Oracle 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

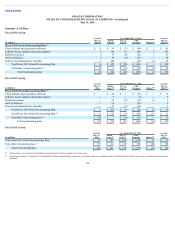

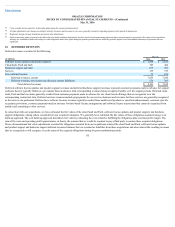

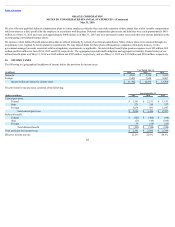

11. DERIVATIVE FINANCIAL INSTRUMENTS

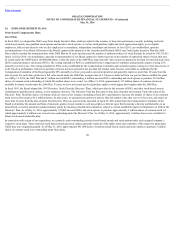

Fair Value Hedges—Interest Rate Swap Agreements

In July 2014, we entered into certain interest rate swap agreements that have the economic effect of modifying the fixed-interest obligations associated with our

October 2019 Notes and July 2021 Notes so that the interest payable on these senior notes effectively became variable based on LIBOR. In July 2013, we entered

into certain interest rate swap agreements that have the economic effect of modifying the fixed-interest obligations associated with our January 2019 Notes so that

the interest payable on these senior notes effectively became variable based on LIBOR. The critical terms of the interest rate swap agreements match the critical

terms of the October 2019 Notes, July 2021 Notes and the January 2019 Notes that the interest rate swap agreements pertain to, including the notional amounts and

maturity dates.

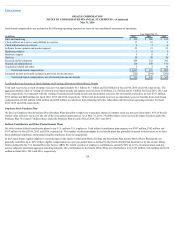

We have designated the aforementioned interest rate swap agreements as qualifying hedging instruments and are accounting for them as fair value hedges pursuant

to ASC 815. These transactions are characterized as fair value hedges for financial accounting purposes because they protect us against changes in the fair values of

certain of our fixed-rate borrowings due to benchmark interest rate movements. The changes in fair values of these interest rate swap agreements are recognized as

interest expense in our consolidated statements of operations with the corresponding amounts included in other assets or other non-current liabilities in our

consolidated balance sheets. The amount of net gain (loss) attributable to the risk being hedged is recognized as interest expense in our consolidated statements of

operations with the corresponding amount included in notes payable, non-current. The periodic interest settlements for the interest rate swap agreements for the

October 2019 Notes, July 2021 Notes and the January 2019 Notes are recorded as interest expense and are included as a part of cash flows from operating

activities.

In July 2014, we settled the fixed to variable interest rate swap agreements associated with the July 2014 Notes. We do not use any interest rate swap agreements

for trading purposes.

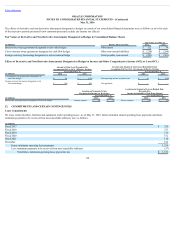

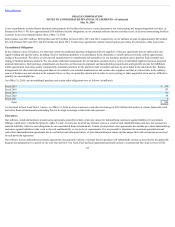

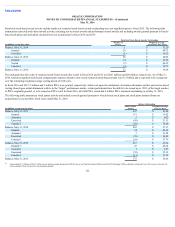

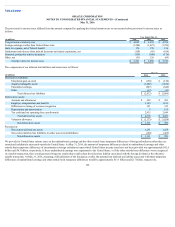

Cash Flow Hedges—Cross-Currency Swap Agreements

In connection with the issuance of our January 2021 Notes, we entered into certain cross-currency swap agreements to manage the related foreign currency

exchange risk by effectively converting the fixed-rate, Euro-denominated January 2021 Notes, including the annual interest payments and the payment of principal

at maturity, to fixed-rate, U.S. Dollar-denominated debt. The economic effect of the swap agreements was to eliminate the uncertainty of the cash flows in U.S.

Dollars associated with the January 2021 Notes by fixing the principal amount of the January 2021 Notes at $1.6 billion with a fixed annual interest rate of 3.53%.

We have designated these cross-currency swap agreements as qualifying hedging instruments and are accounting for these as cash flow hedges pursuant to ASC

815. The critical terms of the cross-currency swap agreements correspond to the January 2021 Notes, including the annual interest payments being hedged, and the

cross-currency swap agreements mature at the same time as the January 2021 Notes.

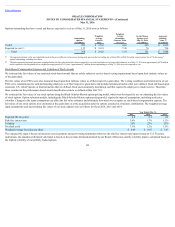

We used the hypothetical derivative method to measure the effectiveness of our cross-currency swap agreements. The fair values of these cross-currency swap

agreements are recognized as other assets or other non-current liabilities in our consolidated balance sheets. The effective portions of the changes in fair values of

these cross-currency swap agreements are reported in accumulated other comprehensive loss in our consolidated balance sheets, and an amount is reclassified out

of accumulated other comprehensive loss into non-operating income (expense), net in the same period that the carrying value of the Euro-denominated January

2021 Notes is remeasured and the interest expense is recognized. The ineffective portion of the unrealized gains and losses on these cross-currency swaps, if any, is

recorded immediately to non-operating income (expense), net. We evaluate the effectiveness of our cross-currency swap agreements on a quarterly basis. We did

not record any ineffectiveness for fiscal 2016, 2015 or 2014. The cash flows related to the cross-currency swap agreements that

116