Pep Boys 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

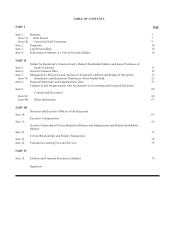

Table of contents

-

Page 1

-

Page 2

... to improve the service center business have required more time to take hold. I want to assure you that this team is extraordinarily focused on improving our profitability. Every one of our 20,000 associates is working towards that plan every day in every store with every customer. Recently, we...

-

Page 3

... to report that, despite the difficult year we just experienced, our front-line team remains highly motivated and extremely energetic. This team of store managers, service managers, field managers and associates are exceptionally knowledgeable and capable professionals. They all know our game plan...

-

Page 4

... number, including area code)

23-0962915 (I.R.S. employer identification no.) 19132 (Zip code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $1.00 par value Common Stock Purchase Rights

New York Stock...

-

Page 5

... and Management and Related Stockholder Matters Item 12. Certain Relationships and Related Transactions Item 13. Item 14. PART IV Item 15. Exhibits and Financial Statement Schedules Signatures 76 Principal Accounting Fees and Services 74 75 73 69 67 11 12 13 25 27 64 64 67 Business Risk Factors...

-

Page 6

... TIRE CENTER, having an aggregate of 6,162 service bays, as well as 10 nonservice/non-tire format PEP BOYS EXPRESS stores. The Company operates approximately 12,167,000 gross square feet of retail space, including service bays. The SUPERCENTERS average approximately 20,700 square feet and the 10 PEP...

-

Page 7

...

Opened

Closed

Opened

Closed

Opened

Closed

Alabama Arizona Arkansas California Colorado Connecticut Delaware Florida Georgia Illinois Indiana Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Missouri Nevada New Hampshire New Jersey New Mexico New York North Carolina...

-

Page 8

...plan from net cash generated from operating activities and its existing line of credit. PRODUCTS AND SERVICES Each Pep Boys SUPERCENTER and PEP BOYS EXPRESS store carries a similar product line, with variations based on the number and type of cars registered in the markets where the store is located...

-

Page 9

... of depth and breadth of product line, price, quality of personnel and customer service. The Company believes that the warranty policies in connection with the higher priced items it sells, such as tires, batteries, brake linings and other major automotive parts and accessories, are comparable or...

-

Page 10

...recycling of batteries, tires and used lubricants, and the ownership and operation of real property. EMPLOYEES At January 28, 2006, the Company employed 19,980 persons as follows:

Full-time Description % Part-time % Total %

Retail Service Center STORE TOTAL Warehouses Offices TOTAL EMPLOYEES

5,410...

-

Page 11

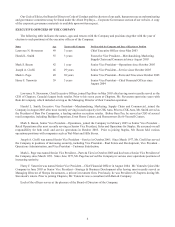

... Vice President-Merchandising, Marketing, Supply Chain and Commercial since August 2003 Senior Vice President-Operations since October 2005 Senior Vice President-Service since October 2005 Senior Vice President-Parts and Tires since October 2005 Senior Vice President-Chief Financial Officer since...

-

Page 12

... If any of the events or circumstances described as risks below actually occurs, our business, results of operations or financial condition could be materially and adversely affected. Risks Related to Pep Boys If we are unable to generate sufficient cash flows from our operations, our liquidity will...

-

Page 13

...) specialized automotive (such as exhaust, brake and transmission) repair facilities that provide additional automotive repair and maintenance services.

Installed Merchandise/Commercial â- mass merchandisers, wholesalers and jobbers (some of which are associated with national parts distributors...

-

Page 14

... customers may defer vehicle maintenance or repair, and during periods of good economic conditions, consumers may opt to purchase new vehicles rather than service the vehicles they currently own and replace worn or damaged parts; gas prices - as increases in gas prices may deter consumers from using...

-

Page 15

...Warehouse Location

San Bernardino, CA Atlanta, GA Mesquite, TX Plainfield, IN Chester, NY Middletown, NY Total

All All All All All All except tires

600,000 392,000 244,000 403,000

Leased Owned Owned Leased

400,400 Leased 90,000 Leased 2,129,400

AZ, CA, NM, NV, UT, WA AL, FL, GA, LA, NC, PR, SC...

