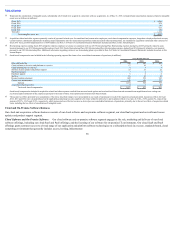

Oracle 2015 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

customers to which these contractual obligations pertain renew these contracts with us, we expect to recognize revenues for the full contracts’ values over the

respective contracts’ renewal periods.

In connection with a business combination or other strategic initiative, we may estimate costs associated with restructuring plans committed to by our management.

Restructuring costs are typically comprised of employee severance costs, costs of consolidating duplicate facilities and contract termination costs. Restructuring

expenses are based upon plans that have been committed to by our management, but may be refined in subsequent periods. We account for costs to exit or

restructure certain activities of an acquired company separately from the business combination pursuant to ASC 420, ExitorDisposalCostObligations.A liability

for costs associated with an exit or disposal activity is recognized and measured at its fair value in our consolidated statement of operations in the period in which

the liability is incurred. When estimating the fair value of facility restructuring activities, assumptions are applied regarding estimated sub-lease payments to be

received, which can differ materially from actual results. This may require us to revise our initial estimates which may materially affect our results of operations

and financial position in the period the revision is made.

For a given acquisition, we may identify certain pre-acquisition contingencies as of the acquisition date and may extend our review and evaluation of these pre-

acquisition contingencies throughout the measurement period in order to obtain sufficient information to assess whether we include these contingencies as a part of

the fair value estimates of assets acquired and liabilities assumed and, if so, to determine their estimated amounts.

If we cannot reasonably determine the fair value of a pre-acquisition contingency (non-income tax related) by the end of the measurement period, which is

generally the case given the nature of such matters, we will recognize an asset or a liability for such pre-acquisition contingency if: (1) it is probable that an asset

existed or a liability had been incurred at the acquisition date and (2) the amount of the asset or liability can be reasonably estimated. Subsequent to the

measurement period, changes in our estimates of such contingencies will affect earnings and could have a material effect on our results of operations and financial

position.

In addition, uncertain tax positions and tax related valuation allowances assumed in connection with a business combination are initially estimated as of the

acquisition date. We reevaluate these items quarterly based upon facts and circumstances that existed as of the acquisition date with any adjustments to our

preliminary estimates being recorded to goodwill if identified within the measurement period. Subsequent to the measurement period or our final determination of

the tax allowance’s or contingency’s estimated value, whichever comes first, changes to these uncertain tax positions and tax related valuation allowances will

affect our provision for income taxes in our consolidated statement of operations and could have a material impact on our results of operations and financial

position.

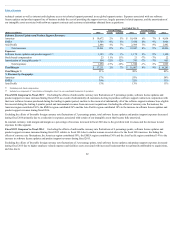

Goodwill and Intangible Assets—Impairment Assessments

We review goodwill for impairment annually and whenever events or changes in circumstances indicate its carrying value may not be recoverable in accordance

with ASC 350, Intangibles—GoodwillandOther. According to ASC 350, we can opt to perform a qualitative assessment to test a reporting unit’s goodwill for

impairment or we can directly perform the two-step impairment test. Based on our qualitative assessment, if we determine that the fair value of a reporting unit is

more likely than not (i.e., a likelihood of more than 50 percent) to be less than its carrying amount, the two-step impairment test prescribed by ASC 350 will be

performed. In the first step, we compare the fair value of each reporting unit to its carrying value. If the fair value of the reporting unit exceeds the carrying value of

the net assets assigned to that unit, goodwill is not considered impaired and we are not required to perform further testing. If the carrying value of the net assets

assigned to the reporting unit exceeds the fair value of the reporting unit, then we must perform the second step of the impairment test in order to determine the

implied fair value of the reporting unit’s goodwill. If the carrying value of a reporting unit’s goodwill exceeds its implied fair value, then we would record an

impairment loss equal to the difference.

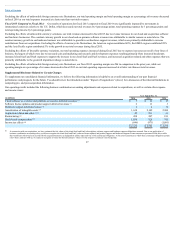

Determining the fair value of a reporting unit involves the use of significant estimates and assumptions. These estimates and assumptions include revenue growth

rates and operating margins used to calculate projected future cash flows, risk-adjusted discount rates, future economic and market conditions and the determination

of appropriate market comparables. We base our fair value estimates on assumptions we believe to be reasonable

52