Oracle 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

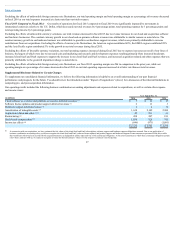

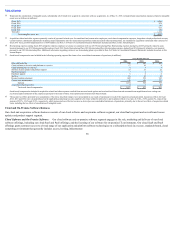

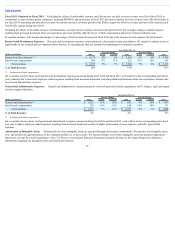

Represents the amortization of intangible assets, substantially all of which were acquired in connection with our acquisitions. As of May 31, 2016, estimated future amortization expenses related to intangible

assets were as follows (in millions):

Fiscal 2017 $ 1,026

Fiscal 2018 878

Fiscal 2019 770

Fiscal 2020 621

Fiscal 2021 476

Thereafter 1,172

Total intangible assets, net $ 4,943

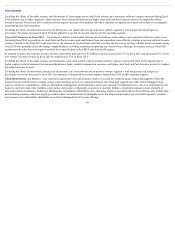

Acquisition related and other expenses primarily consist of personnel related costs for transitional and certain other employees, stock-based compensation expenses, integration related professional services,

certain business combination adjustments including certain adjustments after the measurement period has ended and certain other operating items, net. Included in acquisition related and other expenses for

fiscal 2015 was a goodwill impairment loss of $186 million (see Note 7 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report).

Restructuring expenses during fiscal 2016 primarily related to employee severance in connection with our 2015 Restructuring Plan. Restructuring expenses during fiscal 2015 primarily related to costs

incurred pursuant to our 2015 Restructuring Plan and our Fiscal 2013 Oracle Restructuring Plan (2013 Restructuring Plan). Restructuring expenses during fiscal 2014 primarily related to costs incurred

pursuant to our 2013 Restructuring Plan. Additional information regarding certain of our restructuring plans is provided in Note 9 of Notes to Consolidated Financial Statements included elsewhere in this

Annual Report.

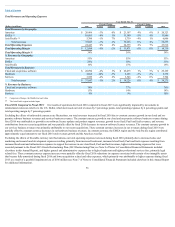

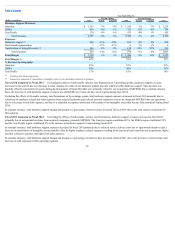

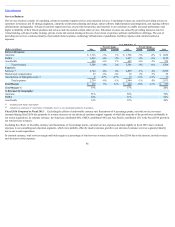

Stock-based compensation was included in the following operating expense line items of our consolidated statements of operations (in millions):

Year Ended May 31,

2016 2015 2014

Sales and marketing $ 220 $ 180 $ 165

Cloud software as a service and platform as a service 17 10 8

Cloud infrastructure as a service 4 5 4

Software license updates and product support 23 21 22

Hardware products 7 6 5

Hardware support 5 6 6

Services 29 30 29

Research and development 609 522 385

General and administrative 120 148 171

Subtotal 1,034 928 795

Acquisition related and other 3 5 10

Total stock-based compensation $ 1,037 $ 933 $ 805

Stock-based compensation included in acquisition related and other expenses resulted from unvested stock options and restricted stock-based awards assumed from acquisitions whose vesting was

accelerated upon termination of the employees pursuant to the terms of those stock options and restricted stock-based awards.

The income tax effects presented were calculated as if the above described charges were not included in our results of operations for each of the respective periods presented. Income tax effects for fiscal

2016, 2015 and 2014 were calculated based on the applicable jurisdictional tax rates applied to the items within the table above and resulted in effective tax rates of 23.2%, 23.6% and 22.5%, respectively,

instead of 22.2%, 22.6% and 20.1%, respectively, which represented our effective tax rates as derived per our consolidated statements of operations, primarily due to the net tax effects of acquisition related

items, including the tax effects of amortization of intangible assets.

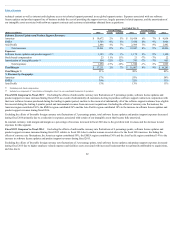

Cloud and On-Premise Software Business

Our cloud and on-premise software business consists of our cloud software and on-premise software segment, our cloud IaaS segment and our software license

updates and product support segment.

Cloud Software and On-Premise Software: Our cloud software and on-premise software segment engages in the sale, marketing and delivery of our cloud

software offerings, including our cloud SaaS and PaaS offerings, and the licensing of our software for on-premise IT environments. Our cloud SaaS and PaaS

offerings grant customers access to a broad range of our application and platform software technologies on a subscription basis in a secure, standards-based, cloud

computing environment that generally includes access, hosting, infrastructure

58

(2)

(3)

(4)

(5)

(6)