Oracle 2015 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

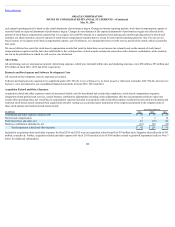

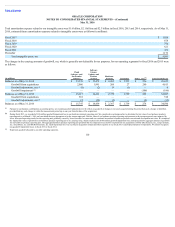

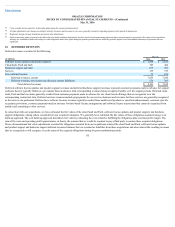

8. NOTES PAYABLE AND OTHER BORROWINGS

Notes payable and other borrowings consisted of the following:

May 31, 2016 May 31, 2015

(Dollars in millions)

Date of

Issuance Amount

Effective

Interest

Rate Amount

Effective

Interest

Rate

Revolving credit agreements:

$3,750, LIBOR plus 0.35%, due June 2016 May 2016 $ 3,750 0.81% $ — N.A.

Floating-rate senior notes:

$1,000, three-month LIBOR plus 0.20%, due July 2017 July 2014 1,000 0.83% 1,000 0.47%

$500, three-month LIBOR plus 0.58%, due January 2019 July 2013 500 1.21% 500 0.86%

$750, three-month LIBOR plus 0.51%, due October 2019 July 2014 750 1.14% 750 0.78%

Fixed-rate senior notes:

$2,000, 5.25%, due January 2016 January 2006 — N.A. 2,000 5.32%

$2,500, 1.20%, due October 2017 October 2012 2,500 1.24% 2,500 1.24%

$2,500, 5.75%, due April 2018 April 2008 2,500 5.76% 2,500 5.76%

$1,500, 2.375%, due January 2019 July 2013 1,500 2.44% 1,500 2.44%

$1,750, 5.00%, due July 2019 July 2009 1,750 5.05% 1,750 5.05%

$2,000, 2.25%, due October 2019 July 2014 2,000 2.27% 2,000 2.27%

$1,000, 3.875%, due July 2020 July 2010 1,000 3.93% 1,000 3.93%

€1,250, 2.25%, due January 2021 July 2013 1,394 2.33% 1,352 2.33%

$1,500, 2.80%, due July 2021 July 2014 1,500 2.82% 1,500 2.82%

$2,500, 2.50%, due May 2022 May 2015 2,500 2.56% 2,500 2.56%

$2,500, 2.50%, due October 2022 October 2012 2,500 2.51% 2,500 2.51%

$1,000, 3.625%, due July 2023 July 2013 1,000 3.73% 1,000 3.73%

$2,000, 3.40%, due July 2024 July 2014 2,000 3.43% 2,000 3.43%

$2,500, 2.95%, due May 2025 May 2015 2,500 3.00% 2,500 3.00%

€750, 3.125%, due July 2025 July 2013 836 3.17% 810 3.17%

$500, 3.25%, due May 2030 May 2015 500 3.30% 500 3.30%

$1,750, 4.30%, due July 2034 July 2014 1,750 4.30% 1,750 4.30%

$1,250, 3.90%, due May 2035 May 2015 1,250 3.95% 1,250 3.95%

$1,250, 6.50%, due April 2038 April 2008 1,250 6.52% 1,250 6.52%

$1,250, 6.125%, due July 2039 July 2009 1,250 6.19% 1,250 6.19%

$2,250, 5.375%, due July 2040 July 2010 2,250 5.45% 2,250 5.45%

$1,000, 4.50%, due July 2044 July 2014 1,000 4.50% 1,000 4.50%

$2,000, 4.125%, due May 2045 May 2015 2,000 4.15% 2,000 4.15%

$1,250, 4.375%, due May 2055 May 2015 1,250 4.40% 1,250 4.40%

Total senior notes and other borrowings $ 43,980 $ 42,162

Unamortized discount/issuance costs (247) (278)

Hedge accounting fair value adjustments 122 74

Total notes payable and other borrowings $ 43,855 $ 41,958

Notes payable and other borrowings, current $ 3,750 $ 1,999

Notes payable, non-current $ 40,105 $ 39,959

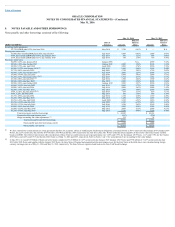

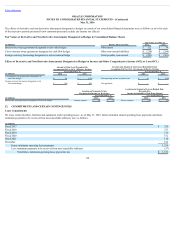

We have entered into certain interest rate swap agreements that have the economic effects of modifying the fixed-interest obligations associated with the 2.375% senior notes due January 2019 (January 2019

Notes), the 2.25% senior notes due October 2019 (October 2019 Notes) and the 2.80% senior notes due July 2021 (July 2021 Notes) so that the interest payable on these notes effectively became variable

based on LIBOR. The effective interest rates after consideration of these fixed to variable interest rate swap agreements were 1.28% and 0.93% for the January 2019 Notes, 1.11% and 0.76% for the October

2019 Notes, and 1.26% and 0.91% for the July 2021 Notes as of May 31, 2016 and 2015, respectively. Refer to Notes 1 and 11 for a description of our accounting for fair value hedges.

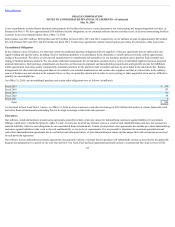

In July 2013, we issued €2.0 billion of fixed-rate senior notes comprised of €1.25 billion of 2.25% senior notes due January 2021 (January 2021 Notes) and €750 million of 3.125% senior notes due July

2025 (July 2025 Notes, and together with the January 2021 Notes, the Euro Notes). Principal and unamortized discount/issuance costs for the Euro Notes in the table above were calculated using foreign

currency exchange rates as of May 31, 2016 and May 31, 2015, respectively. The Euro Notes are registered and trade on the New York Stock Exchange.

111

(1)

(1)

(2)(3)

(1)

(2)(4)

(1)

(1)

(2)