Pep Boys 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

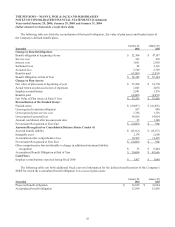

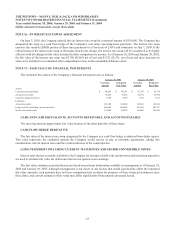

DEFINED CONTRIBUTION PLAN

On January 31, 2004, the Company amended and restated its SERP. This amendment converted the defined benefit plan

to a defined contribution plan for certain unvested participants and all future participants, and resulted in an expense under

SFAS No. 88 of approximately $2,191. All vested participants under the defined benefits portion will continue to accrue

benefits according to the previous defined benefit formula. The Company's contribution expense for the defined contribution

portion of the plan was $560 for the fiscal year ending January 28, 2006.

The Company has 401(k) savings plans, which cover all full-time employees who are at least 21 years of age with one or

more years of service. The Company contributes the lesser of 50% of the first 6% of a participant’s contributions or 3% of the

participant’s compensation. The Company’s savings plans’ contribution expense was $3,126, $3,463 and $4,073 in fiscal 2005,

2004 and 2003, respectively.

DEFERRED COMPENSATION PLAN

In the first quarter of 2004, the Company adopted a non-qualified deferred compensation plan that allows its officers and

certain other employees to defer up to 20% of their annual salary and 100% of their annual bonus. Additionally, the first 20%

of an officer’s bonus deferred into the Company’s stock is matched by the Company on a one-for-one basis with the Company’s

stock that vests and is expensed over three years. The shares required to satisfy distributions of voluntary bonus deferrals and

the accompanying match in the Company’s stock are issued under the Stock Incentive Plans.

The Company has accounted for the non-qualified deferred compensation plan in accordance with EITF 97-14, “Accounting

for Deferred Compensation Arrangements Where Amounts Earned are Held in a Rabbi Trust and Invested.” The Company

establishes and maintains a deferred compensation liability for this plan. The Company plans to fund this liability by remitting

the officers’ deferrals to a Rabbi Trust where these deferrals are invested in various securities. Accordingly, all gains and

losses on these underlying investments, which are held in the Rabbi Trust to fund the deferred compensation liability, are

recognized in the Company’s consolidated statement of operations. Under this plan, there were liabilities of $3,046 at January

28, 2006 and $446 at January 29, 2005 (plan adopted in May 2004).

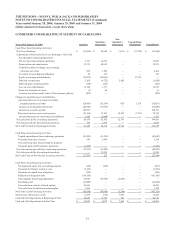

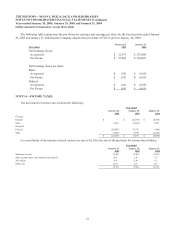

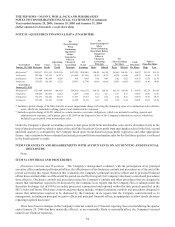

NOTE 11—NET EARNINGS PER SHARE

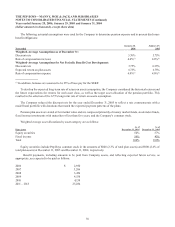

For fiscal years 2005, 2004 and 2003, basic earnings per share are based on net earnings divided by the weighted average

number of shares outstanding during the period. Diluted earnings per share assumes the dilutive effects of the conversion of

convertible senior notes and the exercising of stock options. Adjustments for the stock options were anti-dilutive in fiscal 2005

and 2003 and therefore excluded from the calculation due to the Company’s net loss for the year. Additionally, adjustments for

the convertible senior notes and purchase rights were anti-dilutive in all periods presented.

At January 28, 2006, January 29, 2005 and January 31, 2004 there were outstanding approximately 4,851,000, 5,717,000

and 6,911,000 options to purchase shares of the Company’s common stock, respectively. However, options to purchase

2,932,200, 1,950,980 and 4,313,020 shares of common stock at January 28, 2006, January 29, 2005 and January 31, 2004,

respectively, were not included in the computation of diluted EPS because the options’ exercise prices were greater than the

average market prices of the common shares on such dates.