Oracle 2015 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

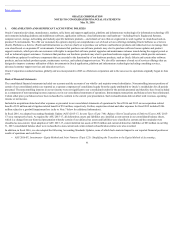

Revenue Recognition for Cloud SaaS, PaaS and IaaS Offerings, Hardware Products, Hardware Support and Related Services (Non-software Elements)

Our revenue recognition policy for non-software deliverables including cloud SaaS, PaaS and IaaS offerings, hardware products, support and related services is

based upon the accounting guidance contained in ASC 605-25, RevenueRecognition, Multiple-ElementArrangements,and we exercise judgment and use

estimates in connection with the determination of the amount of cloud SaaS, PaaS and IaaS revenues, hardware products revenues, support and related services

revenues to be recognized in each accounting period.

Revenues from the sales of our non-software elements are recognized when: (1) persuasive evidence of an arrangement exists; (2) we deliver the products and

passage of the title to the buyer occurs; (3) the sale price is fixed or determinable; and (4) collection is reasonably assured. Revenues that are not recognized at the

time of sale because the foregoing conditions are not met are recognized when those conditions are subsequently met. When applicable, we reduce revenues for

estimated returns or certain other incentive programs where we have the ability to sufficiently estimate the effects of these items. Where an arrangement is subject

to acceptance criteria and the acceptance provisions are not perfunctory (for example, acceptance provisions that are long-term in nature or are not included as

standard terms of an arrangement), revenues are recognized upon the earlier of receipt of written customer acceptance or expiration of the acceptance period.

Our cloud SaaS and PaaS offerings generally provide customers access to certain of our software within a cloud-based IT environment that we manage, host and

support and offer to customers on a subscription basis. Revenues for our cloud SaaS and PaaS offerings are generally recognized ratably over the contract term

commencing with the date the service is made available to customers and all other revenue recognition criteria have been satisfied.

Our cloud IaaS offerings provide infrastructure cloud services and also include deployment and management offerings for software and hardware and related IT

infrastructure. Our cloud IaaS offerings are generally sold on a subscription basis and revenues for these cloud IaaS offerings are generally recognized ratably over

the contract term commencing with the date the service is made available to customers and all other revenue recognition criteria have been satisfied.

Revenues from the sale of hardware products represent amounts earned primarily from the sale of our Oracle Engineered Systems, computer servers, storage,

networking and industry-specific hardware and are recognized upon the delivery of the hardware product to the customer provided all other revenue recognition

criteria have been satisfied.

Our hardware support offerings generally provide customers with software updates for the software components that are essential to the functionality of our

hardware products and can also include product repairs, maintenance services and technical support services. Hardware support contracts are generally priced as a

percentage of the net hardware products fees. Hardware support contracts are entered into at the customer’s option and are recognized ratably over the contractual

term of the arrangements, which is typically one year, provided all other revenue recognition criteria have been satisfied.

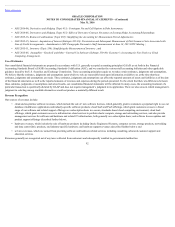

Revenue Recognition for Multiple-Element Arrangements—Cloud SaaS, PaaS and IaaS Offerings, Hardware Products, Hardware Support and Related Services

(Non-software Arrangements)

We enter into arrangements with customers that purchase non-software related products and services from us at the same time, or within close proximity of one

another (referred to as non-software multiple-element arrangements). Each element within a non-software multiple-element arrangement is accounted for as a

separate unit of accounting provided the following criteria are met: the delivered products or services have value to the customer on a standalone basis; and for an

arrangement that includes a general right of return relative to the delivered products or services, delivery or performance of the undelivered product or service is

considered probable and is substantially controlled by us. We consider a deliverable to have standalone value if the product or service is sold separately by us or

another vendor or could be resold by the customer. Further, our revenue

94