-

Page 16

...Boys-Manny, Moe & Jack is listed on the New York Stock Exchange under the symbol "PBY". There were 6,440 registered shareholders as of March 31, 2006. The following table sets forth for the periods listed, the high and low sale prices and the cash dividends paid on the Company's common stock. MARKET...

-

Page 17

...of the Company's distribution centers, which was included in gross profit from merchandise sales. (3) Includes pretax charges of $88,980 related to corporate restructuring and other one-time events of which $29,308 reduced gross profit from merchandise sales, $3,278 reduced gross profit from service...

-

Page 18

... designed to increase customer traffic. During 2005 we grand reopened 181 stores in the following markets: Los Angeles, CA - 76 (first quarter); Chicago, IL, and Philadelphia, PA - 69 (second quarter); Harrisburg, PA - 5 (third quarter); Las Vegas, NV, Phoenix, AZ and Tucson, AZ - 31 (fourth quarter...

-

Page 19

.... • Improving Service Center Performance. We are working to improve the financial performance of our service center operations by improving tire sales and related attachment sales, and improving labor productivity. To improve tire sales, we have reduced our advertised opening price points, while...

-

Page 20

... in "Item 8 Financial Statements and Supplementary Data" for further discussion of our pension plans. (dollar amounts in thousands)

Commercial Commitments Total Due in less than 1 year Due in 1-3 years Due in 3-5 years Due after 5 years

Import letters of credit Standby letters of credit Surety...

-

Page 21

...There was no balance in trade payable program liability at January 29, 2005, as vendors did not participate in the program until fiscal 2005. In October 2001, the Company entered into a contractual commitment to purchase media advertising services with equal annual purchase requirements totaling $39...

-

Page 22

...review of asset class return expectations. The discount rate utilized for the pension plans is based on a model bond portfolio with durations that match the expected payment patterns of the plans. The Company will continue to evaluate its actuarial assumptions and adjust as necessary. In fiscal 2005...

-

Page 23

... the costs associated with the stores remaining from the 33 stores closed on July 31, 2003 as part of our corporate restructuring (see Item 8 Financial Statements and Supplementary Data- note 7). Sales of Stores in Discontinued Operations During fiscal 2005, the Company sold a closed store for...

-

Page 24

... parts or materials. Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits and service center occupancy costs. Occupancy costs include utilities, rents...

-

Page 25

...695,000 gain on disposal of a distribution center in 2004, plus increases in rent expense and rental equipment for the new warehouse in San Bernardino, CA. The increase in store occupancy costs was due to increased lease expense associated with the new point-of sale system and building and equipment...

-

Page 26

... a $12,695,000 gain on the disposal of one of the Company's distribution centers and a decrease in store occupancy costs, offset in part, by decreased merchandise margins. The decrease in store occupancy costs, as a percentage of merchandise sales, was due to the impact of a charge made in 2003 for...

-

Page 27

... during the reporting period. On an on-going basis, management evaluates its estimates and judgments, including those related to customer incentives, product returns and warranty obligations, bad debts, inventories, income taxes, financing operations, restructuring costs, retirement benefits, risk...

-

Page 28

... including discount rates, expected return on plan assets, mortality rates and merit and promotion increases. The Company is required to consider current market conditions, including changes in interest rates, in selecting these assumptions. Changes in the related pension costs or liabilities...

-

Page 29

... its equity instruments for goods and services, primarily on accounting for transactions in which an entity obtains employee services in share-based payment transactions. It also addresses transactions in which an entity incurs liabilities in exchange for goods and services that are based on...

-

Page 30

... interim or annual reporting period that begins after June 15, 2005. However, on April 14, 2005, the United States Securities and Exchange Commission (the "SEC") issued a press release that postponed the application of SFAS 123(R) to no later than the beginning of the first fiscal year beginning...

-

Page 31

...market value of $512,170,000. On June 3, 2003, the Company entered into an interest rate swap for a notional amount of $130,000,000. The Company has designated the swap as a cash flow hedge of the Company's real estate operating lease payments... net of tax) as of January 28, 2006 and January 29, 2005,...

-

Page 32

... the three years in the period ended January 28, 2006. Our audits also included the financial statement schedule listed in the Index at Item 15. These financial statements and financial statement schedule are the responsibility of the Company's management. Our responsibility is to express an opinion...

