upon an existing index or rate are included in the Company’s minimum lease payment calculations.

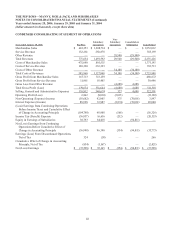

Future minimum rental payments for noncancelable operating leases and capital leases in effect as of January 28, 2006 are

shown in the table below. All amounts are exclusive of lease obligations and sublease rentals applicable to stores for which

reserves, in conjunction with the restructuring, have previously been established.