Oracle 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Provision for Income Taxes: Our effective tax rate in all periods is the result of the mix of income earned in various tax jurisdictions that apply a broad range of

income tax rates. The provision for income taxes differs from the tax computed at the U.S. federal statutory income tax rate due primarily to certain earnings

considered as indefinitely reinvested in foreign operations, state taxes, the U.S. research and development tax credit, settlements with tax authorities and the U.S.

domestic production activity deduction. Future effective tax rates could be adversely affected if earnings are lower than anticipated in countries where we have

lower statutory tax rates, by unfavorable changes in tax laws and regulations or by adverse rulings in tax related litigation.

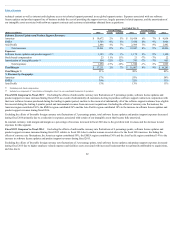

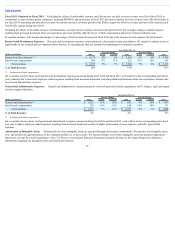

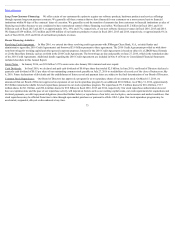

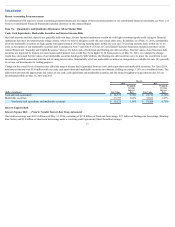

Year Ended May 31,

Percent Change Percent Change

(Dollars in millions) 2016 Actual Constant 2015 Actual Constant 2014

Provision for income taxes $ 2,541 -12% -5% $ 2,896 5% 13% $ 2,749

Effective tax rate 22.2% 22.6% 20.1%

Fiscal 2016 Compared to Fiscal 2015: Provision for income taxes in fiscal 2016 decreased, relative to the provision for income taxes in fiscal 2015, due in

substantial part to lower net income before provision for income taxes during fiscal 2016, settlements with certain tax authorities, and the retroactive extension of

the U.S. research and development tax credit, which collectively were partially offset by unfavorable changes in the jurisdictional mix of our earnings during fiscal

2016.

Fiscal 2015 Compared to Fiscal 2014: Provision for income taxes in fiscal 2015 increased, relative to the provision for income taxes in fiscal 2014, due in

substantial part to an unfavorable change in the jurisdictional mix of our fiscal 2015 earnings, and due to the effects of acquisition related settlements with tax

authorities in fiscal 2014 that were not present in fiscal 2015, which together were partially offset by lower fiscal 2015 income before provision for income taxes.

Liquidity and Capital Resources

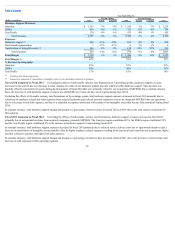

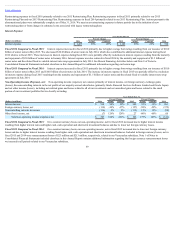

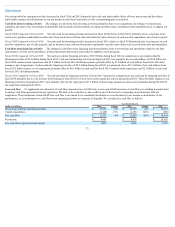

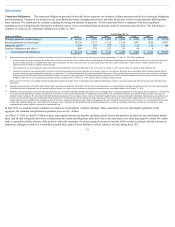

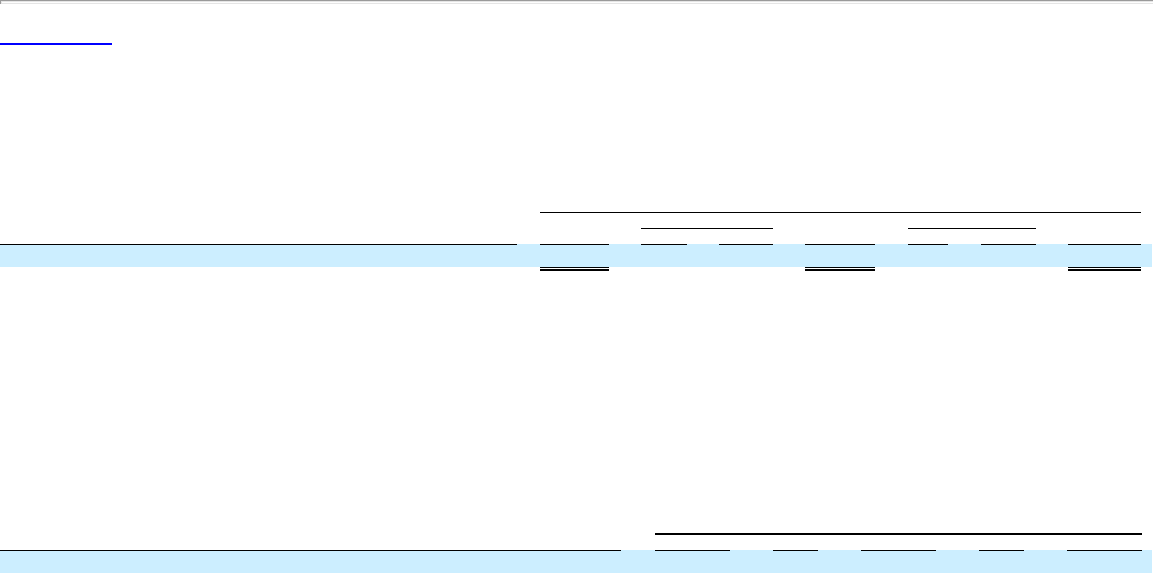

As of May 31,

(Dollars in millions) 2016 Change 2015 Change 2014

Working capital $ 47,105 -2% $ 47,892 42% $ 33,739

Cash, cash equivalents and marketable securities $ 56,125 3% $ 54,368 40% $ 38,819

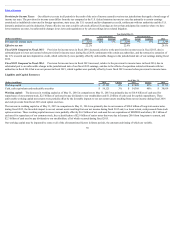

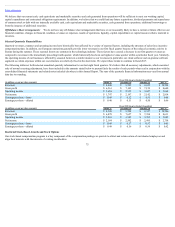

Working capital: The decrease in working capital as of May 31, 2016 in comparison to May 31, 2015 was primarily due to $10.4 billion of cash used for

repurchases of our common stock, $2.5 billion of cash used to pay dividends to our stockholders and $1.2 billion of cash used for capital expenditures. These

unfavorable working capital movements were partially offset by the favorable impacts to our net current assets resulting from our net income during fiscal 2016

and cash proceeds from fiscal 2016 stock option exercises.

The increase in working capital as of May 31, 2015 in comparison to May 31, 2014 was primarily due to our issuance of $20.0 billion of long-term senior notes

during fiscal 2015, the favorable impact to our net current assets resulting from our net income during fiscal 2015 and, to a lesser extent, cash proceeds from stock

option exercises. These working capital increases were partially offset by $6.2 billion of net cash used for our acquisitions of MICROS and others, $8.1 billion of

cash used for repurchases of our common stock, the reclassification of $2.0 billion of senior notes that were due in January 2016 from long-term to current, and

$2.3 billion of cash used to pay dividends to our stockholders, all of which occurred during fiscal 2015.

Our working capital may be impacted by some or all of the aforementioned factors in future periods, the amounts and timing of which are variable.

70