Pep Boys 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

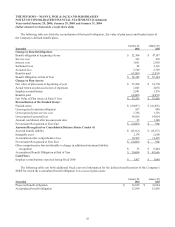

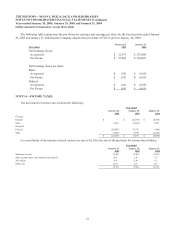

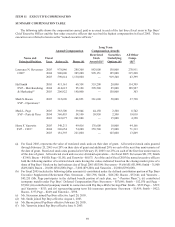

The following table summarizes the pro forma net earnings and earnings per share for the fiscal periods ended January

29, 2005 and January 31, 2004 had the Company adopted the provisions of FIN 47 prior to January 28, 2006:

Year ended

January 29,

2005

January 31,

2004

Net Earnings (Loss):

As reported $ 23,579 $ (33,894)

Pro Forma $ 23,409 $ (34,067)

Net Earnings (Loss) per share:

Basic:

As reported $ 0.42 $ (0.65)

Pro Forma $ 0.42 $ (0.65)

Diluted:

As reported $ 0.41 $ (0.65)

Pro Forma $ 0.41 $ (0.65)

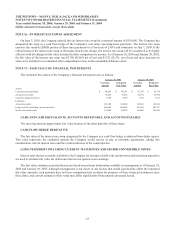

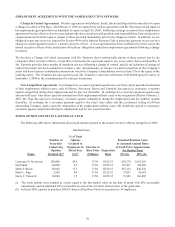

NOTE 14—INCOME TAXES

The provision for income taxes includes the following:

Year ended

January 28,

2006

January 29,

2005

January 31,

2004

Current:

Federal $ — $ (21,764) $ (8,247)

State 1,640 (1,268) 1,856

Deferred:

Federal (20,407) 35,379 (289)

State (1,786) 2,843 (2,274)

$ (20,553) $ 15,190 $ (8,954)

A reconciliation of the statutory federal income tax rate to the effective rate of the provision for income taxes follows:

Year ended

January 28,

2006

January 29,

2005

January 31,

2004

Statutory tax rate 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefits 0.9 2.8 0.7

Job credits 0.8 (1.0) 0.5

Other, net (0.2) 0.6 0.5

36.5% 37.4% 36.7%