MetLife 2000 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management’s Discussion and Analysis of Financial Condition and Results of Operations.

For purposes of this discussion, the term ‘‘Company’’ refers, at all times prior to the date of demutualization (as hereinafter defined), to Metropolitan

Life Insurance Company, a mutual life insurance company organized under the laws of the State of New York (‘‘Metropolitan Life’’), and its subsidiaries,

and at all times on and after the date of demutualization, to MetLife, Inc. (the ‘‘Holding Company’’), a Delaware corporation, and its subsidiaries, including

Metropolitan Life (‘‘MetLife’’). Following this summary is a discussion addressing the consolidated results of operations and financial condition of the

Company for the periods indicated. This discussion should be read in conjunction with the Company’s consolidated financial statements included

elsewhere herein.

The Demutualization

On April 7, 2000 (the ‘‘date of demutualization’’), pursuant to an order by the New York Superintendent of Insurance (‘‘Superintendent’’) approving its

plan of reorganization, as amended (the ‘‘plan’’), Metropolitan Life converted from a mutual life insurance company to a stock life insurance company and

became a wholly-owned subsidiary of the Holding Company. In conjunction therewith, each policyholder’s membership interest was extinguished and

each eligible policyholder received, in exchange for that interest, trust interests representing shares of Common Stock held in the Metropolitan Life

Policyholder Trust, cash or an adjustment to their policy values in the form of policy credits, as provided in the plan. In addition, Metropolitan Life’s

Canadian branch made cash payments to holders of certain policies transferred to Clarica Life Insurance Company in connection with the sale of a

substantial portion of Metropolitan Life’s Canadian operations in 1998, as a result of a commitment made in connection with obtaining Canadian

regulatory approval of that sale. The payments, which were recorded in the second quarter of 2000, were determined in a manner that was consistent

with the treatment of, and fair and equitable to, eligible policyholders of Metropolitan Life.

On the date of demutualization, the Holding Company conducted an initial public offering of 202,000,000 shares of its Common Stock and

concurrent private placements of an aggregate of 60,000,000 shares of its Common Stock at an offering price of $14.25 per share. The shares of

Common Stock issued in the offerings are in addition to 494,466,664 shares of Common Stock of the Holding Company distributed to the Metropolitan

Life Policyholder Trust for the benefit of policyholders of Metropolitan Life in connection with the demutualization. On April 10, 2000, the Holding Company

issued 30,300,000 additional shares of its Common Stock as a result of the exercise of over-allotment options granted to underwriters in the initial public

offering.

Concurrently with these offerings, MetLife, Inc. and MetLife Capital Trust I, a Delaware statutory business trust wholly-owned by MetLife, Inc., issued

20,125,000 8.00% equity security units for an aggregate offering price of $1,006 million. Each unit consists of (i) a contract to purchase shares of

Common Stock and (ii) a capital security of MetLife Capital Trust I.

On the date of demutualization, Metropolitan Life established a closed block for the benefit of holders of certain individual life insurance policies of

Metropolitan Life. See Note 6 of Notes to Consolidated Financial Statements.

On June 27, 2000, the Holding Company’s Board of Directors authorized the repurchase of up to $1 billion of the Holding Company’s outstanding

Common Stock. The buyback may take place over an unspecified period of time. the Holding Company may purchase Common Stock from the

Metropolitan Life Policyholder Trust, in the open market, and in private transactions. Through December 31, 2000, 26,084,751 shares have been

acquired for $613 million.

Acquisitions and Dispositions

On February 28, 2001, the Holding Company consummated the purchase of Grand Bank, N.A. (‘‘Grand Bank’’). Grand Bank, with reported assets

at September 30, 2000 of approximately $84 million, provides banking services to individuals and small businesses in the Princeton, New Jersey area.

On February 12, 2001, the Federal Reserve Board approved the Holding Company’s application for bank holding company status and to become a

financial holding company upon its acquisition of Grand Bank.

On January 6, 2000, Metropolitan Life completed its acquisition of GenAmerica for $1.2 billion. As part of the GenAmerica acquisition, General

American Life Insurance Company paid Metropolitan Life a fee of $120 million in connection with the assumption of certain funding agreements. The fee

has been considered as part of the purchase price of GenAmerica. GenAmerica is a holding company which includes General American Life Insurance

Company, 49% of the outstanding shares of Reinsurance Group of America, Incorporated (‘‘RGA’’) common stock, a provider of reinsurance, and 61.0%

of the outstanding shares of Conning Corporation (‘‘Conning’’) common stock, an asset manager. Metropolitan Life owned 10% of the outstanding

shares of RGA common stock prior to the completion of the GenAmerica acquisition. At December 31, 2000 Metropolitan Life’s ownership percentage of

the outstanding shares of RGA common stock was approximately 59%.

In April 2000, Metropolitan Life acquired the outstanding shares of Conning common stock not already owned by Metropolitan Life for $73 million.

In July 2000, the Company acquired the workplace benefits division of Business Men’s Assurance Company, a Kansas City, Missouri based insurer.

In October 2000, the Company completed the sale of its 48% ownership interest in its affiliates, Nvest, L.P. and Nvest Companies L.P. This

transaction resulted in an investment gain of $663 million.

In September 1999, the Auto & Home segment acquired the standard personal lines property and casualty insurance operations of The St. Paul

Companies.

In November 1999, the Company acquired the individual disability income business of Lincoln National Life Insurance Company.

During 1998, the Company sold MetLife Capital Holdings, Inc., a commercial financing company and a substantial portion of its Canadian insurance

operations, which resulted in an investment gain of $531 million.

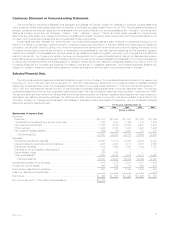

Results of Operations

The Company

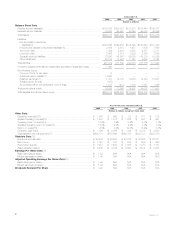

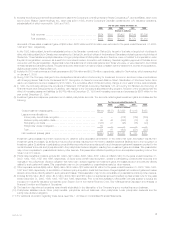

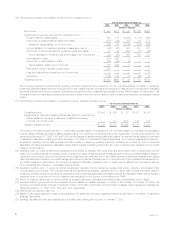

Year ended December 31, 2000 compared with the year ended December 31, 1999

Premiums increased by $4,229 million, or 35%, to $16,317 million in 2000 from $12,088 million in 1999, in part, due to the acquisition of

GenAmerica on January 6, 2000. Excluding the impact of this acquisition, premiums increased by $2,273 million, or 19%. This increase is attributable to

Institutional Business, Auto & Home and International. These increases are partially offset by a $72 million, or 2%, decrease in Individual Business. The

increase of $1,297 million, or 23%, in Institutional Business is predominantly the result of strong sales and continued favorable policyholder retention in

this segment’s group life, dental and disability businesses. The acquisitions of the workplace benefits division from the Business Men’s Assurance

Company in July 2000 and Lincoln National’s disability business in November 1999 (‘‘the BMA and Lincoln National acquisitions’’) account for $103

million of the variance. In addition, significant premiums received from existing group life and retirement and savings customers in 2000 contribute $465

MetLife, Inc. 5