Oracle 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Recent Accounting Pronouncements

For information with respect to recent accounting pronouncements and the impact of these pronouncements on our consolidated financial statements, see Note 1 of

Notes to Consolidated Financial Statements included elsewhere in this Annual Report.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Cash, Cash Equivalents, Marketable Securities and Interest Income Risk

Our bank deposits and time deposits are generally held with large, diverse financial institutions worldwide with high investment-grade credit ratings or financial

institutions that meet investment-grade ratings criteria, which we believe mitigates credit risk and certain other risks. In addition, as of May 31, 2016, substantially

all of our marketable securities are high quality with approximately 28% having maturity dates within one year and 72% having maturity dates within one to six

years (a description of our marketable securities held is included in Note 3 and Note 4 of Notes to Consolidated Financial Statements included elsewhere in this

Annual Report and “Liquidity and Capital Resources” above). We hold a mix of both fixed and floating-rate debt securities. The fair values of our fixed-rate debt

securities are impacted by interest rate movements and if interest rates would have been higher by 50 basis points as of May 31, 2016, we estimate the change

would have decreased the fair values of our marketable securities holdings by $282 million. Our floating-rate debt securities serve to lower the overall risk to our

investments portfolio associated with the risk of rising interest rates. Substantially all of our marketable securities are designated as available-for-sale. We generally

do not use our investments for trading purposes.

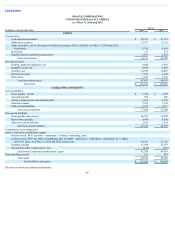

Changes in the overall level of interest rates affect the interest income that is generated from our cash, cash equivalents and marketable securities. For fiscal 2016,

total interest income was $538 million with our cash, cash equivalents and marketable securities investments yielding an average 1.16% on a worldwide basis. The

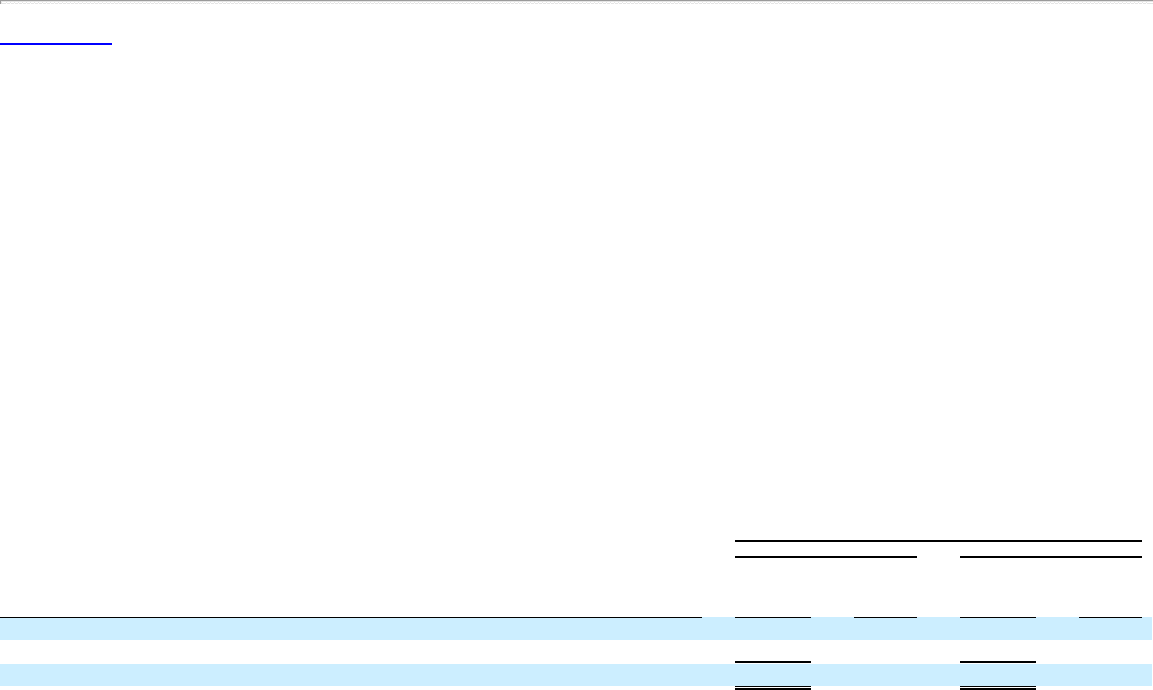

table below presents the approximate fair values of our cash, cash equivalents and marketable securities and the related weighted-average interest rates for our

investment portfolio at May 31, 2016 and 2015.

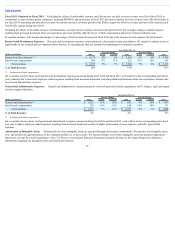

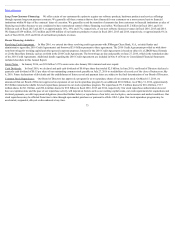

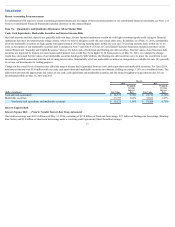

May 31,

2016 2015

(Dollars in millions) Fair Value

Weighted-

Average

Interest

Rate Fair Value

Weighted-

Average

Interest

Rate

Cash and cash equivalents $ 20,152 0.35% $ 21,716 0.36%

Marketable securities 35,973 1.62% 32,652 1.07%

Total cash, cash equivalents and marketable securities $ 56,125 1.16% $ 54,368 0.79%

Interest Expense Risk

Interest Expense Risk — Fixed to Variable Interest Rate Swap Agreements

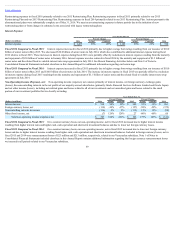

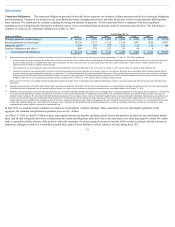

Our total borrowings were $43.9 billion as of May 31, 2016, consisting of $37.8 billion of fixed-rate borrowings, $2.3 billion of floating-rate borrowings (Floating-

Rate Notes) and $3.8 billion of short-term borrowings under a revolving credit agreement (Short-Term Borrowings).

77