Oracle 2015 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

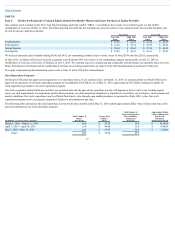

Item 6. Selected Financial Data

The following table sets forth selected financial data as of and for our last five fiscal years. This selected financial data should be read in conjunction with the

consolidated financial statements and related notes included in Item 15 of this Annual Report. Over our last five fiscal years, we have acquired a number of

companies, including MICROS Systems, Inc. in fiscal 2015, among others. The results of our acquired companies have been included in our consolidated financial

statements since their respective dates of acquisition and have contributed to our revenues, income, earnings per share and total assets.

As of and for the Year Ended May 31,

(in millions, except per share amounts) 2016 2015 2014 2013 2012

Consolidated Statements of Operations Data:

Total revenues $ 37,047 $ 38,226 $ 38,275 $ 37,180 $ 37,121

Operating income $ 12,604 $ 13,871 $ 14,759 $ 14,684 $ 13,706

Net income $ 8,901 $ 9,938 $ 10,955 $ 10,925 $ 9,981

Earnings per share—diluted $ 2.07 $ 2.21 $ 2.38 $ 2.26 $ 1.96

Diluted weighted average common shares outstanding 4,305 4,503 4,604 4,844 5,095

Cash dividends declared per common share $ 0.60 $ 0.51 $ 0.48 $ 0.30 $ 0.24

Consolidated Balance Sheets Data:

Working capital $ 47,105 $ 47,892 $ 33,739 $ 28,813 $ 24,630

Total assets $ 112,180 $ 110,903 $ 90,266 $ 81,745 $ 78,274

Notes payable and other borrowings $ 43,855 $ 41,958 $ 24,097 $ 18,427 $ 16,421

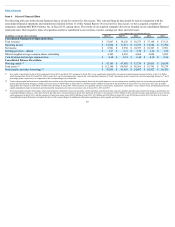

Our results of operations for fiscal 2016 compared to fiscal 2015, and fiscal 2015 compared to fiscal 2014, were significantly impacted by movements in international currencies relative to the U.S. Dollar,

which decreased our fiscal 2016 and 2015 total revenues by 5 and 4 percentage points, respectively, total operating expenses by 4 and 3 percentage points, respectively, and total operating income by 7 and 6

percentage points, respectively, in comparison to the corresponding prior year periods.

Total working capital and total assets sequentially increased in nearly all periods presented primarily due to the favorable impacts to our net current assets resulting from our net income generated during all

periods presented and the issuances of long-term senior notes of $20.0 billion in fiscal 2015, €2.0 billion and $3.0 billion in fiscal 2014 and $5.0 billion in fiscal 2013. Our total assets were also favorably

impacted by the issuance of $3.8 billion of short term borrowings in fiscal 2016. These increases were partially offset by cash used for acquisitions, repurchases of our common stock, dividend payments and

capital expenditures made in all periods presented and the repayments of certain of our senior notes in fiscal 2016, 2015 and 2013.

Our notes payable and other borrowings, which represented the summation of our notes payable, current and other current borrowings, and notes payable and other non-current borrowings as reported per our

consolidated balance sheets as of the dates listed in the table above, increased between fiscal 2012 and fiscal 2016 due to the issuances of $3.8 billion of short-term borrowings made pursuant to our revolving

credit agreements in fiscal 2016, and the issuances of long-term senior notes of $20.0 billion in fiscal 2015, €2.0 billion and $3.0 billion in fiscal 2014, and $5.0 billion in fiscal 2013. See Note 8 of Notes to

Consolidated Financial Statements included elsewhere in this Annual Report for additional information regarding our notes payable and other borrowings.

39

(1) (1)

(2)

(2)

(3)

(1)

(2)

(3)