Oracle 2015 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

each annual reporting period is based on the actual attainment of performance targets. During our interim reporting periods, stock-based compensation expense is

recorded based on expected attainment of performance targets. Changes in our estimates of the expected attainment of performance targets are reflected in the

amount of stock-based compensation expense that we recognize for each PSU tranche on a cumulative basis during each interim reporting period in which such

estimates are altered and may cause the amount of stock-based compensation expense that we record for each interim reporting period to vary. For our service-

based awards, we recognize stock-based compensation expense, net of forfeitures, on a straight-line basis over the service period of the award, which is generally

four years.

We record deferred tax assets for stock-based compensation awards that result in deductions on our income tax returns based on the amount of stock-based

compensation recognized and the fair value attributable to the vested portion of stock awards assumed in connection with a business combination, at the statutory

tax rate in the jurisdiction in which we will receive a tax deduction.

Advertising

All advertising costs are expensed as incurred. Advertising expenses, which were included within sales and marketing expenses, were $68 million, $55 million and

$79 million in fiscal 2016, 2015 and 2014, respectively.

Research and Development and Software Development Costs

All research and development costs are expensed as incurred.

Software development costs required to be capitalized under ASC 985-20, CostsofSoftwaretobeSold,LeasedorMarketed,and under ASC 350-40, Internal-Use

Software,were not material to our consolidated financial statements in fiscal 2016, 2015 and 2014.

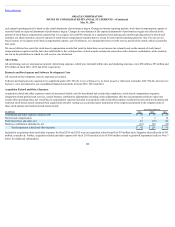

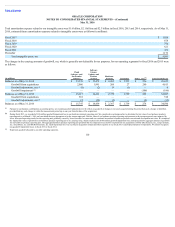

Acquisition Related and Other Expenses

Acquisition related and other expenses consist of personnel related costs for transitional and certain other employees, stock-based compensation expenses,

integration related professional services, certain business combination adjustments including certain adjustments after the measurement period has ended and

certain other operating items, net. Stock-based compensation expenses included in acquisition related and other expenses resulted from unvested stock options and

restricted stock-based awards assumed from acquisitions whereby vesting was accelerated upon termination of the employees pursuant to the original terms of

those stock options and restricted stock-based awards.

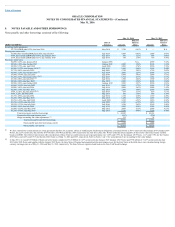

Year Ended May 31,

(in millions) 2016 2015 2014

Transitional and other employee related costs $ 45 $ 57 $ 27

Stock-based compensation 3 5 10

Professional fees and other, net 10 (35) 20

Business combination adjustments, net (16) 184 (16)

Total acquisition related and other expenses $ 42 $ 211 $ 41

Included in acquisition related and other expenses for fiscal 2016 and 2015 were an acquisition related benefit of $19 million and a litigation related benefit of $53

million, respectively. Further, acquisition related and other expenses for fiscal 2015 included a loss of $186 million related to goodwill impairment (refer to Note 7

below for additional information).

102