-

Page 33

... BALANCE SHEETS (dollar amounts in thousands, except share data)

The Pep Boys-Manny, Moe & Jack and Subsidiaries

January 28, 2006

January 29, 2005

ASSETS Current Assets: Cash and cash equivalents Accounts receivable, less allowance for uncollectible accounts of $1,188 and $1,030 Merchandise...

-

Page 34

... Pep Boys-Manny, Moe & Jack and Subsidiaries

Year ended

January 28, 2006

January 29, 2005

January 31, 2004

Merchandise Sales Service Revenue Total Revenues Costs of Merchandise Sales Costs of Service Revenue Total Costs of Revenues Gross Profit from Merchandise Sales Gross Profit from Service...

-

Page 35

...) Effect of stock options and related tax benefits Stock compensation expense Repurchase of Common Stock Dividend reinvestment plan Balance, January 29, 2005 Comprehensive Loss: Net loss Minimum pension liability adjustment, net of tax Fair market value adjustment on derivatives, net of tax Total...

-

Page 36

... STATEMENTS OF CASH FLOWS (dollar amounts in thousands)

The Pep Boys-Manny, Moe & Jack and Subsidiaries Year ended January 29, 2005 $ 23,579

January 28, 2006 Cash Flows from Operating Activities: Net (Loss) Earnings Adjustments to Reconcile Net (Loss) Earnings to Net Cash (Used in) Provided by...

-

Page 37

... ACCOUNTING POLICIES BUSINESS The Pep Boys-Manny, Moe & Jack and subsidiaries (the "Company") is engaged principally in the retail sale of automotive parts and accessories, automotive maintenance and service and the installation of parts through a chain of stores. The Company currently operates...

-

Page 38

... provides warranties for both its merchandise sales and service labor. Warranties for merchandise are generally covered by its vendors, with the Company covering any costs above the vendor's stipulated allowance. Service labor warranties are covered in full by the Company on a limited lifetime basis...

-

Page 39

... any installed parts or materials. COSTS OF REVENUES Costs of merchandise sales include the cost of products sold, buying, warehousing and store occupancy costs. Costs of service revenue include service center payroll and related employee benefits and service center occupancy costs. Occupancy costs...

-

Page 40

...SFAS No. 123, "Accounting for Stock-Based Compensation," to stock-based employee compensation:

Year ended January 29, 2005

January 28, 2006

January 31, 2004

Net (loss) earnings: As reported Add: Stock-based compensation for RSU's, net of tax Less: Total stock-based compensation expense determined...

-

Page 41

...Merchandise Sales Service Total Revenues

$

$

1,548,206 303,861 1,852,067 383,159 2,235,226

$

$

1,537,382 323,246 1,860,628 409,346 2,269,974

$

$

1,390,082 335,928 1,726,010 405,309 2,131,319

The Company's product lines include: tires (not stocked at PEP BOYS EXPRESS stores); batteries; new...

-

Page 42

... to provide service in exchange for the award (usually the vesting period). The grant-date fair value of employee share options and similar instruments will be estimated using option-pricing models. If an equity award is modified after the grant date, incremental compensation cost will be recognized...

-

Page 43

... BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 28, 2006, January 29, 2005 and January 31, 2004 (dollar amounts in thousands, except share data) SFAS 123(R) requires the fair value of stock based compensation to be calculated using...

-

Page 44

... the consolidated balance sheet. In the first quarter of fiscal 2004, the Company entered into arrangements with certain of its vendors and banks to extend payment terms on certain merchandise purchases. Under this program, the bank makes payments to the vendor based upon a negotiated discount rate...

-

Page 45

...amount of 4.25% Convertible Senior Notes due June 1, 2007. The notes may be converted into shares of Pep Boys common stock at 44.6484 shares per each $1 principal amount of notes, equivalent to a conversion price of approximately $22.40 per share. In January 2005, the Company repurchased, in private...

-

Page 46

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 28, 2006, January 29, 2005 and January 31, 2004 (dollar amounts in thousands, except share data) NOTE 4-OTHER CURRENT ASSETS The Company's other current assets as of January 28,...

-

Page 47

... balance sheet. SALE OF COMMON STOCK On March 24, 2004, the Company sold 4,646,464 shares of common stock (par value $1 per share) at a price of $24.75 per share for net proceeds of $108,854. RIGHTS AGREEMENT On December 31, 1997, the Company distributed as a dividend one common share purchase...

