Oracle 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

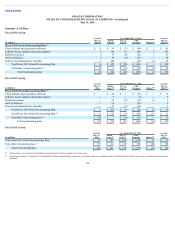

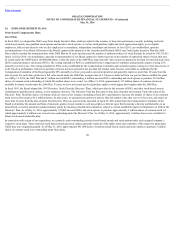

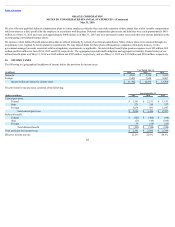

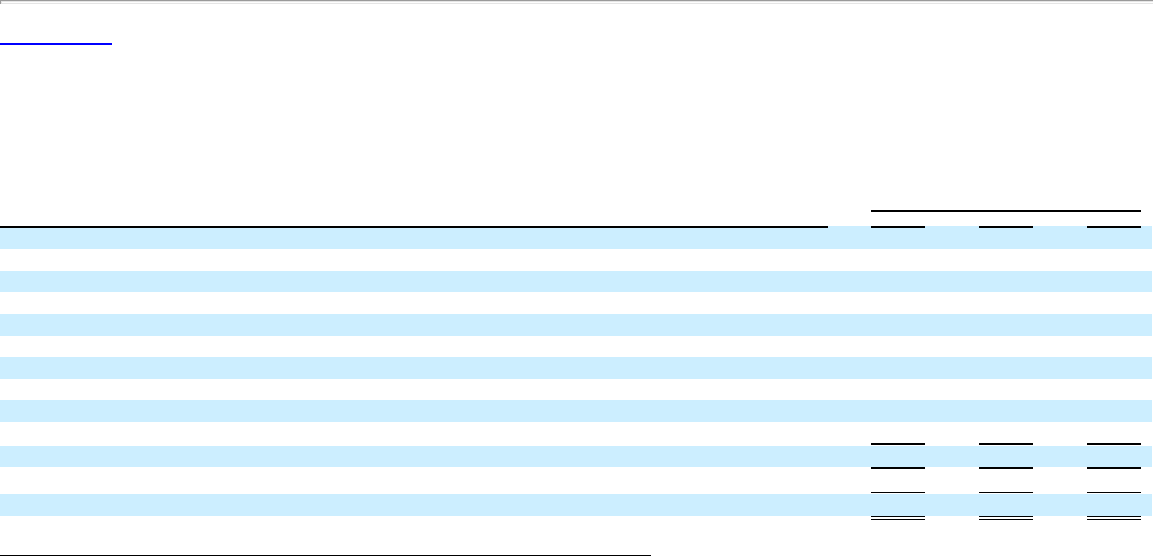

Stock-based compensation was included in the following operating expense line items in our consolidated statements of operations:

Year Ended May 31,

(in millions) 2016 2015 2014

Sales and marketing $ 220 $ 180 $ 165

Cloud software as a service and platform as a service 17 10 8

Cloud infrastructure as a service 4 5 4

Software license updates and product support 23 21 22

Hardware products 7 6 5

Hardware support 5 6 6

Services 29 30 29

Research and development 609 522 385

General and administrative 120 148 171

Acquisition related and other 3 5 10

Total stock-based compensation $ 1,037 $ 933 $ 805

Estimated income tax benefit included in provision for income taxes (322) (294) (260)

Total stock-based compensation, net of estimated income tax benefit $ 715 $ 639 $ 545

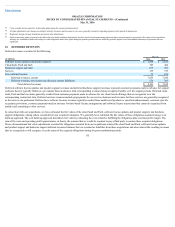

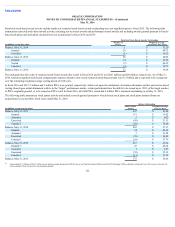

Tax Benefits from Exercise of Stock Options and Vesting of Restricted Stock-Based Awards

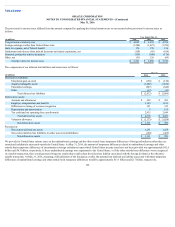

Total cash received as a result of option exercises was approximately $1.3 billion, $1.7 billion and $2.0 billion for fiscal 2016, 2015 and 2014, respectively. The

aggregate intrinsic value of vesting of restricted stock-based awards and options exercised was $1.0 billion, $1.3 billion and $1.5 billion for fiscal 2016, 2015 and

2014, respectively. In connection with the vesting of restricted stock-based awards and stock option exercises, the tax benefits realized by us were $311 million,

$396 million and $480 million for fiscal 2016, 2015 and 2014, respectively. Of the total tax benefits received, we classified excess tax benefits from stock-based

compensation of $124 million, $244 million and $250 million as cash flows from financing activities rather than cash flows from operating activities for fiscal

2016, 2015 and 2014, respectively.

Employee Stock Purchase Plan

We have an Employee Stock Purchase Plan (Purchase Plan) that allows employees to purchase shares of common stock at a price per share that is 95% of the fair

market value of Oracle stock as of the end of the semi-annual option period. As of May 31, 2016, 54 million shares were reserved for future issuances under the

Purchase Plan. We issued 3 million shares under the Purchase Plan in each of fiscal 2016, 2015 and 2014.

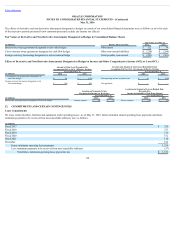

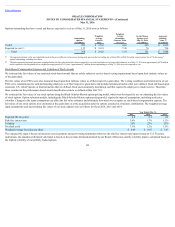

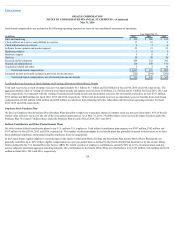

Defined Contribution and Other Postretirement Plans

We offer various defined contribution plans for our U.S. and non-U.S. employees. Total defined contribution plan expense was $387 million, $362 million and

$357 million for fiscal 2016, 2015 and 2014, respectively. The number of plan participants in our benefit plans has generally increased in recent years as we have

hired additional employees and assumed eligible employees from our acquisitions.

In the United States, regular employees can participate in the Oracle Corporation 401(k) Savings and Investment Plan (Oracle 401(k) Plan). Participants can

generally contribute up to 40% of their eligible compensation on a per-pay-period basis as defined by the Oracle 401(k) Plan document or by the section 402(g)

limit as defined by the U.S. Internal Revenue Service (IRS). We match a portion of employee contributions, currently 50% up to 6% of compensation each pay

period, subject to maximum aggregate matching amounts. Our contributions to the Oracle 401(k) Plan, net of forfeitures, were $153 million, $144 million and $134

million in fiscal 2016, 2015 and 2014, respectively.

124