Pep Boys 2005 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

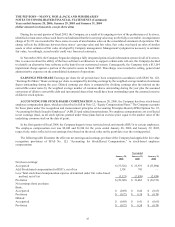

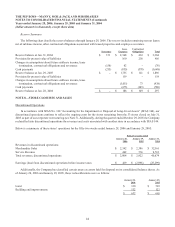

The fair value of each option granted during fiscal years 2005, 2004 and 2003 is estimated on the date of grant using the

Black-Scholes option-pricing model with the following weighted-average assumptions:

Year ended

January 28,

2006

January 29,

2005

January 31,

2004

Dividend yield 1.77% 1.67% 1.57%

Expected volatility 41% 41% 41%

Risk-free interest rate range:

High 4.6% 4.8% 4.6%

Low 3.5% 2.0% 1.5%

Ranges of expected lives in years 3-8 3-8 4-8

COMPREHENSIVE LOSS Comprehensive loss is reported in accordance with SFAS No. 130, “Reporting

Comprehensive Income.” Other comprehensive loss includes minimum pension liability and fair market value of cash flow

hedge.

ACCOUNTING FOR DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES The Company reports

derivatives and hedging activities in accordance with SFAS No. 133, “Accounting for Derivative Instruments and Hedging

Activities,” as amended by SFAS No. 137, SFAS No. 138 and SFAS No. 149. This statement establishes accounting and

reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts

(collectively referred to as derivatives), and for hedging activities. It requires that an entity recognize all derivatives as either

assets or liabilities in the statement of financial position and measure those instruments at fair value.

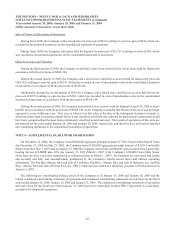

SEGMENT INFORMATION The Company reports segment information in accordance with SFAS No. 131, “Disclosure

about Segments of an Enterprise and Related Information.” The Company operates in one industry, the automotive aftermarket.

In accordance with SFAS No. 131, the Company aggregates all of its stores and reports one operating segment. Sales by major

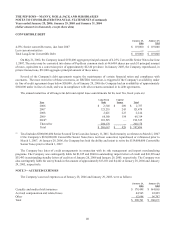

product categories are as follows:

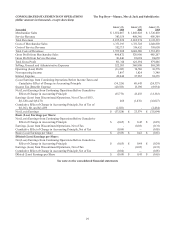

Year ended

Jan. 28,

2006

Jan. 29,

2005

Jan. 31,

2004

Parts and Accessories $ 1,548,206 $ 1,537,382 $ 1,390,082

Tires 303,861 323,246 335,928

Total Merchandise Sales 1,852,067 1,860,628 1,726,010

Service 383,159 409,346 405,309

Total Revenues $ 2,235,226 $ 2,269,974 $ 2,131,319

The Company’s product lines include: tires (not stocked at PEP BOYS EXPRESS stores); batteries; new and remanufactured

parts for domestic and import vehicles; chemicals and maintenance items; fashion, electronic, and performance accessories;

personal transportation merchandise; and select non-automotive merchandise that appeals to automotive “DIY” customers,

such as generators, power tools and canopies. Service consists of the labor charge for installing merchandise or maintaining

or repairing vehicles.

RECENT ACCOUNTING STANDARDS

In March 2006, the FASB issued SFAS No. 156, “Accounting for Servicing of Financial Assets- an amendment of FASB

Statement No. 140” (SFAS 156). SFAS 156 requires an entity to recognize a servicing asset or servicing liability each time it

undertakes an obligation to service a financial asset by entering into a servicing contract in specific situations. Additionally,

the servicing asset or servicing liability shall be initially measured at fair value, if practicable. SFAS 156 is effective as of an

entity’s first fiscal year beginning after September 15, 2006. Early adoption is permitted as of the beginning of an entity’s

fiscal year, provided the entity has not yet issued financial statements, including interim financial statements, for any period

of that fiscal year. We do not expect the adoption of this statement to have a material impact on our financial condition, results

of operations or cash flows.