Oracle 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

more significant estimates, judgments and assumptions and which we believe are the most critical to aid in fully understanding and evaluating our reported

financial results include:

• Revenue Recognition;

• Business Combinations;

• Goodwill and Intangible Assets—Impairment Assessments;

• Accounting for Income Taxes; and

• Legal and Other Contingencies.

In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in its application.

There are also areas in which management’s judgment in selecting among available alternatives would not produce a materially different result. Our senior

management has reviewed our critical accounting policies and related disclosures with the Finance and Audit Committee of the Board of Directors.

Revenue Recognition

Our sources of revenues include:

• cloud and on-premise software revenues, which include the sale of: new software licenses, which generally grant to customers a perpetual right to use our

database, middleware, applications and industry-specific software products; cloud SaaS and PaaS offerings, which grant customers access to a broad

range of our software and related support offerings on a subscription basis in a secure, standards-based cloud computing environment; cloud IaaS

offerings, which grant customers access to infrastructure cloud services to perform elastic compute, storage and networking services, and also provide

management services for software and hardware and related IT infrastructure, both generally on a subscription basis; and software license updates and

product support offerings (described further below);

• hardware revenues, which include the sale of hardware products including Oracle Engineered Systems, computer servers, storage products, networking

and data center fabric products, and industry-specific hardware; and hardware support revenues (described further below); and

• services revenues, which are earned from providing software and hardware related services including consulting, advanced customer support and

education services.

Revenues generally are recognized net of any taxes collected from customers and subsequently remitted to governmental authorities.

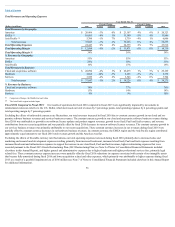

Revenue Recognition for Software Products and Software Related Services (Software Elements)

New software licenses revenues primarily represent fees earned from granting customers licenses to use our database, middleware, application and industry-specific

software products and exclude cloud SaaS and PaaS revenues and revenues derived from software license updates, which are included in software license updates

and product support revenues. The basis for our new software licenses revenue recognition is substantially governed by the accounting guidance contained in ASC

985-605, Software-RevenueRecognition.We exercise judgment and use estimates in connection with the determination of the amount of software and software

related services revenues to be recognized in each accounting period.

For software license arrangements that do not require significant modification or customization of the underlying software, we recognize new software licenses

revenues when: (1) we enter into a legally binding arrangement with a customer for the license of software; (2) we deliver the products; (3) the sale price is fixed or

determinable and free of contingencies or significant uncertainties; and (4) collection is probable. Revenues that are not recognized at the time of sale because the

foregoing conditions are not met, are recognized when those conditions are subsequently met.

46