Pep Boys 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

BENEFITS TRUST On April 29, 1994, the Company established a flexible employee benefits trust with the intention of

purchasing up to $75,000 worth of the Company’s common shares. The repurchased shares will be held in the trust and will

be used to fund the Company’s existing benefit plan obligations including healthcare programs, savings and retirement plans

and other benefit obligations. The trust will allocate or sell the repurchased shares through 2023 to fund these benefit programs.

As shares are released from the trust, the Company will charge or credit additional paid-in capital for the difference between

the fair value of shares released and the original cost of the shares to the trust. For financial reporting purposes, the trust is

consolidated with the accounts of the Company. All dividend and interest transactions between the trust and the Company are

eliminated. In connection with the Dutch Auction self-tender offer, 37,230 shares were tendered at a price of $16.00 per share

in fiscal 1999. At January 28, 2006, the Company has reflected 2,195,270 shares of its common stock at a cost of $59,264 as

“cost of shares in benefits trust” on the Company’s consolidated balance sheet.

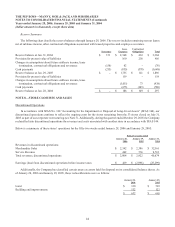

NOTE 7—RESTRUCTURING

Building upon the Profit Enhancement Plan launched in October 2000, the Company, during fiscal 2003, conducted a

comprehensive review of its operations including individual store performance, the entire management infrastructure and its

merchandise and service offerings. On July 31, 2003, the Company announced several initiatives aimed at realigning its

business and continuing to improve upon the Company’s profitability. These actions, including the disposal and sublease of

the Company’s real properties, were substantially completed by January 31, 2004 with net costs of approximately $65,986.

The Company is accounting for these initiatives in accordance with the provisions of SFAS No. 146 “Accounting for Costs

Associated with Exit or Disposal Activities” and SFAS No. 144 “Accounting for the Impairment or Disposal of Long-Lived

Assets”. These initiatives included:

Closure of 33 under-performing stores on July 31, 2003

The charges related to these closures included a $31,237 write-down of fixed assets, $424 in long-term lease and other

related obligations, net of subleases, $980 in workforce reduction costs, store breakdown costs of $2,031 and inventory transfer

costs of $862. These charges are included in discontinued operations in the consolidated statement of operations. The write-

down of fixed assets includes the adjustment to the market value of those owned stores that are now classified as assets held

for disposal in accordance with SFAS No. 144 and the write-down of leasehold improvements. The assets held for disposal

have been valued at the lower of their carrying amount or their estimated fair value, net of disposal costs. The long-term lease

and other related obligations represent the fair value of such obligations less the estimated net sublease income. The workforce

reduction costs represent the involuntary termination benefits payable to approximately 900 store employees, all of whom

were notified on or prior to July 31, 2003. Severance for these employees was accrued in accordance with SFAS No. 146.

Approximately 61% of these employees were terminated as of November 1, 2003. The remaining employees accepted other

positions within the Company subsequent to the July 31, 2003 notification date. The accrued severance of $557 related to

employees that accepted other positions was reversed in the third quarter of fiscal 2003. An additional $187 in accrued

severance was reversed in the fourth quarter of fiscal 2003 due to a change in the estimate of severance payable. These

reversals were recorded in discontinued operations on the consolidated statement of operations.

Discontinuation of certain merchandise offerings

In the second quarter of fiscal 2003, the Company recorded a $24,580 write-down of inventory as a result of a decision to

discontinue certain merchandising offerings. This write-down was recorded in cost of merchandise sales on the consolidated

statement of operations.

Corporate realignment

The charges related to this fiscal 2003 realignment included $3,070 in workforce reduction costs, $2,543 of expenses

incurred in the development of the restructuring plan, a $536 write-down of certain assets and $467 in costs related to two

warehouse lease terminations. The workforce reduction costs represent the involuntary termination benefits payable to 150

Store Support Center employees and field managers. All of these employees were terminated as of November 1, 2003. The

realignment charges were recorded in selling, general and administrative expenses and cost of merchandise sales on the

consolidated statement of operations.