Oracle 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

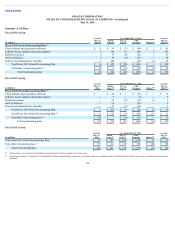

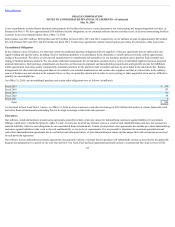

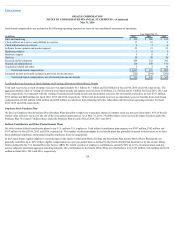

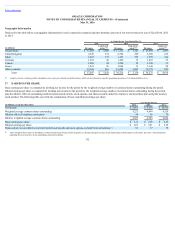

Restricted stock-based award activity and the number of restricted stock-based awards outstanding were not significant prior to fiscal 2015. The following table

summarizes restricted stock-based award activity, including service-based awards and performance-based awards and including awards granted pursuant to Oracle-

based stock plans and stock plans assumed from our acquisitions for fiscal 2016 and 2015:

Restricted Stock-Based Awards Outstanding

(in millions, except fair value)

Number of

Shares

Weighted-Average

Grant Date Fair Value

Balance, May 31, 2014 1 $ 35.29

Granted 28 $ 40.73

Canceled (1) $ 39.52

Balance, May 31, 2015 28 $ 40.63

Granted 34 $ 38.50

Vested (7) $ 40.39

Canceled (3) $ 39.73

Balance, May 31, 2016 52 $ 39.29

The total grant date fair value of restricted stock-based awards that vested in fiscal 2016 and 2015 was $261 million and $28 million, respectively. As of May 31,

2016, total unrecognized stock-based compensation expense related to non-vested restricted stock-based awards was $1.3 billion and is expected to be recognized

over the remaining weighted-average vesting period of 2.88 years.

In fiscal 2016 and 2015, 2 million and 3 million PSUs were granted, respectively, which vest upon the attainment of certain performance metrics and service-based

vesting. Based upon actual attainment relative to the “target” performance metric, certain participants have the ability to be issued up to 150% of the target number

of PSUs originally granted, or to be issued no PSUs at all. In fiscal 2016, 463,000 PSUs vested and 4 million PSUs remained outstanding as of May 31, 2016.

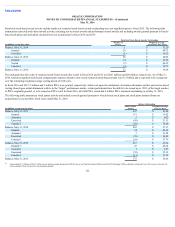

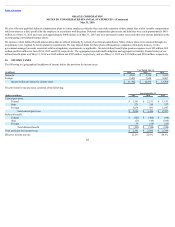

The following table summarizes stock option activity and includes awards granted pursuant to Oracle-based stock plans and stock plans assumed from our

acquisitions for our last three fiscal years ended May 31, 2016:

Options Outstanding

(in millions, except exercise price)

Shares Under

Option

Weighted-Average

Exercise Price

Balance, May 31, 2013 447 $ 25.48

Granted 131 $ 31.02

Assumed 5 $ 9.02

Exercised (95) $ 21.51

Canceled (26) $ 30.60

Balance, May 31, 2014 462 $ 27.37

Granted 34 $ 40.54

Assumed 3 $ 21.98

Exercised (70) $ 24.49

Canceled (16) $ 33.76

Balance, May 31, 2015 413 $ 28.64

Granted 25 $ 40.34

Assumed 1 $ 4.97

Exercised (53) $ 25.13

Canceled (11) $ 35.19

Balance, May 31, 2016 375 $ 29.66

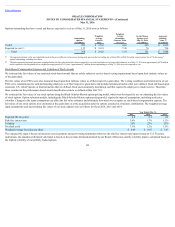

Approximately 7 million of the 25 million stock options granted during fiscal 2016 were to our Chief Executive Officers and Chief Technology Officer and had contractual lives of five years versus the 10-

year contractual lives for the other stock options granted.

122

(1)

(1)