Oracle 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

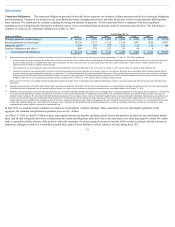

We expect that we will continue to realize gains or losses with respect to our foreign currency exposures, net of gains or losses from our foreign currency forward

contracts. Our ultimate realized gain or loss with respect to foreign currency exposures will generally depend on the size and type of cross-currency transactions

that we enter into, the currency exchange rates associated with these exposures and changes in those rates, the net realized gain or loss on our foreign currency

forward contracts and other factors. As of May 31, 2016 and 2015, the notional amounts of the forward contracts we held to purchase U.S. Dollars in exchange for

other major international currencies were $2.7 billion and $2.2 billion, respectively. As of May 31, 2016 and 2015, the notional amounts of forward contracts we

held to sell U.S. Dollars in exchange for other major international currencies were $2.0 billion and $1.2 billion, respectively. The fair values of our outstanding

foreign currency forward contracts were nominal at May 31, 2016 and 2015. Net foreign exchange transaction losses included in non-operating income (expense),

net in the accompanying consolidated statements of operations were $110 million, $157 million and $375 million in fiscal 2016, 2015 and 2014, respectively.

Included in the net foreign exchange transaction losses for fiscal 2016, 2015 and 2014 were foreign currency remeasurement losses relating to our Venezuelan

subsidiary’s operations of $7 million, $23 million and $213 million, respectively (see Note 1 of Notes to Consolidated Financial Statements included elsewhere in

this Annual Report for additional information). As a large portion of our consolidated operations are international, we could experience additional foreign currency

volatility in the future, the amounts and timing of which are unknown.

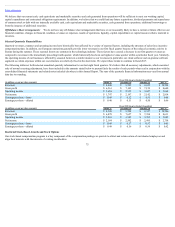

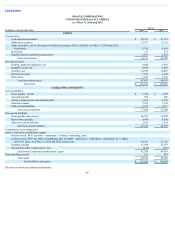

Foreign Currency Translation Risk—Impact on Cash, Cash Equivalents and Marketable Securities

Fluctuations in foreign currencies impact the amount of total assets and liabilities that we report for our foreign subsidiaries upon the translation of these amounts

into U.S. Dollars. In particular, the amount of cash, cash equivalents and marketable securities that we report in U.S. Dollars for a significant portion of the cash

held by these subsidiaries is subject to translation variance caused by changes in foreign currency exchange rates as of the end of each respective reporting period

(the offset to which is substantially recorded to accumulated other comprehensive loss on our consolidated balance sheet and is also presented as a line item in our

consolidated statements of comprehensive income included elsewhere in this Annual Report).

As the U.S. Dollar fluctuated against certain international currencies as of the end of fiscal 2016, the amount of cash, cash equivalents and marketable securities

that we reported in U.S. Dollars for foreign subsidiaries that hold international currencies as of May 31, 2016 decreased relative to what we would have reported

using a constant currency rate as of May 31, 2015. As reported in our consolidated statements of cash flows, the estimated effects of exchange rate changes on our

reported cash and cash equivalents balances in U.S. Dollars for fiscal 2016, 2015 and 2014 were decreases of $115 million, $1.2 billion and $158 million,

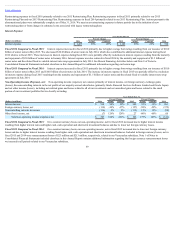

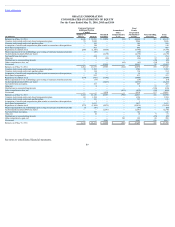

respectively. The following table includes estimates of the U.S. Dollar equivalent of cash, cash equivalents and marketable securities denominated in certain major

foreign currencies that we held as of May 31, 2016:

(in millions)

U.S. Dollar

Equivalent at

May 31, 2016

Euro $ 2,430

Japanese Yen 618

Indian Rupee 493

Chinese Renminbi 442

Canadian Dollar 369

British Pound 262

Swiss Franc 191

Australian Dollar 184

Other foreign currencies 1,806

Total cash, cash equivalents and marketable securities denominated in foreign currencies $ 6,795

If overall foreign currency exchange rates in comparison to the U.S. Dollar uniformly would have been weaker by 10%, the amount of cash, cash equivalents and

marketable securities we would report in U.S. Dollars would have decreased by approximately $680 million, assuming constant foreign currency cash, cash

equivalents and marketable securities balances.

79