Oracle 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

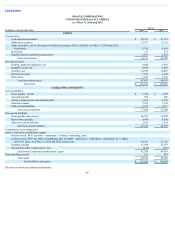

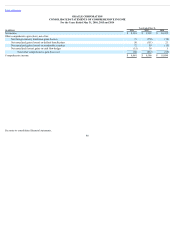

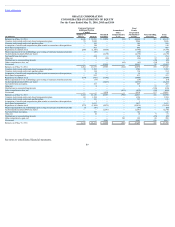

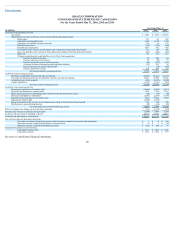

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

May 31, 2016

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Oracle Corporation develops, manufactures, markets, sells, hosts and supports application, platform and infrastructure technologies for information technology (IT)

environments including database and middleware software, application software, cloud infrastructure and hardware—including Oracle Engineered Systems,

computer server, storage, networking and industry-specific hardware products—and related services that are engineered to work together in cloud-based and on-

premise IT environments. We offer our customers the option to deploy our comprehensive set of cloud services offerings including Oracle Software as a Service

(SaaS), Platform as a Service (PaaS) and Infrastructure as a Service (IaaS) or to purchase our software and hardware products and related services to manage their

own cloud-based or on-premise IT environments. Customers that purchase our software products may elect to purchase software license updates and product

support contracts, which provide our customers with rights to unspecified software product upgrades and maintenance releases issued during the support period as

well as technical support assistance. Customers that purchase our hardware products may elect to purchase hardware support contracts, which provide customers

with software updates for software components that are essential to the functionality of our hardware products, such as Oracle Solaris and certain other software

products, and can include product repairs, maintenance services, and technical support services. We also offer customers a broad set of services offerings that are

designed to improve customer utilization of their investments in Oracle application, platform and infrastructure technologies including consulting services,

advanced customer support services and education services.

Oracle Corporation conducts business globally and was incorporated in 2005 as a Delaware corporation and is the successor to operations originally begun in June

1977.

Basis of Financial Statements

The consolidated financial statements included our accounts and the accounts of our wholly- and majority-owned subsidiaries. Noncontrolling interest positions of

certain of our consolidated entities are reported as a separate component of consolidated equity from the equity attributable to Oracle’s stockholders for all periods

presented. The noncontrolling interests in our net income were not significant to our consolidated results for the periods presented and therefore have been included

as a component of non-operating income (expense), net in our consolidated statements of operations. Intercompany transactions and balances have been eliminated.

Certain other prior year balances have been reclassified to conform to the current year presentation. Such reclassifications did not affect total revenues, operating

income or net income.

Included in acquisition related and other expenses as presented in our consolidated statements of operations for fiscal 2016 and 2015 are an acquisition related

benefit of $19 million and a litigation related benefit of $53 million, respectively. Further, acquisition related and other expenses for fiscal 2015 included $186

million related to a goodwill impairment loss (refer to Note 7 below for additional information).

In fiscal 2016, we adopted Accounting Standards Update (ASU) 2015-17, IncomeTaxes(Topic740):BalanceSheetClassificationofDeferredTaxes(ASU 2015-

17) on a retrospective basis. As required by ASU 2015-17, all deferred tax assets and liabilities are classified as non-current in our consolidated balance sheets,

which is a change from our historical presentation whereby certain of our deferred tax assets and liabilities were classified as current and the remainder were

classified as non-current. Upon adoption of ASU 2015-17, current deferred tax assets of $663 million and current deferred tax liabilities of $85 million in our May

31, 2015 consolidated balance sheet were reclassified as non-current and certain related reclassification entries were also recorded.

In addition, in fiscal 2016, we also adopted the following Accounting Standards Updates, none of which had a material impact to our reported financial position or

results of operations and cash flows:

• ASU 2016-07, Investments—EquityMethodandJointVentures(Topic323):SimplifyingtheTransitiontotheEquityMethodofAccounting;

91