-

Page 48

...in the development of the restructuring plan, a $536 write-down of certain assets and $467 in costs related to two warehouse lease terminations. The workforce reduction costs represent the involuntary termination benefits payable to 150 Store Support Center employees and field managers. All of these...

-

Page 49

...ongoing costs for the stores remaining from the 33 stores closed on July 31, 2003 as part of our corporate restructuring (see Note 7). Additionally, during the quarter ended October 29, 2005 the Company reclassified into discontinued operations the revenues and costs associated with another store in...

-

Page 50

...Pep Boys Manny, Moe and Jack of California, Pep Boys - Manny, Moe and Jack of Delaware, Inc. and Pep Boys - Manny, Moe and Jack of Puerto Rico, Inc. PBY Corporation was added as a subsidiary guarantor of both issuances on January 6, 2005. The following are consolidating balance sheets of the Company...

-

Page 51

...

As of January 28, 2006

Pep Boys

Consolidated

ASSETS Current Assets: Cash and cash equivalents Accounts receivable, net Merchandise inventories Prepaid expenses Other Assets held for disposal Total Current Assets Property and Equipment-at cost: Land Buildings and improvements Furniture...

-

Page 52

...As of January 29, 2005

Pep Boys

Consolidated

ASSETS Current Assets: Cash and cash equivalents Accounts receivable, net Merchandise inventories Prepaid expenses Deferred income taxes Other Assets held for disposal Total Current Assets Property and Equipment-at cost: Land Buildings and improvements...

-

Page 53

...28, 2006, January 29, 2005 and January 31, 2004 (dollar amounts in thousands, except share data) CONDENSED CONSOLIDATING STATEMENT OF OPERATIONS

Subsidiary Guarantors NonSubsidiary Guarantors Consolidation/ Elimination

Year ended January 28, 2006

Pep Boys

Consolidated

Merchandise Sales $ 643,353...

-

Page 54

... 2005 Pep Boys Subsidiary Guarantors NonSubsidiary Guarantors Consolidation/ Elimination Consolidated

Merchandise Sales Service Revenue Other Revenue Total Revenues Costs of Merchandise Sales Costs of Service Revenue Costs of Other Revenue Total Costs of Revenues Gross Profit from Merchandise Sales...

-

Page 55

...

Pep Boys

Subsidiary Guarantors

Consolidation/ Elimination

Consolidated

Merchandise Sales Service Revenue Other Revenue Total Revenues Costs of Merchandise Sales Costs of Service Revenue Costs of Other Revenue Total Costs of Revenues Gross Profit from Merchandise Sales Gross Profit from Service...

-

Page 56

... Intercompany borrowings (payments) Dividends paid Repurchase of common stock Proceeds from exercise of stock options Proceeds from dividend reinvestment plan Net Cash (used in) Provided by Financing Activities Net (Decrease) Increase in Cash Cash and Cash Equivalents at Beginning of Year Cash and...

-

Page 57

... paid on life insurance policies Net cash used in continuing operations Net cash provided by discontinued operations Net Cash Used in Investing Activities Cash Flows from Financing Activities: Net borrowings under line of credit agreements Payments for finance issuance costs Net payments on trade...

-

Page 58

...line of credit agreements Payments for finance issuance costs Payments on capital lease obligations Reduction of long-term debt Intercompany borrowings (payments) Dividends paid Proceeds from exercise of stock options Proceeds from dividend reinvestment plan Net Cash Used In Financing Activities Net...

-

Page 59

...are made using the "projected unit credit method." Variances between actual experience and assumptions for costs and returns on assets are amortized over the remaining service lives of employees under the plan. As of December 31, 1996, the Company froze the accrued benefits under the plan and active...

-

Page 60

... loss Benefits paid Benefit Obligation at End of Year Change in Plan Assets: Fair value of plan assets at beginning of year Actual return on plan assets (net of expenses) Employer contributions Benefits paid Fair Value of Plan Assets at End of Year Reconciliation of the Funded Status: Funded status...

-

Page 61

... were used by the Company to determine pension expense and to present disclosure benefit obligations:

January 28, 2006 January 29, 2005

Year ended

Weighted-Average Assumptions as of December 31: Discount rate Rate of compensation increase Weighted-Average Assumptions for Net Periodic Benefit Cost...

-

Page 62

... of stock options. Adjustments for the stock options were anti-dilutive in fiscal 2005 and 2003 and therefore excluded from the calculation due to the Company's net loss for the year. Additionally, adjustments for the convertible senior notes and purchase rights were anti-dilutive in all periods...

