Pep Boys 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

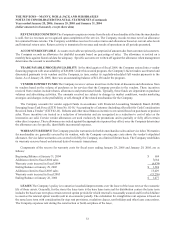

25

modified after the grant date, incremental compensation cost will be recognized in an amount equal to the excess of the fair

value of the modified award over the fair value of the original award immediately before the modification. SFAS 123(R) also

amended FAS No. 95, “Statement of Cash Flows” to require the benefits of tax deductions in excess of recognized compensation

cost be reported as financing cash inflows rather than as a reduction in income taxes paid, which is included within operating

cash flows.

SFAS 123(R) requires the fair value of stock based compensation to be calculated using a valuation model (such as the

Black-Scholes or binomial-lattice models). Consistent with the Company’s historical practice of measuring the fair value of

stock-based compensation for its pro forma disclosures, the Company will utilize the Black-Scholes model to determine the

fair value of its stock-based compensation awards in the future. The statement allows companies the option of adopting its

provisions using a modified-prospective approach or a modified-retrospective approach. The Company will utilize the

modified-prospective approach. Under this approach, the Company must recognize compensation cost for all awards

subsequent to adopting the standard and for the unvested portion of previously granted awards outstanding upon adoption.

The statement also permits the use of either the straight-line or an accelerated method to amortize the cost as an expense for

awards with graded vesting. The Company will use the straight-line method for amortization.

The Company was initially required to apply SFAS 123(R) to all awards granted, modified or settled as of the beginning

of the first interim or annual reporting period that begins after June 15, 2005. However, on April 14, 2005, the United States

Securities and Exchange Commission (the “SEC”) issued a press release that postponed the application of SFAS 123(R) to no

later than the beginning of the first fiscal year beginning after June 15, 2005. For the Company, this is the fiscal year

beginning January 29, 2006. While the impact of adoption of SFAS 123(R) will depend on levels of share-based compensation

granted in the future and the fair value assigned thereto, it is likely to approximate the pro forma compensation expense

reported under SFAS 123 as described in the Company’s disclosure of pro forma net earnings and earnings per share in note

1 of Item 8.

In November 2004, the FASB issued SFAS No. 151, “ Inventory Costs, an Amendment of ARB No. 43, Chapter 4

‘Inventory Pricing’.” The standard requires that abnormal amounts of idle facility expense, freight, handling costs and wasted

materials (spoilage) should be excluded from the cost of inventory and expensed when incurred. The provision is effective for

fiscal periods beginning after June 15, 2005. The Company does not expect the adoption of this standard to have a material

impact on its financial position, results of operations or cash flows.

ITEM 7A QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company does not utilize financial instruments for trading purposes, and does not hold any derivative financial

instruments that could expose the Company to significant market risk. The Company’s primary market risk exposure with

regard to financial instruments is to changes in interest rates. Pursuant to the terms of its revolving credit agreement, changes

in the lenders’ LIBOR could affect the rates at which the Company could borrow funds thereunder. At January 28, 2006, the

Company had outstanding borrowings of $66,137,000 against these credit facilities. Additionally, the Company has a

$200,000,000 senior secured term loan facility that bears interest at LIBOR plus 3.0%, and $123,970,000 of real estate

operating leases and $20,507,000 of equipment operating leases which have lease payments that vary based on changes in

LIBOR.

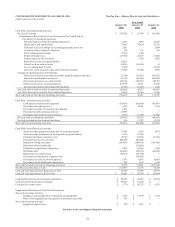

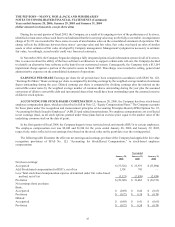

The table below summarizes the fair value and contract terms of fixed rate debt instruments held by the Company at

January 28, 2006:

(dollar amounts in thousands) Amount

Average

Interest

Rate

Fair value at January 28, 2006 $ 315,039

Expected maturities:

2006 $ — —%

2007 119,215 4.25

2008 ——

2009 ——

2010 ——

Thereafter 200,000 7.50

$ 319,215