Oracle 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

In connection with the issuance of the January 2021 Notes, we entered into certain cross-currency swap agreements that have the economic effect of converting our fixed-rate, Euro-denominated debt,

including annual interest payments and the payment of principal at maturity, to a fixed-rate, U.S. Dollar-denominated debt of $1.6 billion with a fixed annual interest rate of 3.53% (see Note 11 for additional

information).

We designated the July 2025 Notes as a net investment hedge of our investments in certain of our international subsidiaries that use the Euro as their functional currency in order to reduce the volatility in

stockholders’ equity caused by the changes in foreign currency exchange rates of the Euro with respect to the U.S. Dollar (see Note 11 for additional information).

Senior Notes and Other Borrowings

In January 2016, our $2.0 billion of 5.25% senior notes due January 2016 matured and were repaid. In July 2014, our $1.5 billion of 3.75% senior notes due July

2014 (July 2014 Notes) matured and were repaid (we also settled the fixed to variable interest rate swap agreements associated with the July 2014 Notes).

Interest is payable semi-annually for the senior notes except for the Euro Notes for which interest is payable annually and the floating-rate senior notes for which

interest is payable quarterly. We may redeem some or all of the senior notes of each series prior to their maturity, subject to certain restrictions, and the payment of

an applicable make-whole premium in certain instances except for the floating-rate senior notes which may not be redeemed prior to their maturity.

The senior notes rank pari passu with any other notes we may issue in the future pursuant to our commercial paper program (see additional discussion regarding our

commercial paper program below) and all existing and future unsecured senior indebtedness of Oracle Corporation. All existing and future liabilities of the

subsidiaries of Oracle Corporation are or will be effectively senior to the senior notes and any future issuances of commercial paper notes. We were in compliance

with all debt-related covenants at May 31, 2016.

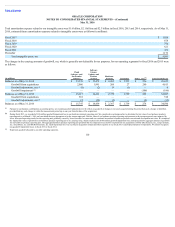

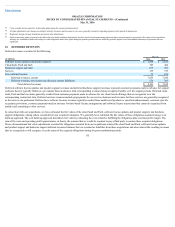

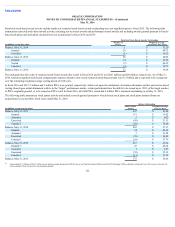

Future principal payments (adjusted for the effects of the cross-currency swap agreements associated with the January 2021 Notes) for all of our borrowings at May

31, 2016 were as follows (in millions):

Fiscal 2017 $ 3,750

Fiscal 2018 6,000

Fiscal 2019 2,000

Fiscal 2020 4,500

Fiscal 2021 2,655

Thereafter 25,336

Total $ 44,241

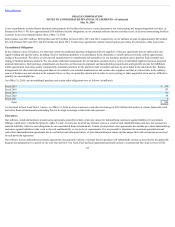

Revolving Credit Agreements

In May 2016, we entered into three revolving credit agreements with JPMorgan Chase Bank, N.A., as initial lender and administrative agent (the 2016 Credit

Agreements) and borrowed $3.8 billion pursuant to these agreements. The 2016 Credit Agreements provided us with short-term borrowings for working capital and

other general corporate purposes. Interest for the 2016 Credit Agreements is based on either (1) a LIBOR-based formula or (2) the Base Rate formula, each as set

forth in the 2016 Credit Agreements. The borrowings are due and payable on June 27, 2016, which is the termination date of the 2016 Credit Agreements.

In April 2013, we entered into a $3.0 billion Revolving Credit Agreement with Wells Fargo Bank, N.A., Bank of America, N.A., BNP Paribas, JPMorgan Chase

Bank, N.A. and certain other lenders (the 2013 Credit Agreement). The 2013 Credit Agreement provides for an unsecured 5-year revolving credit facility to be used

for general corporate purposes including back-stopping any commercial paper notes that we may issue. Subject to certain conditions stated in the 2013 Credit

Agreement, we may borrow, prepay and re-borrow amounts under the 2013 Credit Agreement at any time during the term of the 2013 Credit Agreement. Interest

under the 2013 Credit Agreement is based on either (a) a LIBOR-based formula or (b) the Base Rate formula, each as set forth in the

112

(3)

(4)