-

Page 63

... operations (c) Average number of common shares outstanding during period Common shares assumed issued upon conversion of convertible senior notes Common shares assumed issued upon exercise of dilutive stock options, net of assumed repurchase, at the average market price (d) Average number of common...

-

Page 64

... a stand alone inducement stock option plan, which authorized the issuance of options to purchase up to 174,540 shares of the Company's common stock to the Chief Executive Officer in connection with his hire. The non-qualified stock options are exercisable over a four-year period with one-fifth...

-

Page 65

... (dollar amounts in thousands, except share data) recognized an asset of $2,844, accumulated depreciation of $2,247 and a liability of $4,540 on its consolidated balance sheet. In the fourth quarter of fiscal 2005, the Company reviewed and revised its estimated settlement costs. The Company reversed...

-

Page 66

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 28, 2006, January 29, 2005 and January 31, 2004 (dollar amounts in thousands, except share data) The following table summarizes the pro forma net earnings and earnings per share...

-

Page 67

... share data) Items that gave rise to significant portions of the deferred tax accounts are as follows:

January 28, 2006 January 29, 2005

Deferred tax assets: Employee compensation Store closing reserves Legal Benefit Accruals Net operating loss carryforwards Tax credit carryforwards Accrued leases...

-

Page 68

THE PEP BOYS-MANNY, MOE & JACK AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Years ended January 28, 2006, January 29, 2005 and January 31, 2004 (dollar amounts in thousands, except share data) NOTE 16-INTEREST RATE SWAP AGREEMENT On June 3, 2003, the Company entered into ...

-

Page 69

... Company's distribution centers, which was included in gross profit from merchandise sales.

Under the Company's present accounting system, actual gross profit from merchandise sales can be determined only at the time of physical inventory, which is taken at the end of the fiscal year. Gross profit...

-

Page 70

... the policies or procedures may deteriorate. Deloitte & Touche LLP, the Company's independent registered public accounting firm who audited the Company's consolidated financial statements, has issued a report on management's assessment of the Company's internal control over financial reporting as...

-

Page 71

... OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of The Pep Boys-Manny, Moe & Jack We have audited management's assessment, included in the accompanying Management's Report on Internal Control over Financial Reporting, that The Pep Boys-Manny, Moe & Jack...

-

Page 72

...-profit charitable organization. He was an executive officer of Pep Boys until 1992 and then served as a part-time consultant to Pep Boys until 1997. Malcolmn D. Pryor Director since 1994

Mr. Pryor, 59, is Chairman of Pryor, Miller Capital Ventures, LLC, a financial advising and project management...

-

Page 73

... of Pep Boys Stock. Based solely upon a review of copies of such reports, we believe that during fiscal 2005, our directors, executive officers and 10% Holders complied with all applicable Section 16(a) filing requirements. CODE OF ETHICS The Company has adopted a Code of Ethics applicable to...

-

Page 74

... - $6,075. As of the end of fiscal 2005 the named executive officers held the following number of restricted stock units having the values indicated based on the closing market price of a share of Pep Boys' Stock on the last business day of fiscal 2005 ($15.84): Stevenson - 91,666 ($1,451,989...

-

Page 75

...(a) The stock options were granted at a price equal to the fair market value on the date of grant with 20% exercisable immediately and an additional 20% exercisable on each of the next four anniversaries of the grant date. (b) In fiscal 2005, options to purchase 288,675 shares of Pep Boys Stock were...

-

Page 76

...,580 - - - -

Based on the New York Stock Exchange composite closing price as published by Yahoo, Inc. for the last business day of fiscal 2005 ($15.84).

PENSION PLANS Qualified Defined Benefit Pension Plan. We have a qualified defined benefit pension plan for all employees hired prior to February...

-

Page 77

Pension Plan Table Estimated Annual Retirement Income ($)

Years of Service

Average Included Compensation 400...500,000 600,000 700,000 800,000 900,000

Mr. Page, the only named executive officer currently participating under the defined benefit portion of the SERP, is credited with 25 years of service...

-

Page 78

... Drive North Bethesda, MD 20852 DB Zwirn & Co., LP and affiliates 745 Fifth Avenue, 18th Floor New York, NY 101513 Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, CA 904014 Ameriprise Financial, Inc. 145 Ameriprise Financial Center Minneapolis, MN 554745

1 2 3 4 5

Number...

