MetLife 2000 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2000 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

defendants believe they have meritorious defenses to the plaintiffs’ claims and are contesting vigorously all of the plaintiffs’ claims in these actions. The

defendants have moved to dismiss most of these actions; the Kings County action and the Article 78 proceeding are being voluntarily held in abeyance.

Three lawsuits were also filed against Metropolitan Life in 2000 in the United States District Courts for the Southern District of New York, for the

Eastern District of Louisiana, and for the District of Kansas, alleging racial discrimination in the marketing, sale, and administration of life insurance policies,

including ‘‘industrial’’ life insurance policies, sold by Metropolitan Life decades ago. The plaintiffs in these three purported class actions seek unspecified

compensatory damages, punitive damages, reformation, imposition of a constructive trust, a declaration that the alleged practices are discriminatory and

illegal, injunctive relief requiring Metropolitan Life to discontinue the alleged discriminatory practices and adjust policy values, and other relief. Metropolitan

Life believes it has meritorious defenses to the plaintiffs’ claims and is contesting vigorously plaintiffs’ claims in these actions. Metropolitan Life has

successfully transferred the Louisiana action to the United States District Court for the Southern District of New York and has also filed a motion to transfer

the Kansas action to the same court. Metropolitan Life has moved for summary judgment in the two actions pending in New York, citing the applicable

statute of limitations. The New York cases are scheduled for trial in November 2001.

Insurance departments in a number of states have initiated inquiries in 2000 about possible race-based underwriting of life insurance. These

inquiries generally have been directed to all life insurers licensed in the respective states, including Metropolitan Life and certain of its subsidiaries. The

New York Insurance Department has commenced examinations of certain domestic life insurance companies, including Metropolitan Life and certain of

its subsidiaries, concerning possible past race-based underwriting practices.

Various litigation, claims and assessments against the Company, in addition to those discussed above and those otherwise provided for in the

Company’s consolidated financial statements, have arisen in the course of the Company’s business, including, but not limited to, in connection with its

activities as an insurer, employer, investor, investment advisor and taxpayer. Further, state insurance regulatory authorities and other Federal and state

authorities regularly make inquiries and conduct investigations concerning the Company’s compliance with applicable insurance and other laws and

regulations.

It is not feasible to predict or determine the ultimate outcome of all pending investigations and legal proceedings or provide reasonable ranges of

potential losses. In some of the matters referred to above, very large and/or indeterminate amounts, including punitive and treble damages, are sought.

Based on information currently known by the Company’s management, in its opinion, the outcomes of such pending investigations and legal

proceedings are not likely to have a material adverse effect on the Company’s consolidated financial position. However, given the large and/or

indeterminate amounts sought in certain of these matters and the inherent unpredictability of litigation, it is possible that an adverse outcome in certain

matters could, from time to time, have a material adverse effect on the Company’s operating results or cash flows in particular quarterly or annual periods.

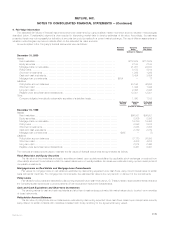

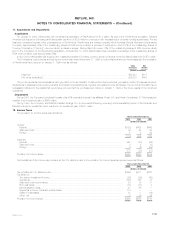

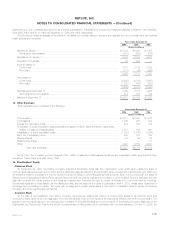

Leases

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants is contingent upon the level of the

tenants’ sales revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office space, data

processing and other equipment. Future minimum rental and subrental income, and minimum gross rental payments relating to these lease agreements

were as follows:

Gross

Rental Sublease Rental

Income Income Payments

(Dollars in millions)

2001 *************************************************************************** $ 881 $17 $145

2002 *************************************************************************** 679 15 114

2003 *************************************************************************** 631 12 93

2004 *************************************************************************** 574 11 76

2005 *************************************************************************** 538 11 61

Thereafter *********************************************************************** 2,322 21 264

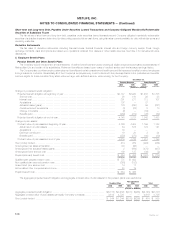

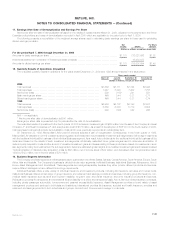

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded commit-

ments were $1,311 million and $1,131 million at December 31, 2000 and 1999, respectively. The Company anticipates that these amounts will be

invested in the partnerships over the next three to five years.

MetLife, Inc.

F-28