Oracle 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

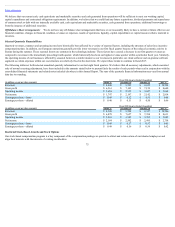

Table of Contents

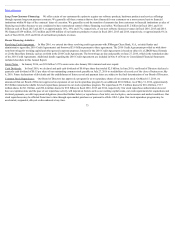

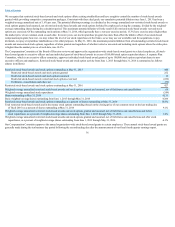

Foreign Currency Translation Risk — Net Investment Hedge

In July 2013, we issued €750 million of 3.125% senior notes due July 2025 (July 2025 Notes). We designated the July 2025 Notes as a net investment hedge of our

investments in certain of our international subsidiaries that use the Euro as their functional currency in order to reduce the volatility in stockholders’ equity caused

by the changes in foreign currency exchange rates of the Euro with respect to the U.S. Dollar. As a result, provided there is no ineffectiveness related to the hedge,

the change in the carrying value of the Euro-denominated July 2025 Notes due to fluctuations in foreign currency exchange rates on the effective portion is

recorded in accumulated other comprehensive loss on our consolidated balance sheet and is also presented as a line item in our consolidated statements of

comprehensive income included elsewhere in this Annual Report and totaled $25 million of net other comprehensive losses for fiscal 2016. Any remaining change

in the carrying value of the July 2025 Notes representing any ineffective portion of the net investment hedge is recognized in non-operating income (expense), net.

We did not record any ineffectiveness during fiscal 2016.

Fluctuations in the exchange rates between the Euro and the U.S. Dollar will impact the amount of U.S. Dollars that we will require to settle the July 2025 Notes at

maturity. If the U.S. Dollar would have been weaker by 10% in comparison to the Euro as of May 31, 2016, we estimate our obligation to cash settle the principal

portion of the July 2025 Notes in U.S. Dollars would have increased by approximately $84 million.

Item 8. Financial Statements and Supplementary Data

The response to this item is submitted as a separate section of this Annual Report. See Part IV, Item 15.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None.

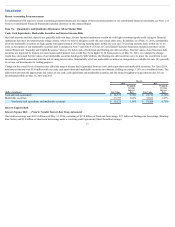

Item 9A. Controls and Procedures

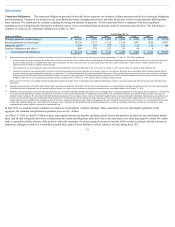

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this Annual Report on Form 10-K, we carried out an evaluation under the supervision and with the participation of our

Disclosure Committee and our management, including our Principal Executive Officers (one of whom is our Principal Financial Officer), of the effectiveness of the

design and operation of our disclosure controls and procedures pursuant to Exchange Act Rules 13a-15(e) and 15d-15(e). Disclosure controls are procedures that

are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, or the Exchange Act, such as this

Annual Report on Form 10-K, is recorded, processed, summarized and reported within the time periods specified by the U.S. Securities and Exchange Commission.

Disclosure controls are also designed to ensure that such information is accumulated and communicated to our management, including our Principal Executive

Officers (one of whom is our Principal Financial Officer), as appropriate to allow timely decisions regarding required disclosure. Our quarterly evaluation of

disclosure controls includes an evaluation of some components of our internal control over financial reporting. We also perform a separate annual evaluation of

internal control over financial reporting for the purpose of providing the management report below.

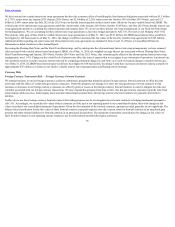

The evaluation of our disclosure controls included a review of their objectives and design, our implementation of the controls and the effect of the controls on the

information generated for use in this Annual Report on Form 10-K. In the course of the controls evaluation, we reviewed data errors or control problems identified

and sought to confirm that appropriate corrective actions, including process improvements, were being undertaken. This type of evaluation is performed on a

quarterly basis so that the conclusions of management, including our Principal Executive Officers (one of whom is our Principal Financial Officer), concerning the

effectiveness of the disclosure controls can be reported in our periodic reports on Form 10-Q and Form 10-K. Many of the components of our disclosure controls

are also evaluated on an ongoing basis by both our internal audit and finance organizations. The overall goals of these various evaluation activities are to monitor

our disclosure controls and to modify them as necessary. We intend to maintain our disclosure controls as dynamic processes and procedures that we adjust as

circumstances merit.

80