Oracle 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

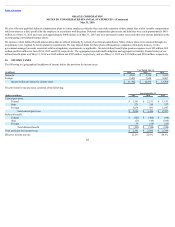

14. EMPLOYEE BENEFIT PLANS

Stock-based Compensation Plans

Stock Plans

In fiscal 2001, we adopted the 2000 Long-Term Equity Incentive Plan, which provides for the issuance of long-term performance awards, including restricted

stock-based awards, non-qualified stock options and incentive stock options, as well as stock purchase rights and stock appreciation rights, to our eligible

employees, officers and directors who are also employees or consultants, independent consultants and advisers. In fiscal 2011, our stockholders, upon the

recommendation of our Board of Directors (the Board), approved the adoption of the Amended and Restated 2000 Long-Term Equity Incentive Plan (the 2000

Plan), which extended the termination date of the 2000 Plan by 10 years and increased the number of authorized shares of stock that may be issued by 388,313,015

shares. In fiscal 2014, our stockholders, upon the recommendation of our Board, approved a further increase in the number of authorized shares of stock that may

be issued under the 2000 Plan by 305,000,000 shares. Under the terms of the 2000 Plan, long-term full value awards are granted in the form of restricted stock units

(RSUs) and performance stock units (PSUs). The vesting schedule for RSUs is established by the Compensation Committee and generally requires vesting 25%

annually over four years. The vesting schedule for PSUs is also established by the Compensation Committee and currently requires vesting over four fiscal years, if

at all, based on performance. Options to purchase common stock are granted at not less than fair market value, become exercisable as established by the

Compensation Committee of the Board (generally 25% annually over four years under our current practice) and generally expire no more than 10 years from the

date of grant. For each share granted as a full value award under the 2000 Plan, an equivalent of 2.5 shares is deducted from our pool of shares available for grant.

As of May 31, 2016, the 2000 Plan had 47 million unvested RSUs outstanding, 4 million unvested PSUs outstanding and stock options to purchase 367 million

shares of common stock outstanding of which 246 million shares were vested. As of May 31, 2016, approximately 317 million shares of common stock were

available for future awards under the 2000 Plan. To date, we have not issued any stock purchase rights or stock appreciation rights under the 2000 Plan.

In fiscal 1993, the Board adopted the 1993 Directors’ Stock Plan (the Directors’ Plan), which provides for the issuance of RSUs and other stock-based awards,

including non-qualified stock options, to non-employee directors. The Directors’ Plan has from time to time been amended and restated. Under the terms of the

Directors’ Plan, 10 million shares of common stock are reserved for issuance (including a fiscal 2013 amendment to increase the number of shares of our common

stock reserved for issuance by 2 million shares). In prior years, we granted stock options at not less than fair market value, that vest over four years, and expire no

more than 10 years from the date of grant. The Directors’ Plan was most recently amended on April 29, 2016 and permits the Compensation Committee of the

Board to determine the amount and form of automatic grants of stock awards to each non-employee director upon first becoming a director and thereafter on an

annual basis, as well as automatic nondiscretionary grants for chairing certain Board committees, subject to certain stockholder approved limitations set forth in the

Directors’ Plan. As of May 31, 2016, approximately 147,000 unvested RSUs and stock options to purchase approximately 3 million shares of common stock (of

which approximately 2 million were vested) were outstanding under the Directors’ Plan. As of May 31, 2016, approximately 1 million shares were available for

future stock awards under this plan.

In connection with certain of our acquisitions, we assumed certain outstanding restricted stock-based awards and stock options under each acquired company’s

respective stock plans. These restricted stock-based awards and stock options generally retain all of the rights, terms and conditions of the respective plans under

which they were originally granted. As of May 31, 2016, approximately 491,000 shares of restricted stock-based awards and stock options to purchase 5 million

shares of common stock were outstanding under these plans.

121