Oracle 2015 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

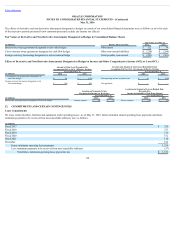

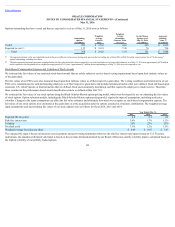

domestic audit issues considered in the aggregate, we believe it was reasonably possible that, as of May 31, 2016, the gross unrecognized tax benefits related to

these audits could decrease (whether by payment, release, or a combination of both) in the next 12 months by as much as $228 million ($176 million net of

offsetting tax benefits). Our U.S. federal income tax returns have been examined for all years prior to fiscal 2007 and we are no longer subject to audit for those

periods. Our U.S. state income tax returns, with some exceptions, have been examined for all years prior to fiscal 2004 and we are no longer subject to audit for

those periods.

Internationally, tax authorities for numerous non-U.S. jurisdictions are also examining returns affecting our unrecognized tax benefits. We believe it was

reasonably possible that, as of May 31, 2016, the gross unrecognized tax benefits, could decrease (whether by payment, release, or a combination of both) by as

much as $199 million ($74 million net of offsetting tax benefits) in the next 12 months, related primarily to transfer pricing. Other issues are related to years with

expiring statutes of limitation. With some exceptions, we are generally no longer subject to tax examinations in non-U.S. jurisdictions for years prior to fiscal 1997.

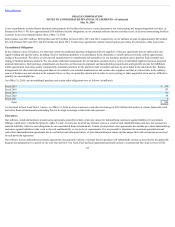

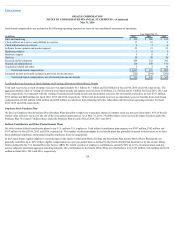

We believe that we have adequately provided under GAAP for outcomes related to our tax audits. However, there can be no assurances as to the possible outcomes

or any related financial statement effect thereof. On July 27, 2015, in AlteraCorp.v.Commissioner, the U.S. Tax Court issued an opinion related to the treatment

of stock-based compensation expense in an intercompany cost-sharing arrangement. A final decision has yet to be issued by the U.S. Tax Court due to other

outstanding issues related to the case. At this time, the U.S. Department of the Treasury has not withdrawn the requirement to include stock-based compensation

from its regulations. We have reviewed this case and its impact on Oracle and concluded that no adjustment to the consolidated financial statements is appropriate

at this time. We will continue to monitor ongoing developments and potential impacts to our consolidated financial statements.

We are under audit by the IRS and various other domestic and foreign tax authorities with regards to income tax and indirect tax matters and are involved in

various challenges and litigation in a number of countries, including, in particular, India, Brazil, and Korea, where the amounts under controversy are significant. In

some, although not all, cases, we have reserved for potential adjustments to our provision for income taxes and accrual of indirect taxes that may result from

examinations by, or any negotiated agreements with, these tax authorities or final outcomes in judicial proceedings, and we believe that the final outcome of these

examinations, agreements or judicial proceedings will not have a material effect on our results of operations. If events occur which indicate payment of these

amounts is unnecessary, the reversal of the liabilities would result in the recognition of benefits in the period we determine the liabilities are no longer necessary. If

our estimates of the federal, state, and foreign income tax liabilities and indirect tax liabilities are less than the ultimate assessment, it would result in a further

charge to expense.

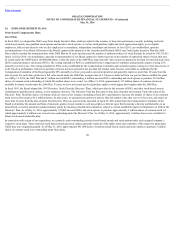

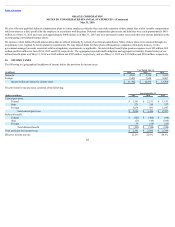

16. SEGMENT INFORMATION

ASC 280, SegmentReporting, establishes standards for reporting information about operating segments. Operating segments are defined as components of an

enterprise about which separate financial information is available that is evaluated regularly by the chief operating decision maker, or decision-making group, in

deciding how to allocate resources and in assessing performance. Our chief operating decision makers are our Chief Executive Officers. We are organized

geographically and by line of business. While our Chief Executive Officers evaluate results in a number of different ways, the line of business management

structure is the primary basis for which the allocation of resources and financial results are assessed.

We have three businesses—cloud and on-premise software, hardware and services—which are further divided into certain operating segments. Our cloud and on-

premise software business is comprised of three operating segments: (1) cloud software and on-premise software, which includes our cloud SaaS and PaaS

offerings, (2) cloud IaaS and (3) software license updates and product support. Our hardware business is comprised of two operating segments: (1) hardware

products and (2) hardware support. All other operating segments are combined under our services business.

128