Oracle 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

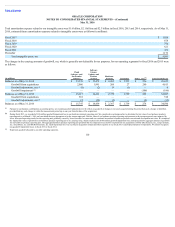

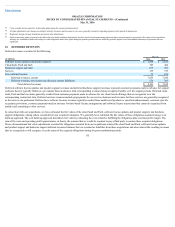

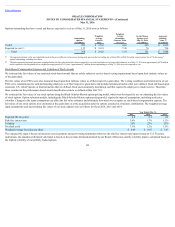

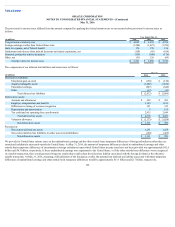

Lease commitments included future minimum rent payments for facilities that we have vacated pursuant to our restructuring and merger integration activities, as

discussed in Note 9. We have approximately $54 million in facility obligations, net of estimated sublease income and other costs, in accrued restructuring for these

locations in our consolidated balance sheet at May 31, 2016.

Rent expense was $283 million, $290 million and $278 million for fiscal 2016, 2015 and 2014, respectively, net of sublease income of approximately $45 million

for each of fiscal 2016 and 2015, and $55 million for fiscal 2014. Certain lease agreements contain renewal options providing for extensions of the lease terms.

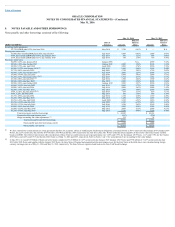

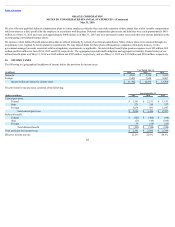

Unconditional Obligations

In the ordinary course of business, we enter into certain unconditional purchase obligations with our suppliers, which are agreements that are enforceable and

legally binding and specify terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price provisions; and the approximate

timing of the payment. We utilize several external manufacturers to manufacture sub-assemblies for our hardware products and to perform final assembly and

testing of finished hardware products. We also obtain individual components for our hardware products from a variety of individual suppliers based on projected

demand information. Such purchase commitments are based on our forecasted component and manufacturing requirements and typically provide for fulfillment

within agreed upon lead-times and/or commercially standard lead-times for the particular part or product and have been included in the amounts below. Routine

arrangements for other materials and goods that are not related to our external manufacturers and certain other suppliers and that are entered into in the ordinary

course of business are not included in the amounts below, as they are generally entered into in order to secure pricing or other negotiated terms and are difficult to

quantify in a meaningful way.

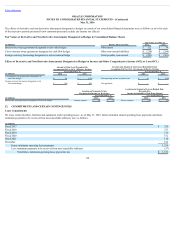

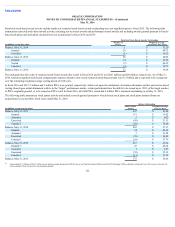

As of May 31, 2016, our unconditional purchase and certain other obligations were as follows (in millions):

Fiscal 2017 $ 574

Fiscal 2018 153

Fiscal 2019 91

Fiscal 2020 68

Fiscal 2021 8

Total $ 894

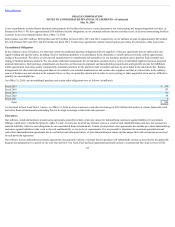

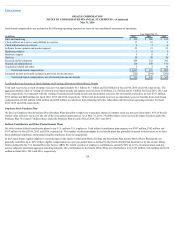

As described in Note 8 and Note 11 above, as of May 31, 2016 we have senior notes and other borrowings of $43.9 billion that mature at various future dates and

derivative financial instruments outstanding that we leverage to manage certain risks and exposures.

Guarantees

Our software, cloud and hardware product sales agreements generally include certain provisions for indemnifying customers against liabilities if our products

infringe a third party’s intellectual property rights. To date, we have not incurred any material costs as a result of such indemnifications and have not accrued any

material liabilities related to such obligations in our consolidated financial statements. Certain of our product sales agreements also include provisions indemnifying

customers against liabilities in the event we breach confidentiality or service level requirements. It is not possible to determine the maximum potential amount

under these indemnification agreements due to our limited and infrequent history of prior indemnification claims and the unique facts and circumstances involved

in each particular agreement.

Our software license and hardware products agreements also generally include a warranty that our products will substantially operate as described in the applicable

program documentation for a period of one year after delivery. Our SaaS, PaaS and IaaS agreements generally include a warranty that the cloud services will be

119