Oracle 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

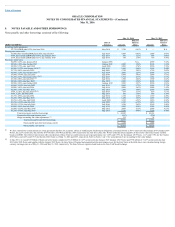

2013 Credit Agreement. Any amounts drawn pursuant to the 2013 Credit Agreement are due on April 20, 2018. No amounts were outstanding pursuant to the 2013

Credit Agreement as of May 31, 2016 and 2015.

The 2016 Credit Agreements and the 2013 Credit Agreement contain certain customary representations and warranties, covenants and events of default. If any of

the events of default occur and are not cured within applicable grace periods or waived, any unpaid amounts owed under the agreement to which the default relates

may be declared immediately due and payable and the relevant agreement may be terminated. We were in compliance with the covenants of the 2016 Credit

Agreements and the 2013 Credit Agreement as of May 31, 2016.

Commercial Paper Program and Commercial Paper Notes

In April 2013, pursuant to our existing $3.0 billion commercial paper program which allows us to issue and sell unsecured short-term promissory notes pursuant to

a private placement exemption from the registration requirements under federal and state securities laws, we entered into new dealer agreements with various banks

and a new Issuing and Paying Agency Agreement with JP Morgan Chase Bank, N.A. (JP Morgan). Effective on December 22, 2014, Deutsche Bank Trust

Companies Americas became the Successor Issuing and Paying Agent replacing JP Morgan. Since that time, we have entered into new dealer agreements with

additional banks. As of May 31, 2016 and 2015, we did not have any outstanding commercial paper notes. We intend to back-stop any commercial paper notes that

we may issue in the future with the 2013 Credit Agreement.

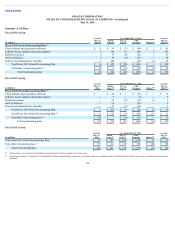

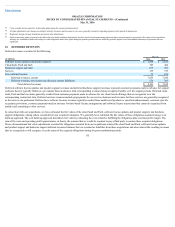

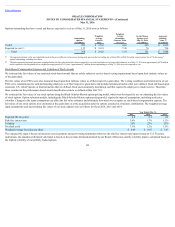

9. RESTRUCTURING ACTIVITIES

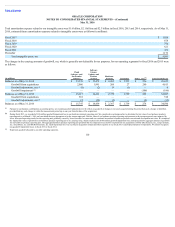

Fiscal 2015 Oracle Restructuring Plan

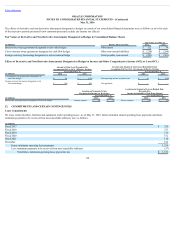

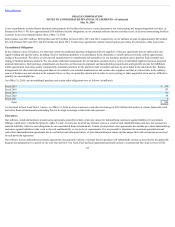

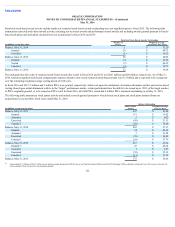

During the second quarter of fiscal 2015, our management approved, committed to and initiated plans to restructure and further improve efficiencies in our

operations due to our acquisition of MICROS and certain other operational activities (2015 Restructuring Plan). Restructuring costs associated with the 2015

Restructuring Plan were recorded to the restructuring expense line item within our consolidated statements of operations as they were incurred. We recorded $462

million and $100 million of restructuring expenses in connection with the 2015 Restructuring Plan in fiscal 2016 and 2015, respectively. Actions pursuant to the

2015 Restructuring Plan were substantially complete as of May 31, 2016.

Fiscal 2013 Oracle Restructuring Plan

During the first quarter of fiscal 2013, our management approved, committed to and initiated plans to restructure and further improve efficiencies in our operations

(2013 Restructuring Plan). Restructuring costs associated with the 2013 Restructuring Plan were recorded to the restructuring expense line item within our

consolidated statements of operations as they were incurred. We recorded $119 million and $174 million of restructuring expenses in connection with the 2013

Restructuring Plan in fiscal 2015 and 2014, respectively. Actions pursuant to the 2013 Restructuring Plan were substantially complete as of the end of fiscal 2015.

113