Pep Boys 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

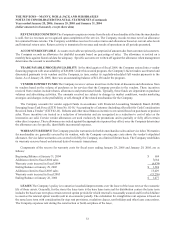

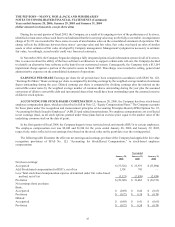

At January 29, 2005, the Company had outstanding $502,659,000 of fixed rate notes with an aggregate fair market value

of $512,170,000.

On June 3, 2003, the Company entered into an interest rate swap for a notional amount of $130,000,000. The Company

has designated the swap as a cash flow hedge of the Company’s real estate operating lease payments. The interest rate swap

converts the variable LIBOR portion of these lease payments to a fixed rate of 2.90% and terminates on July 1, 2008. If the

critical terms of the interest rate swap or the hedge item do not change, the interest rate swap will be considered to be highly

effective with all changes in fair value included in other comprehensive income. The fair value of the interest rate swap was

$5,790,000 and $3,721,000 ($3,660,000 and $2,351,000, net of tax) as of January 28, 2006 and January 29, 2005, respectively,

and these increases in value reduced our accumulated other comprehensive loss on the consolidated balance sheets.