Oracle 2015 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

2. ACQUISITIONS

Fiscal 2017 Acquisitions

In June 2016, we acquired certain companies primarily to expand our cloud industry solutions offerings. These acquisitions were not individually significant. In the

aggregate, the estimated total preliminary purchase price was $1.3 billion. An initial allocation of the purchase price for these acquisitions will be performed in the

first quarter of fiscal 2017.

Fiscal 2016 Acquisitions

During fiscal 2016, we acquired certain companies and purchased certain technology and development assets primarily to expand our products and services

offerings. These acquisitions were not significant individually or in the aggregate.

Fiscal 2015 Acquisitions

Acquisition of MICROS Systems, Inc.

On June 22, 2014, we entered into an Agreement and Plan of Merger (Merger Agreement) with MICROS Systems, Inc. (MICROS), a provider of integrated

software, hardware and services solutions to the hospitality and retail industries. On July 3, 2014, pursuant to the Merger Agreement, we commenced a tender offer

to purchase all of the issued and outstanding shares of common stock of MICROS at a purchase price of $68.00 per share, net to the holder in cash, without interest

thereon, based upon the terms and subject to the conditions set forth in the Merger Agreement. Between September 3, 2014 and September 8, 2014, pursuant to the

terms of the tender offer, we accepted and paid for the substantial majority of outstanding shares of MICROS common stock. On September 8, 2014, we

effectuated the merger of MICROS with and into a wholly-owned subsidiary of Oracle pursuant to the terms of the Merger Agreement and applicable Maryland

law, and MICROS became an indirect, wholly-owned subsidiary of Oracle. Pursuant to the merger, shares of MICROS common stock that remained outstanding

and were not acquired by us were converted into, and cancelled in exchange for, the right to receive $68.00 per share in cash. The unvested equity awards to

acquire MICROS common stock that were outstanding immediately prior to the conclusion of the merger were converted into equity awards denominated in shares

of Oracle common stock based on formulas contained in the Merger Agreement. We acquired MICROS to, among other things, expand our cloud and on-premise

software, hardware and related services offerings for hotels, food and beverage industries, facilities, and retailers. We have included the financial results of

MICROS in our consolidated financial statements from the date of acquisition.

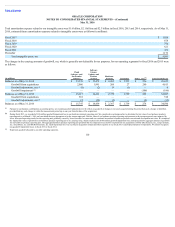

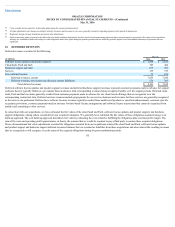

Pursuant to our business combinations accounting policy, we estimated the fair values of net tangible and intangible assets acquired, and the excess of the

consideration transferred over the aggregate of such fair values was recorded as goodwill. The following table summarizes the estimated fair values of net assets

acquired from MICROS:

(in millions)

Cash and cash equivalents $ 683

Trade receivables, net 181

Inventories 28

Goodwill 3,242

Intangible assets 2,030

Other assets 155

Accounts payable and other liabilities (359)

Deferred tax liabilities, net (536)

Deferred revenues (177)

Total $ 5,247

105