Oracle 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2016

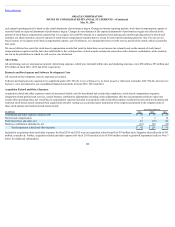

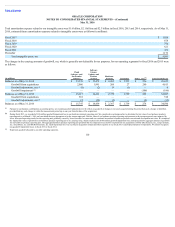

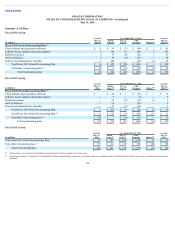

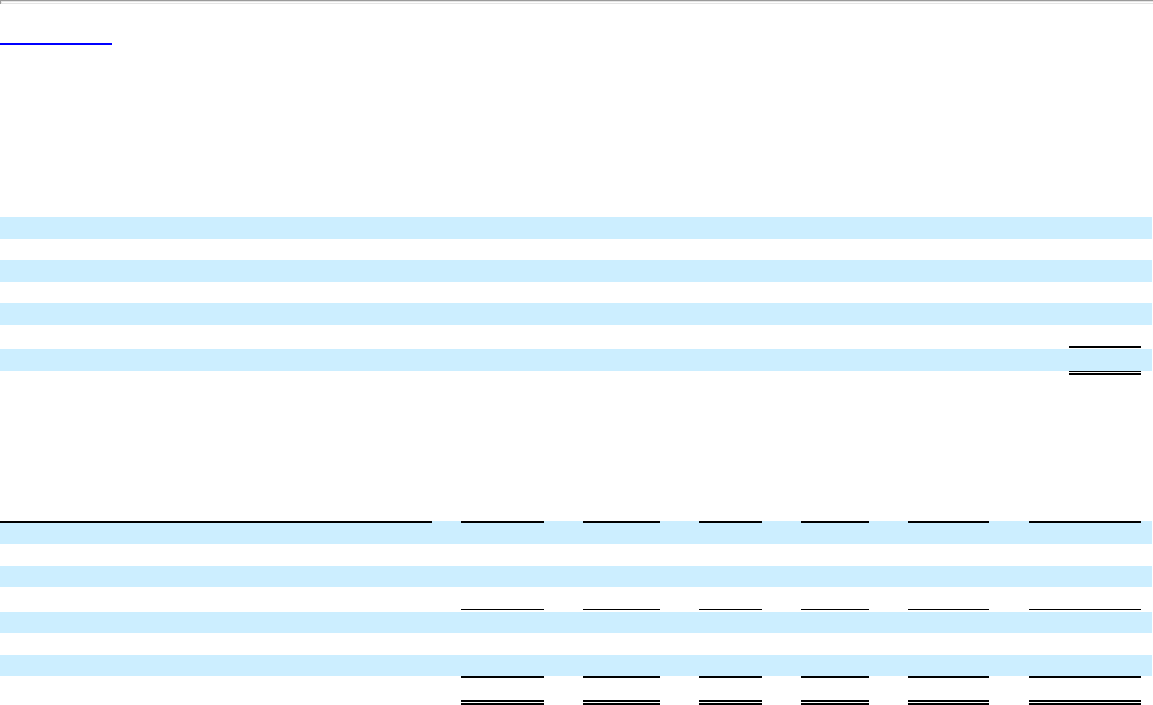

Total amortization expense related to our intangible assets was $1.6 billion, $2.1 billion and $2.3 billion in fiscal 2016, 2015 and 2014, respectively. As of May 31,

2016, estimated future amortization expenses related to intangible assets were as follows (in millions):

Fiscal 2017 $ 1,026

Fiscal 2018 878

Fiscal 2019 770

Fiscal 2020 621

Fiscal 2021 476

Thereafter 1,172

Total intangible assets, net $ 4,943

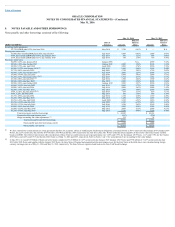

The changes in the carrying amounts of goodwill, net, which is generally not deductible for tax purposes, for our operating segments for fiscal 2016 and 2015 were

as follows:

(in millions)

Cloud

Software and

On-Premise

Software

Software

License

Updates and

Product

Support

Hardware

Support Consulting Other, net Total Goodwill, net

Balances as of May 31, 2014 $ 13,139 $ 12,472 $ 2,082 $ 1,733 $ 226 $ 29,652

Goodwill from acquisitions 2,086 1,991 269 27 240 4,613

Goodwill adjustments, net (8) (2) 19 (1) — 8

Goodwill impairment — — — — (186) (186)

Balances as of May 31, 2015 15,217 14,461 2,370 1,759 280 34,087

Goodwill from acquisitions 518 — — — — 518

Goodwill adjustments, net 12 (22) (3) — (2) (15)

Balances as of May 31, 2016 $ 15,747 $ 14,439 $ 2,367 $ 1,759 $ 278 $ 34,590

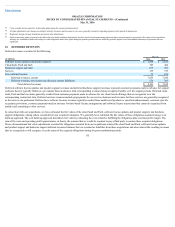

Pursuant to our business combinations accounting policy, we recorded goodwill adjustments for the effects on goodwill of changes to net assets acquired during the period that such a change is identified,

provided that any such change is within the measurement period (up to one year from the date of the acquisition).

During fiscal 2015, we recorded a $186 million goodwill impairment loss to our hardware products reporting unit. We considered several approaches to determine the fair value of our hardware products

reporting unit as of March 1, 2015 and concluded the most appropriate to be the income approach. The fair value of our hardware products reporting unit pursuant to the income approach was impacted by

lower forecasted operating results for this reporting unit, primarily caused by lower forecasted revenues and our continued investment in hardware products research and development activities. We compared

the implied fair value of goodwill in our hardware products reporting unit to its carrying value, which resulted in the $186 million goodwill impairment loss and represented the aggregate amount of goodwill

for our hardware products reporting unit. The aggregate hardware products reporting unit goodwill that was impaired in fiscal 2015 resulted from our acquisitions of Pillar Data Systems, Inc., Xsigo Systems,

Inc., GreenBytes, Inc. and MICROS Systems, Inc. Such impairment loss was recorded to acquisition related and other expenses in our fiscal 2015 consolidated statement of operations. We did not recognize

any goodwill impairment losses in fiscal 2016 or fiscal 2014.

Represents goodwill allocated to our other operating segments.

110

(3)

(1)

(2)

(1)

(1)

(2)

(3)