Oracle 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

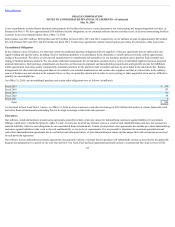

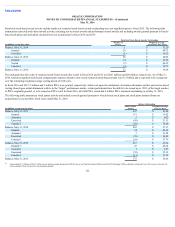

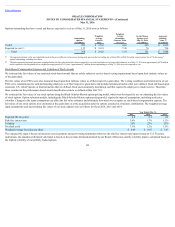

We also offer non-qualified deferred compensation plans to certain employees whereby they may defer a portion of their annual base and/or variable compensation

until retirement or a date specified by the employee in accordance with the plans. Deferred compensation plan assets and liabilities were each approximately $419

million as of May 31, 2016 and were each approximately $408 million as of May 31, 2015 and were presented in other assets and other non-current liabilities in the

accompanying consolidated balance sheets.

We sponsor certain defined benefit pension plans that are offered primarily by certain of our foreign subsidiaries. Many of these plans were assumed through our

acquisitions or are required by local regulatory requirements. We may deposit funds for these plans with insurance companies, third-party trustees, or into

government-managed accounts consistent with local regulatory requirements, as applicable. Our total defined benefit plan pension expenses were $95 million, $69

million and $64 million for fiscal 2016, 2015 and 2014, respectively. The aggregate projected benefit obligation and aggregate net liability (funded status) of our

defined benefit plans as of May 31, 2016 was $949 million and $587 million, respectively, and as of May 31, 2015 was $1.0 billion and $599 million, respectively.

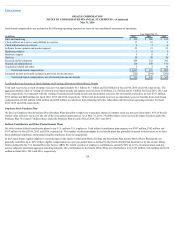

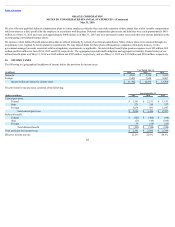

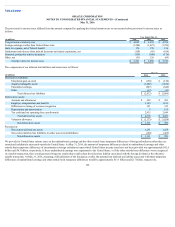

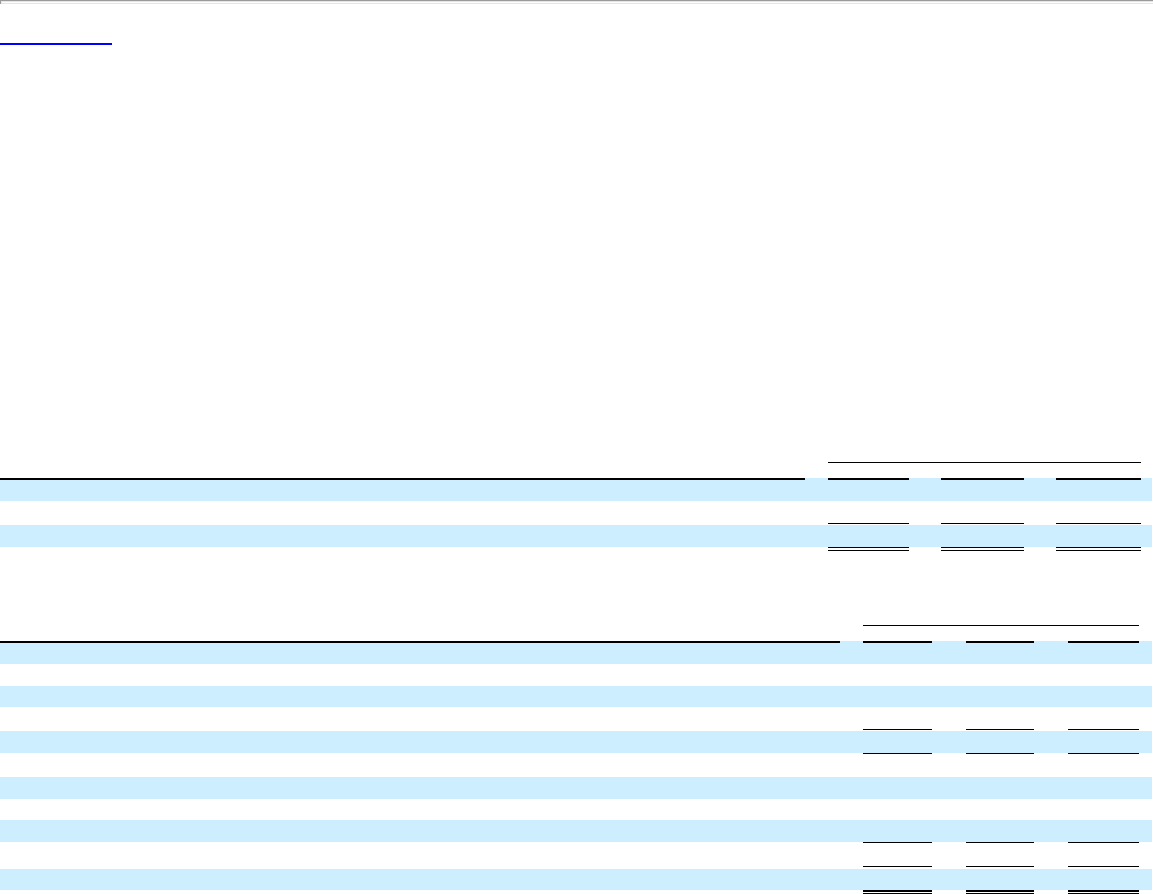

15. INCOME TAXES

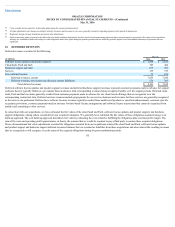

The following is a geographical breakdown of income before the provision for income taxes:

Year Ended May 31,

(in millions) 2016 2015 2014

Domestic $ 4,033 $ 5,136 $ 5,397

Foreign 7,409 7,698 8,307

Income before provision for income taxes $ 11,442 $ 12,834 $ 13,704

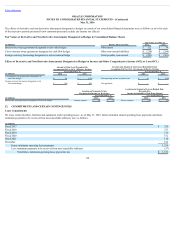

The provision for income taxes consisted of the following:

Year Ended May 31,

(Dollars in millions) 2016 2015 2014

Current provision:

Federal $ 1,301 $ 2,153 $ 1,613

State 271 310 337

Foreign 1,074 981 1,047

Total current provision $ 2,646 $ 3,444 $ 2,997

Deferred benefit:

Federal $ (123) $ (408) $ (68)

State (21) (46) (100)

Foreign 39 (94) (80)

Total deferred benefit $ (105) $ (548) $ (248)

Total provision for income taxes $ 2,541 $ 2,896 $ 2,749

Effective income tax rate 22.2% 22.6% 20.1%

125