Pep Boys 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

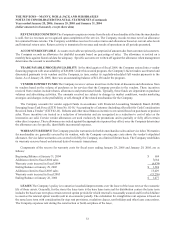

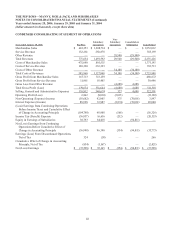

The aggregate minimum rental payments for such leases having initial terms of more than one year are approximately:

Year

Operating

Leases

Capital

Leases

2006 $ 61,930 $ 317

2007 60,114 259

2008 56,835 230

2009 46,925 144

2010 40,369 —

Thereafter 236,843 —

Aggregate minimum lease payments $ 503,016 $ 950

Less: interest on capital leases (121)

Present Value of Net Minimum Lease Payments $ 829

Rental expenses incurred for operating leases in fiscal years 2005, 2004 and 2003 were $67,601, $60,941 and $63,806,

respectively.

In October 2001, the Company entered into a contractual commitment to purchase media advertising services with equal

annual purchase requirements totaling $39,773 over four years. During the second quarter of fiscal 2004, it was determined

that the Company would be unable to meet its obligation for the 2004 contract year, which ended on November 30, 2004. As

a result, the Company recorded a $1,579 charge to selling, general and administrative expenses in the quarter ending July 31,

2004 related to the anticipated shortfall in this purchase commitment. The Company has satisfied all purchase requirements

under this contract at January 28, 2006.

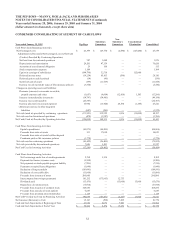

NOTE 6—STOCKHOLDERS’ EQUITY

SHARE REPURCHASE—TREASURY STOCK In the third quarter of fiscal 2004, the Company announced a share

repurchase program for up to $100,000 of the Company’s shares. The Company repurchased approximately 1,283,000 shares

during fiscal 2005 for approximately $15,523, net of expenses. The repurchase program was extended through September 8,

2006. As of January 28, 2006, the Company had repurchased a total of 4,359,600 shares at an average cost of $12.68 per share

($55,280).

All of these repurchased shares were placed into the Company’s treasury. A portion of the treasury shares will be used

by the Company to provide benefits to employees under its compensation plans and in conjunction with the Company’s

dividend reinvestment program. As of January 28, 2006, the Company has reflected 12,152,968 shares of its common stock at

a cost of $181,187 as “cost of shares in treasury” on the Company’s consolidated balance sheet.

SALE OF COMMON STOCK On March 24, 2004, the Company sold 4,646,464 shares of common stock (par value $1

per share) at a price of $24.75 per share for net proceeds of $108,854.

RIGHTS AGREEMENT On December 31, 1997, the Company distributed as a dividend one common share purchase

right on each of its common shares. The rights will not be exercisable or transferable apart from the Company’s common stock

until a person or group, as defined in the rights agreement (dated December 5, 1997), without the proper consent of the

Company’s Board of Directors, acquires 15% or more, or makes an offer to acquire 15% or more of the Company’s outstanding

stock. When exercisable, the rights entitle the holder to purchase one share of the Company’s common stock for $125. Under

certain circumstances, including the acquisition of 15% of the Company’s stock by a person or group, the rights entitle the

holder to purchase common stock of the Company or common stock of an acquiring company having a market value of twice

the exercise price of the right.

The rights do not have voting power and are subject to redemption by the Company’s Board of Directors for $.01 per right

anytime before a 15% position has been acquired and for 10 days thereafter, at which time the rights become non-redeemable.

The rights expire on December 31, 2007.