Pep Boys 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

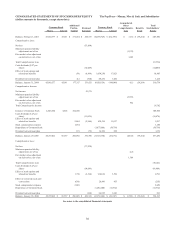

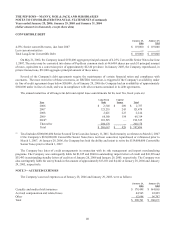

CONVERTIBLE DEBT

January 28,

2006

January 29,

2005

4.25% Senior convertible notes, due June 2007 $ 119,000 $ 119,000

Less current maturities — —

Total Long-Term Convertible Debt $ 119,000 $ 119,000

On May 21, 2002, the Company issued $150,000 aggregate principal amount of 4.25% Convertible Senior Notes due June

1, 2007. The notes may be converted into shares of Pep Boys common stock at 44.6484 shares per each $1 principal amount

of notes, equivalent to a conversion price of approximately $22.40 per share. In January 2005, the Company repurchased, in

private transactions, $31,000 aggregate principal amount of these notes.

Several of the Company’s debt agreements require the maintenance of certain financial ratios and compliance with

covenants. The most restrictive of these covenants, an EBITDA restriction, is triggered if the Company’s availability under

its line of credit agreement drops below $50,000. As of January 28, 2006 the Company had an availability of approximately

$166,000 under its line of credit, and was in compliance with all covenants contained in its debt agreements.

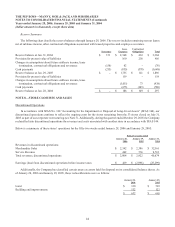

The annual maturities of all long-term debt and capital lease commitments for the next five fiscal years are:

Year

Long-Term

Debt

Capital

Leases Total

2006 $ 2,548 $ 209 $ 2,757

2007 121,235 243 121,478

2008 2,021 223 2,244

2009 68,160 154 68,314

2010(1) 192,525 — 192,525

Thereafter 200,178 — 200,178

Total $ 586,667 $ 829 $ 587,496

(1) Total includes $200,000,000 Senior Secured Term Loan due January 11, 2011. Such maturity accelerates to March 1, 2007

if the Company’s $119,000,000 Convertible Senior Notes have not been converted, repurchased or refinanced prior to

March 1, 2007. At January 28, 2006, the Company has both the ability and intent to retire the $119,000,000 Convertible

Senior Notes prior to March 1, 2007.

The Company has letter of credit arrangements in connection with its risk management and import merchandising

programs. The Company was contingently liable for $1,015 and $960 in outstanding import letters of credit and $41,218 and

$35,493 in outstanding standby letters of credit as of January 28, 2006 and January 29, 2005, respectively. The Company was

also contingently liable for surety bonds in the amount of approximately $13,021 and $4,442 at January 28, 2006 and January

29, 2005, respectively.

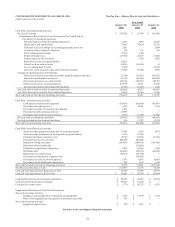

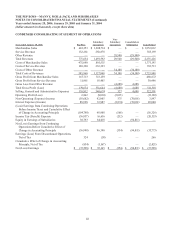

NOTE 3—ACCRUED EXPENSES

The Company’s accrued expenses as of January 28, 2006 and January 29, 2005, were as follows:

January 28,

2006

January 29,

2005

Casualty and medical risk insurance $ 178,498 $ 164,065

Accrued compensation and related taxes 44,565 45,899

Other 67,698 96,707

Total $ 290,761 $ 306,671