Oracle 2015 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

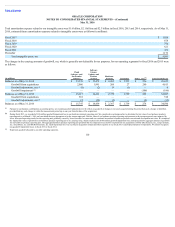

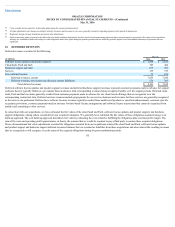

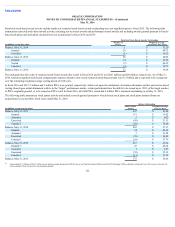

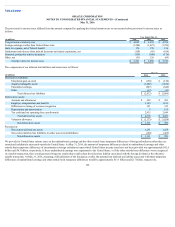

The effects of derivative and non-derivative instruments designated as hedges on certain of our consolidated financial statements were as follows as of or for each

of the respective periods presented below (amounts presented exclude any income tax effects):

Fair Values of Derivative and Non-Derivative Instruments Designated as Hedges in Consolidated Balance Sheets

Fair Value as of May 31,

(in millions) Balance Sheet Location 2016 2015

Interest rate swap agreements designated as fair value hedges Other assets $ 122 $ 74

Cross-currency swap agreements designated as cash flow hedges Other non-current liabilities $ (218) $ (244)

Foreign currency borrowings designated as net investment hedge Notes payable, non-current $ (991) $ (981)

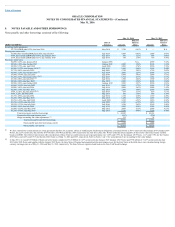

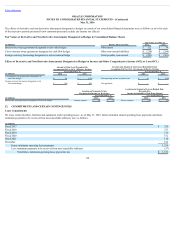

Effects of Derivative and Non-Derivative Instruments Designated as Hedges on Income and Other Comprehensive Income (OCI) or Loss (OCL)

Amount of Gain (Loss) Recognized in

Accumulated OCI or OCL (Effective Portion)

Location and Amount of Gain (Loss) Reclassified from

Accumulated OCI or OCL into Income (Effective Portion)

Year Ended May 31, Year Ended May 31,

(in millions) 2016 2015 2016 2015

Cross-currency swap agreements designated as

cash flow hedges $ 26 $ (318) Non-operating income (expense), net $ 41 $ (348)

Foreign currency borrowings designated as net

investment hedge $ (25) $ 208 Not applicable $ — $ —

Location and Amount of Gain

Recognized in Income on Derivative

Location and Amount of Loss on Hedged Item

Recognized in

Income Attributable to Risk Being Hedged

Year Ended May 31, Year Ended May 31,

(in millions) 2016 2015 2016 2015

Interest rate swap agreements designated as fair value hedges Interest expense $ 48 $ 51 Interest expense $ (48) $ (51)

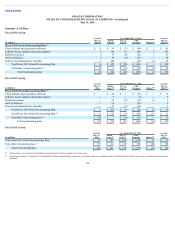

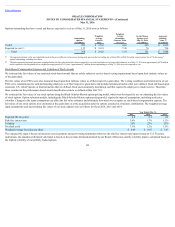

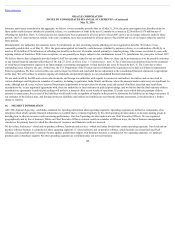

12. COMMITMENTS AND CERTAIN CONTINGENCIES

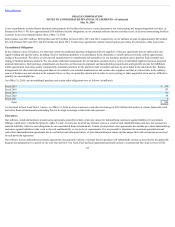

Lease Commitments

We lease certain facilities, furniture and equipment under operating leases. As of May 31, 2016, future minimum annual operating lease payments and future

minimum payments to be received from non-cancelable subleases were as follows:

(in millions)

Fiscal 2017 $ 328

Fiscal 2018 273

Fiscal 2019 211

Fiscal 2020 152

Fiscal 2021 110

Thereafter 164

Future minimum operating lease payments 1,238

Less: minimum payments to be received from non-cancelable subleases (57)

Total future minimum operating lease payments, net $ 1,181

118