Pep Boys 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

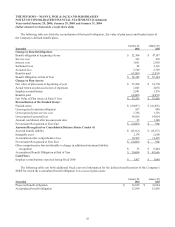

NOTE 16—INTEREST RATE SWAP AGREEMENT

On June 3, 2003, the Company entered into an interest rate swap for a notional amount of $130,000. The Company has

designated the swap as a cash flow hedge of the Company’s real estate operating lease payments. The interest rate swap

converts the variable LIBOR portion of these lease payments to a fixed rate of 2.90% and terminates on July 1, 2008. If the

critical terms of the interest rate swap or the hedge item do not change, the interest rate swap will be considered to be highly

effective with all changes in fair value included in other comprehensive income. As of January 28, 2006 and January 29, 2005,

the fair value of the interest rate swap was $5,790 ($3,660, net of tax) and $3,721 ($2,351, net of tax) and these increases in

value were included in accumulated other comprehensive loss on the consolidated balance sheet.

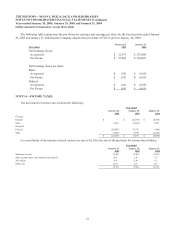

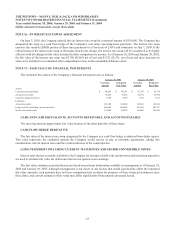

NOTE 17—FAIR VALUE OF FINANCIAL INSTRUMENTS

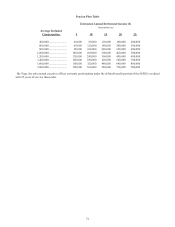

The estimated fair values of the Company’s financial instruments are as follows:

January 28, 2006 January 29, 2005

Carrying

Amount

Estimated

Fair Value

Carrying

Amount

Estimated

Fair Value

Assets:

Cash and cash equivalents $ 48,281 $ 48,281 $ 82,758 $ 82,758

Accounts receivable 36,434 36,434 30,994 30,994

Cash flow hedge derivative 5,790 5,790 3,721 3,721

Liabilities:

Accounts payable 261,940 261,940 310,981 310,981

Long-term debt including current maturities 468,496 444,585 393,564 401,527

Senior convertible notes 119,000 114,835 119,000 120,549

CASH AND CASH EQUIVALENTS, ACCOUNTS RECEIVABLE AND ACCOUNTS PAYABLE

The carrying amounts approximate fair value because of the short maturity of these items.

CASH FLOW HEDGE DERIVATIVE

The fair value of the interest rate swap designated by the Company as a cash flow hedge is obtained from dealer quotes.

This value represents the estimated amount the Company would receive or pay to terminate agreements, taking into

consideration current interest rates and the creditworthiness of the counterparties.

LONG-TERM DEBT INCLUDING CURRENT MATURITIES AND SENIOR CONVERTIBLE NOTES

Interest rates that are currently available to the Company for issuance of debt with similar terms and remaining maturities

are used to estimate fair value for debt issues that are not quoted on an exchange.

The fair value estimates presented herein are based on pertinent information available to management as of January 28,

2006 and January 29, 2005. Although management is not aware of any factors that would significantly affect the estimated

fair value amounts, such amounts have not been comprehensively revalued for purposes of these financial statements since

those dates, and current estimates of fair value may differ significantly from amounts presented herein.