-

Page 79

... Includes shares for which the named person has sole voting and investment power and non-voting interests including restricted stock units and deferred compensation accounted for as Pep Boys Stock. Also includes the following shares that can be acquired through stock option exercises through May 30...

-

Page 80

... to SEC matters. Audit-Related Fees billed in fiscal 2005 and 2004 consisted of (i) financial accounting and reporting consultations, (ii) Sarbanes-Oxley Act Section 404 advisory services and (iii) employee benefit plan audits. Tax Fees billed in fiscal 2005 and 2004 consisted of tax compliance...

-

Page 81

... are filed as part of this report:

Page

The following consolidated financial statements of The Pep Boys-Manny, Moe & Jack are included in 1. Item 8. Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets-January 28, 2006 and January 29, 2005 Consolidated Statements of...

-

Page 82

... 5, 2005 between the Company and Mark L. Page. The Pep Boys-Manny, Moe and Jack 1990 Stock Incentive Plan-Amended and Restated as of March 26, 2001. The Pep Boys-Manny, Moe and Jack 1999 Stock Incentive Plan-amended and restated as of September 15, 2005. The Pep Boys-Manny, Moe & Jack Pension Plan...

-

Page 83

... Plan-Puerto Rico.

(10.15)*

(10.16)*

The Pep Boys Deferred Compensation Plan The Pep Boys Annual Incentive Bonus Plan (amended and restated as of December 9, 2003) Amendment to and Restatement of the Executive Supplemental Pension Plan, effective as of January 31, 2004. Flexible Employee Benefits...

-

Page 84

... of Earnings to Fixed Charges Subsidiaries of the Company Consent of Independent Registered Public Accounting Firm Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley...

-

Page 85

... Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. THE PEP BOYS -M ANNY, MOE & JACK (Registrant) by: Dated: April 12, 2006 /s/ H ARRY F. YANOWITZ

Harry F. Yanowitz Senior Vice President and Chief Financial...

-

Page 86

... to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following...Officer (Principal Executive Officer) Senior Vice President and Chief Financial Officer (Principal Financial Officer) Chief Accounting Officer and Treasurer (Principal Accounting Officer...

-

Page 87

... accounts written off.

Column B Balance at Beginning of Period Column C Additions Additions Charged to Charged to Costs and Other Expenses Accounts2 Column D Column E Balance at End of Period

Column A

Description

Deductions3

SALES RESERVE: Year Ended January 28, 2006 Year Ended January 29, 2005...

-

Page 88

THE PEP BOYS - MANNY, MOE & JACK AND SUBSIDIARIES

Exhibit 12 - Statement Regarding Computation of Ratios of Earnings to Fixed Charges

(in thousands, except ratios) Fiscal year Interest Interest factor in rental expense Capitalized interest (a) Fixed charges, as defined (Loss) Earnings from ...

-

Page 89

...Inc. 3111 W. Allegheny Avenue Philadelphia, PA 19132 Pep Boys - Manny, Moe & Jack of Puerto Rico, Inc. 3111 W. Allegheny Avenue Philadelphia, PA 19132 Colchester Insurance Company 7 Burlington Square Burlington, VT 05401 PBY Corporation Suite 1006 1105 North Market Street Wilmington, DE 19801 Carrus...

-

Page 90

...31.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Lawrence N. Stevenson, certify that: 1. 2. I have reviewed this annual report on Form 10-K of The Pep Boys - Manny, Moe and Jack; Based on my knowledge, this report does not contain any untrue...

-

Page 91

... 31.2 CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Harry F. Yanowitz, certify that: 1. 2. I have reviewed this annual report on Form 10-K of The Pep Boys - Manny, Moe and Jack Based on my knowledge, this report does not contain any untrue...

-

Page 92

... with the Annual Report on Form 10-K of The Pep Boys - Manny, Moe & Jack (the "Company") for the year ended January 28, 2006, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Lawrence N. Stevenson, Chief Executive Officer of the Company, certify, pursuant...

-

Page 93

... Form 10-K of The Pep Boys - Manny, Moe & Jack (the "Company") for the year ended January 28, 2006, as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Harry F. Yanowitz, Senior Vice President and Chief Financial Officer of the Company, certify, pursuant to 18...